| Project | Investment amount | Year | FDV | Current supply | |

| Axelar AXL | $ 114.74M | 2022 | $349.25M | 40.46% | |

| Blur BLUR | $ 113.00M | 2022 | $693.30M | 34.36% | |

| Aurory AURY | $ 108.85M | 2021 | < td style="color: var(--gray-900);"> $41.47M35.39% | ||

| HUMAN Protocol HMT | $ 100.10M | 2021 | $44.40M | 23.06% | |

| Karura | $ 89.41 M | 2021 | $7.83M | 95.10% | |

| Agoric BLD | $ 84M | 2022 | < td style="color: var(--gray-900);"> $93.24M62.60% | ||

| Nym NYM | $ 61.21M | 2022 | $130.60M | 55.66% | |

| UXD Protocol UXP | $ 60.09M | 2021 | $60.08M | 57.00% | |

| VEGA Protocol VEGA | < td style="color: var(--gray-900);"> $ 59.85M2021 | $88.07M | 88.56% | ||

| Casper CSPR | $ 59.40M | 2021 | $392.32M | 94.26% | |

| Unique Network UNQ | $ 58.20M | 2021 | $4.26M | 21.48% | |

| Clover CLV | $ 57.40M | 2021 | $34.27M | 74.20% | td> |

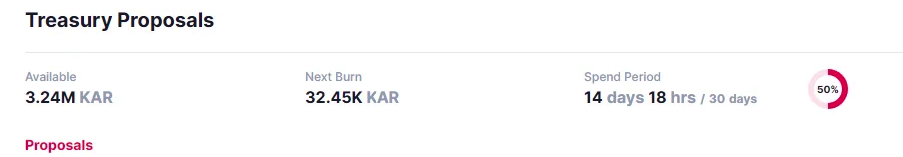

Karura

Karura - DeFi hub on Kusama. Founded by the Acala Foundation, Karura is a scalable, EVM-compatible network optimized for DeFi.

Raised $89 million in 2021 using Parachain Auction

Financial status

The moderator simply skips the question on this topic. sold 18 thousand KSM (~$800 thousand). On the site with voting, it is written that 3.24 million KAR are available (~$226 thousand). treasury $61 million.

Activity

Activity is average, different ones are releasedreleases. There is little news from Acala regarding Karura.

Agoric< /a>

L1 blockchain, built on the basis of Cosmos SDK and Tendermint, decentralized applications which can be built in JavaScript.

In 2021 we held a private round with a total raise of ~$32 million. Next we conducted 2 sales on Coinlist with a total raise of ~$52 million.

Financial condition

There is nothing in the public domain regarding the current state, they ignore it on discord. But judging by their roadmap they perform most of the tasks.

Activity

Activity in X is high, added stATOM as collateral for storage. Participate in various forums. We concluded a partnership with Kado. They conduct various AMAs with subscribers, answering their questions.

Nym< /a>

Blockchain VPN that allows various applications through Mixnet Nym to protect privacy.

Raised:

- Seed round in May 2021 - $6.5 million (Polychain Capital, 1kx, Greenfield One, etc.)< /li>

- Seed round in July 2021 - $10 million

- Series A in November 2021 - $13 million (a16z, DCG, HTX Venures, etc.)

- 2 sales on Coinlist in February 2022 - $31.25 million

Financial condition

They remained silent about the financial condition, but in June 2023 NYM was launched program in which they distribute 200K NYM (~$24 thousand) from the treasury for increasing the number of nodes.

Activity

Activity in X is high, and various projects with a fund of $300 thousand are attracted. Various AMA sessions are held. November 2 they will talk about the current state of the project and its updates.

