Kava KAVA

Report IssueKava is a cross-chain DeFi platform offering collateralized loans and stablecoins to users of major crypto assets (BTC, XRP, BNB, ATOM, etc.). There are two tokens on the platform: KAVA, a governance and staking token responsible for network security and voting on key parameters; and USDX, an algorithmically-backed stablecoin backed by crypto assets.

DetailsSentiment Neutral

Fundraising Statistics

$0.4 -0.62%

$0.46

KAVAKava

KAVAKava

USDCUSD Coin

USDCUSD Coin

Short Review Kava

Crypto project Kava (KAVA) is classified as a Finance. Kava is a Utility token that is hosted on the BSC (BEP-20) Network. The current total supply is 342.07 M KAVA (Circulating Supply + Tokens yet to be released - Burned Tokens). A total of $3,000,000 (6.52% of total tokens) have been allocated for the public sale. The level of social activity of the Kava project is assessed as Medium.

Kava ICO Overview

Public sale of tokens will take place on the Binance Launchpad. Estimated date for the public token sale: 24 October 2019. Kava (KAVA) price during the token sale: 0.46 USD. Min/Max Personal Cap: TBA / 200 USD. You can purchase project tokens for BNB

KAVA Price Chart

The launch of KAVA token trading took place on 25 October 2019.

Fundraising Rounds

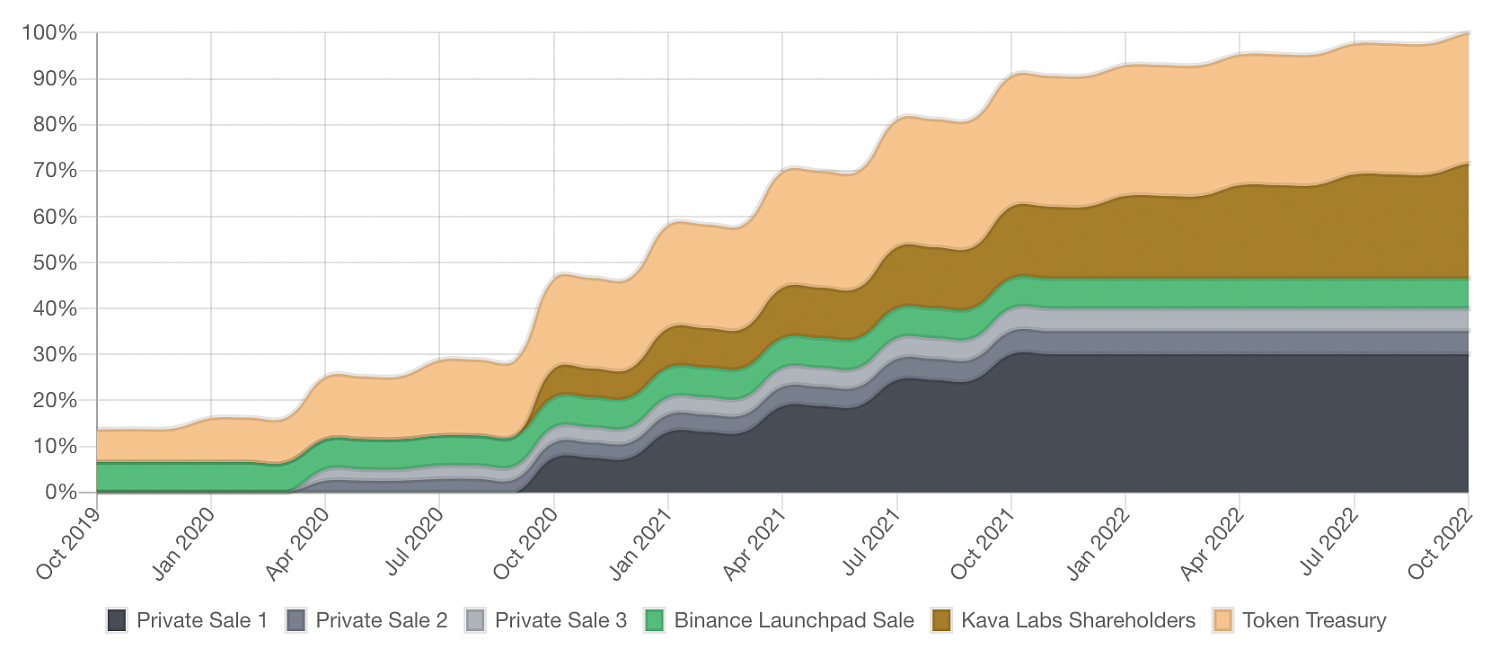

Total sold 46.45 M KAVA tokens (0.46% of total tokens). Total amount of funds raised by the Kava project is $8.48 M.

| Investment Round | Date | Price | Funds Raised |

| Binance Launchpad | October 24, 2019 | $0.46 | $3.00 M |

| Private sale 3 | August 2019 | $0.40 | $1.97 M |

| Private sale 2 | July 2019 | $0.25 | $1.26 M |

| Private sale 1 | June 2019 | $0.075 | $2.25 M |

Kava Investors

Binance Tier 1

Binance Tier 1 Arrington XRP Tier 2

Arrington XRP Tier 2 IOSG Ventures Tier 2

IOSG Ventures Tier 2 Lemniscap Tier 2

Lemniscap Tier 2 Robot Ventures Tier 2

Robot Ventures Tier 2 TRGC Tier 2

TRGC Tier 2Cryptocurrency Kava (KAVA)

Kava is a cross-chain project < a target="_blank" href="https://cryptobread.net/product/ico/filter/tags-is-defi/apply/">DeFi, based on Cosmos, which provides users with access to collateralized decentralized loans and stablecoins. Unlike other DeFi platforms, Kava currently supports several cross-chain cryptocurrencies, including BTC, ATOM, XRP and BNB. And Kava's main goal is to become the standard offering all major crypto assets. The KAVA token and USDX stablecoin are the two main cryptocurrencies featured on the Kava platform.

KAVA is a native token for staking and managing your own blockchain. This gives owners the opportunity to stake and receive block rewards. USDX is a synthetic stablecoin.

Kava Project History

Kava was founded in 2017 by Scott Stewart, CEO (who founded AppEase), Brian Kerr (who is also an advisor to Snowball and DMarket.io) and Ruaridh O 'Donnell, head of blockchain development. In 2019, they released the CDP system, which is considered Kava's core product.

The Kava CDP platform allows people to use your electronic funds as collateral to obtain a loan in US dollars. Once the debt is repaid, the system burns the USDX and the mortgage is returned to the user. The Kava Labs project team participated in the development of blockchain solutions for projects such as Ripple, Tezos Tendermint / Cosmos, MakerDao, etc.

In March 2019, Xpring, a division of the Ripple ecosystem that enables banks, payment providers and exchanges to use blockchain technology, invested in Kava Labs. In November 2019, Kava successfully launched the KAVA mainnet, and in 2020, cross-chain assets in the CDP system on the mainnet.

Kava is supported by many different wallets, such as Trust Wallet, Cosmostation, Kepler, Ledger and others.

Advantages of Kava

- Voting. The ability to vote on proposals to make changes to the blockchain or configure system parameters for KAVA holders.

- Decentralization.

- Protection against volatility. Support for stablecoins as protection against excessive volatility of the crypto market.

- No third parties needed. Possibility of lending directly between users, without counterparties.

- Rewards. User reward program for running validator nodes.

Disadvantages of Kava

- Limited liquidity.

- Lack of details about the project and its founders and consultants.

ByBit

ByBit  Binance

Binance  Gate

Gate  Score

Score