| Project | X to ATH | Investors | FDV | Current supply |

| MultiversX 2020 < /td> | 17.80x | $1.90 M | $848.08 M | 99.98% |

| Kava 2019 | 13.06x | $8.5 M | $618.50 M | 100.00% |

| Fetch.ai 2019 | 3.10x | $74.33 M | $420.15 M | 70.46% | Band Protocol 2019 | 15.23x | $10.85 M | $203.74 M | 96.85% |

| Harmony 2019 | 31.49x | $23.35 M | $174.14 M | 96.65% |

| Coin98 2021 | < td> 34.39x$20.25 M | $183.50 M | 62.17% | |

| Open Campus 2023 | 3.14x | $2.50 M | $510.00 M | 20.86% |

| Space ID 2023 | 4.99x | $12.50 M | $520.79 M | 20.63% |

| Arkham 2023 | 1.75x | $14.50 M | $364.90 M | 15.00% |

| Beta Finance 2021 | 70.38x | $11.55 M | $66.08 M | 73.79% |

| Shentu 2020 | 8.17x | $279.63 M | $62.34 M | 75.20% |

| League of Kingdoms 2022 | 24.13x | $7.10 M | $47.88 M | 59.45% |

MultiversX

MultiversX (Elrond) is a blockchain focused on ensuring security, efficiency, and scalability through the use of two elements: Adaptive State Sharding and the new Secure Proof of Stake (“SPoS”) consensus mechanism

Two months before the launch, the project raised $1. .9 million in a private round with the participation of Binance Labs and Electric Capital

In November 2022, the Elrond project was renamed MultiversX, thereby focusing on development in the field of Web 3.0 technologies and product development. services for metaverses

Now MultiversX is a full-fledged ecosystem with its own blockchain

The project has performed well in the 2021 bull market, reaching an ATH of $466. It has been trading in the $30-50 range for more than a year. They know how to do marketing, remember at least their “100 days of growth” campaign.

Financial condition

Information about their financial condition was not found in the public domain. In the chat, they remain silent when asked directly about treasuries. There were some addresses supposedly with team tokens, but these messages were cleared.

But apparently they are doing well.

As they write in the same chat:

“10% of all daily staking rewards go to MultiversX.

All royalties from the smart contracts of all their products also go to them.

And it is likely that they also earn money offline: https://www .romanian-companies.eu/multiversx-labs-srl-39424028

Activity

- Social activity networks is very high.

- We held an offline conference xDay.2023, the broadcast of which was watched more than 8.5 million times. It presented integrations and partnerships with large technology companies (Google Cloud, Tencent Cloud, Deutsche Telekom, etc.), releases and updates of main products.

- Launched xAlias, a Web3 single login solution using Google credentials.

- Updated xExchange V3. Work continues to rework more than 30 components, create new contracts and introduce new functions.

- We introduced ERC20 USDC and USDT into xPortal, providing the possibility of easy cross-chain swaps between them and other assets.

- We showed the first version of the xAI bot, thanks to which every user and developer will be able to receive instant answers to all questions about MultiversX, code reviews, explanations of smart contracts, etc.

Kava

Kava is a decentralized blockchain platform in the Cosmos ecosystem.

The project raised $5.5 million in several rounds in 2019 and an additional $3 million on Binance Launchpad

100% in circulation. All tokens are already in the right hands. Trading at 1.5x IEO.

Financial condition

No information is provided regarding the treasury.

Activity

Activity in social media. networks are high. They partner with projects, expand the ecosystem.

Fetch.ai

Fetch.ai is a platform designed to connect Internet of Things (IoT) devices and algorithms to enable their collective learning.

Raised more than $70 million and $6 million on Binance Launchpad.

Both ATH and ATL were a few years ago. Since the beginning of October, the token has grown by ~60%. Unlocking tokens remained only for future developments and rewards for mining. At the beginning of 2023, volumes appeared. A good token for artificial intelligence narrative.

Financial condition

There is no answer regarding information about the treasury.

Activity

The project activity is high. November 2, updates for the test network were released and the NOMX token was launched.

Band Protocol

Band Protocol is a data management protocol, a cross-chain oracle that aggregates and connects real-world data and APIs to smart contracts.