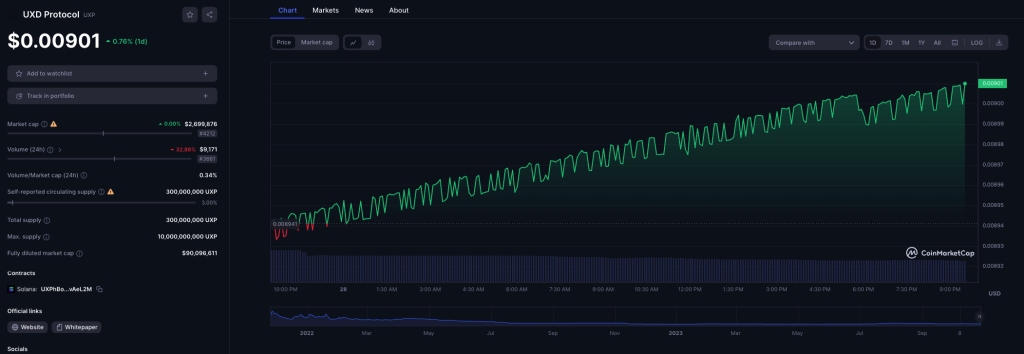

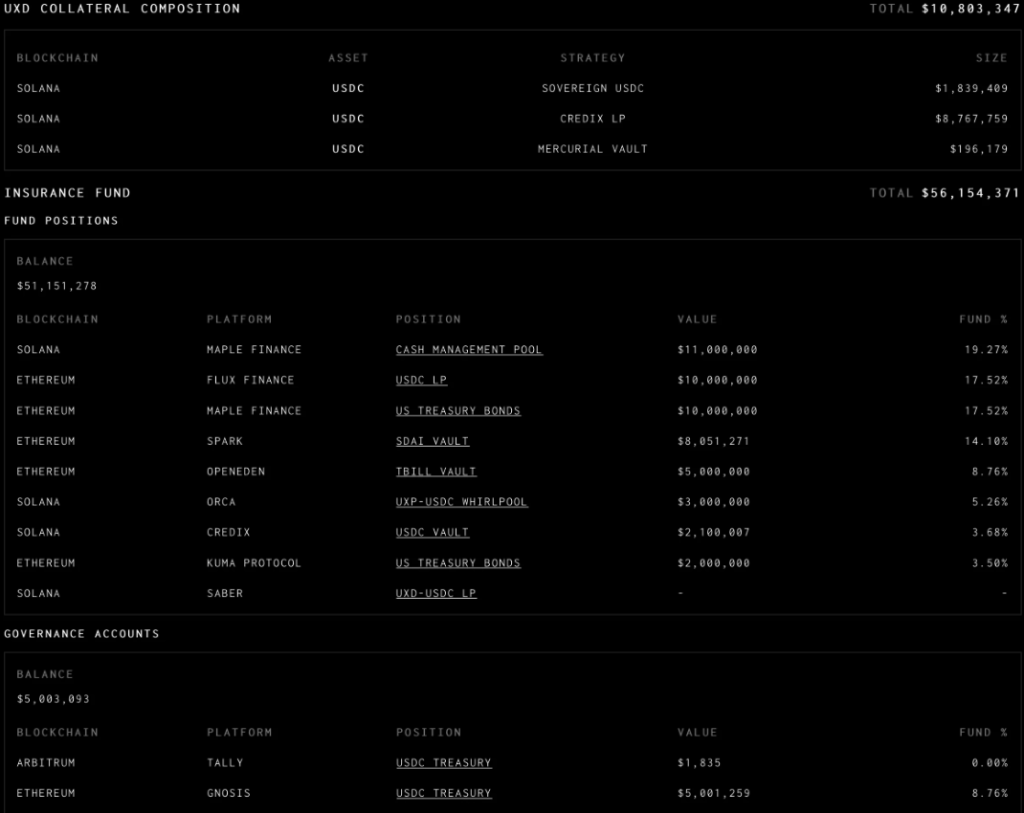

UXD Protocol

UXD Protocol is a project that has created an algorithmic stablecoin backed by a delta-neutral position using permanent swaps. The goal of the protocol is to solve the stablecoin trilemma, which includes decentralization, stability, and capital efficiency.

UXP token holders will be able to vote on proposals aimed at increasing the value of the UXD protocol.

Funds such as Multicoin Capital are behind the project

CMS Holdings, Solana Ventures, DeFiance Capital and others.

Raised more than $60 million in the seed round and IDO.

Financial status

The project website provides information on their finances. More than $10 million in USDC, and just over $51 million invested in various instruments - LP, bonds, etc.

Apparently there is money, unless, of course, the numbers are drawn.

Activity

Activity in the media space is average. The latest news was a vote to sell all crypto assets (except stablecoins) into US dollars and US government bonds.

The project was sponsored by Solana's latest AI/crypto hackathon.

Every month they buy back their tokens from the market for an average of $200 - 250 thousand.

VEGA Protocol

Vega Protocol is a proof-of-stake blockchain built on top of Tendermint, allowing derivatives trading on dexes similar to centralized exchanges.

The sale took place on the coinlist. Among the investors are Arrington XRP Capital, Cumberland, Coinbase Ventures, Parachain Ventures, Pantera Capital, Hashed Fund, etc.

We raised more than $80 million through the seed round, strategic rounds and ICO on the coinlist.

Financial status

Most of the project funds are used for the development and testing of Vega software.

There is currently no community-managed fund or treasury. However, this is likely to change in the future as on-chain management features are introduced.

The team did not provide specific numbers to our request.

Activity

All social networks of the project are very active. The technical aspects of the project are mainly covered.

There was recently an ATH of daily volume on their platform of over 13 million USDT out of a total volume of over 700 million USDT.

Casper

Now the project was also held on the coinlist, showing one of the most outstanding results - almost 40x, at which the allocation could be sold.

Among the funds it is worth noting the following - HashKey Capital, Arrington XRP Capital and others.

We raised almost $60 million through a sale on the coinlist and a private round.

Financial condition

Information about the financial condition of the project was not found. Our questions have been ignored, and older questions from other community members about their finances have not been answered concretely.

Activity

There is activity in social media. Network updates are carried out periodically to improve speed and security.

Unique Network

Unique Network is a scalable blockchain - a platform for marketplaces, games and decentralized applications (dApps), created for the Polkadot and Kusama ecosystems.

The public sale took place on Tokensoft. Among the funds are Outlier Ventures, Animoca Brands, DFG Capital and others.

Raised just over $58 million through a private round and ICO.

Financial condition

The team does not disclose information on its financial condition, citing the fact that this information is not public.

Activity

Activity in the networks is high. They often hold community calls where technical updates are covered.

Participate in offline events - were at Polkadot Hackathon, Polkadot Relayers Incubator 2023 and TOKEN2049 in Singapore.

CLV

CLV is a specialized first-level network based on Substrate , which is EVM-compatible and can interact with other networks. The CLV wallet is a multi-chain application designed for everyday transactions, DeFi and gaming.

The public sale took place on the coinlist. Among the funds are Polychain Capital, Hypersphere Ventures and Divergence Ventures, as well as the Gate.io exchange.

We collected more than $57 million through a seed round, a private round and an ICO on the coinlist.

Financial status

There is no data on finances, questions have not been answered before Apparently no one was interested (or maybe they are cleaning it up).

Activity

Activity on social networks is low. In recent news, they announced a migration to the Binance Smart Chain (BSC) network from their CLV P-chain network. In the summer we took part in the EthCC conference in France.

Cere Network

Cere Network is a decentralized infrastructure for Data, providing tools to meet the data needs of content creators, game developers, brands and decentralized applications (dApps). This network provides services such as a decentralized content delivery network (dCDN) and a decentralized consumer data platform (dCDP) for managing consumer data. The main goal of the network is to reduce costs and overhead by directly transferring media content and game resources to users who own the rights to the content.

The public sale took place on the Republic platform. The project's funds are Binance Labs, Arrington XRP Capital, Republic, LD Capital, Fenbushi Capital, Polygon Fund, OKX Ventures, Alphabit Digital Currency Fund and others.

Raised through a seed round, private round and ICO $53 million.

Financial status

No numbers, the question was not answered. But judging by their messages and articles, the treasury is managed by the DAO and all matters are completely transparent.

Activity

Cere DAO was launched in October. They constantly update their staking dashboard. It was announced that Cere Bridge now supports WalletConnect 2.0.

Axelar

Axelar is a scalable cross-chain platform connecting several blockchains with different languages, providing cross-chain communication.

Raised $3.8 million in the seed round and $60 million in the next two. Raised $50 million in ICO.