Raised $5 million in several rounds and $5.85 on Binance Launchpad

In the 2021 bull market, the project showed good results. The circulation is 96%, and the remaining distributions of the remaining ~4% for the team occur in August 2024.

Financial condition

The project is in excellent financial condition, according to the community manager. There is a grant program for developers, researchers, community and infrastructure.

Activity

Activity in social media. networks are high, the project is recruiting new developers to the team, entering into partnerships and taking part in hackathons. There is also a program for validators.

Harmony

Harmony is an open blockchain platform designed for decentralized applications.

The project raised $23.5 million, $5 of which was on Binance Launchpad.

The project performed well in the bull market in 2021, however, it did not recover after fall in the spring of 2022. Over the past month it has increased by 20%.

Financial status

In January 2023, $21.9 million was stolen when the Harmony Protocol platform was hacked.

Activity

A network update and hard fork are scheduled for November 2 (which is not reported on official social networks). The project activity is high.

Coin98

Coin98 is a multi-chain liquidity protocol that has its own wallet and other services.

They collected a total of $20.25 million in 2021 from Multicoin Capital, Hashed, ParaFi Capital, etc.

In August 2023 they announcedrebrandinggrants for startups with funding from $100k.

Activity

Activity in social media. networks are high, they hold various sweepstakes, participate in hackathons and partnerArbitrum

Activity

Activity is high, various partnerships are being concluded, AMAs are being held . Launched domains on Injective.

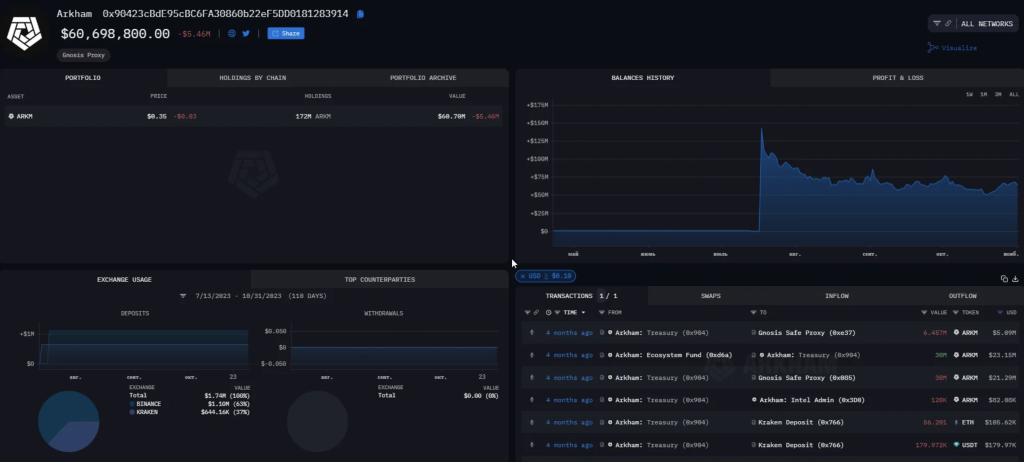

Arkham

Arkham is a tool for analyzing various on-chain metrics and wallets.

We raised a total of $14.5 million, $12 million of which from Coinbase Ventures, DCG and others (price unknown).

The token fell by ~50% of ATH. There is only 15% in circulation, but this will not prevent the token from being pumped up in a good market, since investor unlocks will only be in July 2024.

Financial condition

In the treasury ~172 million ARKM (~$60 million), of which 35.93 million tokens ($12 million) were unlocked.

Activity

Activity high, the team releases various reports on their blog.

Beta Finance

Beta Finance is a decentralized money market for borrowing, lending and trading cryptocurrency assets.

In 2021, they raised $11.55 million. In addition to the seed round, launch pad and strategic round, an equity round was held with the participation of Multicoin Capital, Delphi Digital (Delphi Labs) and Sequoia Capital India.

Since its launch, the token has only fallen. The last year has been at the bottom and is trading within $0.1.

Financial condition

Administrator's response regarding their financial condition:

"Most of our funds are held in a secure custodial service, so there is no address that we can provide to you. We make payments similar to other leading DeFi + Web3 projects. and the project has sufficient funds to last more than 3 years at current operating costs (which may vary)."