Financial status

When asked about financing, we were sent to a document with the tokenomics of the project in which 12.5% of the supply was reserved for the company’s activities and 36% for programs for the community. No current status information is provided. Since December 2022, Axelar, together with investors, has been conducting a grant program “Axelar Ecosystem Startup Funding Program” for a total of $60 million.

Activity

In early October, Axelar published plans for scaling its network and a transition plan on Axelar Virtual Machine. Periodically enters into partnerships with other projects. Activity is high.

Blur

Blur is an NFT marketplace with the ability to use the NFT protocol lending.

Raised $11 million in a seed round with the participation of Paradigm and $113 million in a strategic round

Financial status

There is no publicly available information on the current status, but in the discord ignored.

DAO

A proposal to revise tokenomics with a new fee structure to increase the utility and value of tokens is being discussed.

It is proposed to enable the commission switching function with a base commission of 1%. All fees will go to the smart contract for the redemption and burning of the BLUR token.

Activity

The end of the second season and a new airdrop are planned for November 20th. Activity has been average recently, however, in the first half of the year the NFT lending protocol was released and activity was higher.

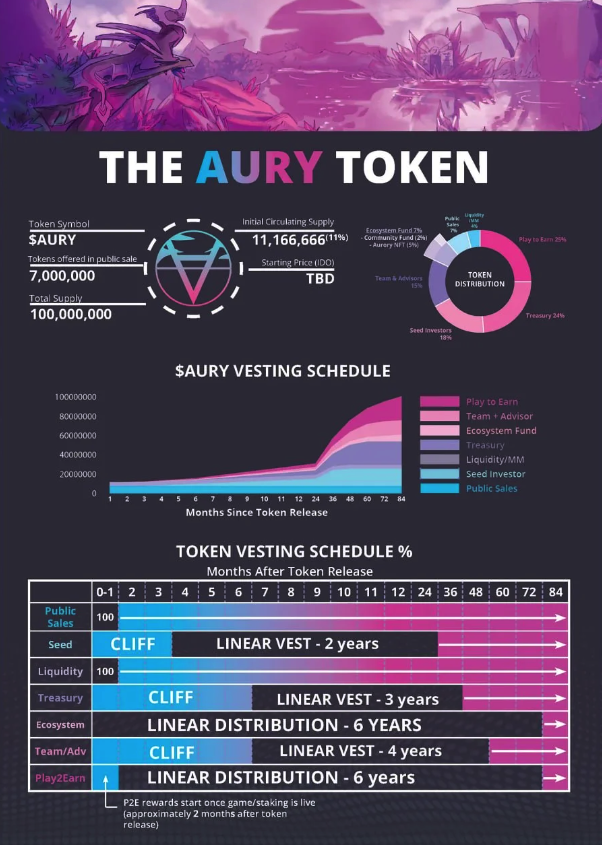

Aurory

Aurory is a gaming platform developed by Aurory Project. It includes many games and mini-games.

On August 31, 2021, the game sold 10,000 PFP (profile photos) in less than 3 seconds, collecting 10,000 thousand SOL. Then they raised ~$108 million on IDO.

Financial condition

The project suffered from the collapse of FTX and ~15% of the treasury is now locked in the FTX Dept case. Not all wallets are made publicly available; according to the latest reports, the project’s treasury contains $60+ million; with current expenses, this is a reserve for 3-5 years. Part of the Treasury is invested in T-bills (Treasury bonds).

Activity

The project activity is high. A monthly development report is posted on Twitter ( September).

HUMAN Protocol

HUMAN Protocol is a cross-chain protocol to improve interaction between human and AI. Allows you to automate job markets for people to collaborate. Initially, the protocol focuses on markets where huge volumes of human annotations can be traded to facilitate machine learning.

Raised $2.5 million in a strategic round with the support of Hashed Fund, Hypersphere and almost $100 million in several ICO rounds.

Financial status

There is no publicly available information on the current state of finances. There is no response on the project’s discord and no one was interested in it before, or it was cleared.

There is a grant program for a total of $10 million.

Activity

On October 23, we launched the Newconomics online hackathon. The Newconomics offline event will be held on November 14-15 in Paris.

The project is highly active, dedicated to the hackathon and covering events in the world of AI.