Activity

As part of the project, a new protocol called Omni was released. In their words, “Omni is a compositional, dynamic and secure money market, capable of processing all types of collateral and loans without fragmentation and with maximum capital efficiency.”

A White Paper was published a few days ago.

The token will not be changed.

Activity on Twitter and Discord is very high. The project is not abandoned.

Shentu

Shentu (formerly CertiK) is a cross-chain protocol with security assessment and decentralized compensation for creating secure decentralized applications and blockchains.

In total, they raised $279.63 million. At the end of 2021 and in 2022, there were two series B-3 rounds, in which they raised $168 million with the participation of Sequoia Capital and Lightspeed Venture Partners.

Over the past two years, the token has been falling with small rebounds. On October 19 there was ATL – $0.4 per token. In the last bull market, it performed well, falling short of the ATH by only about 15-20%.

In circulation 75.20%.

Financial condition

Our question about their well-being was ignored. Other community members also inquired about their fund, but there were no responses.

Activity

In the fall of 2021, Certik Chain was renamed Shentu Chain. The rebranding coincided with the beginning of the pump.

At the same time, two new Russian-platform tools were introduced in the CertiK security suite - ShentuShield and Shentu Security Oracle - to ensure the security of the decentralized financial (DeFi) ecosystem.

Since then there has been no global news. But recently, updates and hard forks of the network have been carried out, supported by all leading exchanges.

Twitter and discord are live.

Flamingo Finance

Flamingo Finance is a decentralized finance protocol on Neo. It allows users to convert tokens, provide liquidity, generate income through staking, and borrow stablecoins against their crypto assets.

100% in circulate. All tokens are already in the right hands, there are no random passengers left. The project is being overseen by Andrew Kang.

Performed well in the 2021 bull market. Then he drew a double top at the end of the market growth. At the end of summer I updated the loi.

Financial condition

Information about their financial condition was not found in the public domain.

Activity

Social networks of the project are active. Mostly they post platform indicators and conduct AMAs.

The bridge to Flamingo, which was stopped due to an attack on the Poly Network, the cross-network bridge that Flamingo uses for cross-network transactions, has been restarted.

The ambassador program, which had been active since the beginning of summer, ended in October.

In addition to all other plans, such as the launch of Token Auction Offering (TAO), Orderbook+ Version 2, Flamingo Pay and Flamingo Javascript Library, the team focuses on marketing “Marketing, marketing, and more marketing!”

League of Kingdoms

League of Kingdoms is a multiplayer online real-time strategy game on the blockchain.

In 2021, the project raised $3.1 million in a private sale, among investors a16z (Andreessen Horowitz), Sequoia Capital and Binance Labs.

Over the past month, the token price has increased by more than 30%. But on a global scale it is still near the bottom.

The project performed well at the end of the bull market in the spring of 2022, reaching an ATH of $4.1.

A little less than 60% of the tokens are in circulation, but a16z, Sequoia Capital and Binance are behind the project, there is a chance for a ramp-up if the market is good. But you shouldn’t expect an independent trend.

Financial condition

Information about their financial condition was not found in the public domain. The question was ignored.

Activity

Activity on Twitter is high.

In 2022, a new type of token for play-to-earn mechanics was announced - Dragon Soul Toke, used for in-game tasks.

There were no more major updates.

What's the result?

All selected projects have received support from Binance, which is now considered a kind of quality mark. Most of them are already active or are beginning to become active. Many projects, such as MultiversX, Kava, Band Protocol, Harmony, have more than 90% of tokens in circulation, providing stability and trust to their holders.

Some of them have undergone a rebranding process, becoming effective ecosystem projects like MultiversX. Others, such as Beta Finance and Shentu, have successfully attracted additional investment, strengthening their financial base. Projects like Fetch.Ai have a clear growth narrative (AI) that underpins their prospects.

Among the newcomers there are those who still have a small supply, but who are just beginning to reveal their potential, such as Space ID, Arkham and Open Campus. There are also established projects with a small supply but the support of large funds, like League of Kingdoms. Don't forget about old projects that are followed by interesting personalities (Andrew Kang), for example, Flamingo.

This article is the opinion of the editors and does not constitute financial advice.