| Project | Collected on LBP | FDV | Current supply |

| Illuvium | $90 million | $393 million | 46.6% |

| Mask Network | $39.82 million | $306.70 million | 82.11% |

| Radilce | $24.68 million | $145.5 million | 51.4% |

| Perpetual Protocol | $12.26 million | $92.3 million | 44.00% |

| HOPR | $19.8 million | $14.93 million | 93.00% |

| Kine Protocol | $10.33 million | $13.67 million | 20.2% |

| Globe | $42 million | $2.86 million | - |

| Tidal | $20 million | $2.44 million | 30.00% |

| Coldstack | $1.25 million | $2.09 million | 35.00% |

Illuvium

Illuvium is a game in virtual reality, built on the Ethereum blockchain. The game takes place in a fantasy world where players can collect, battle, and trade digital creatures called Illuvials. The game combines elements of strategy, role-playing game and collectible card game.

The project raised $5 million in a seed round in 2021 with the participation of Delphi Digital. Raised $90 million on LBP. Additionally, in 2023 raised $10 million from Framework Ventures.

Over the past week, the price of the token has increased by more than 20% and is close to August peak. However, relative to the annual high reached in February, the price is still 50% lower.

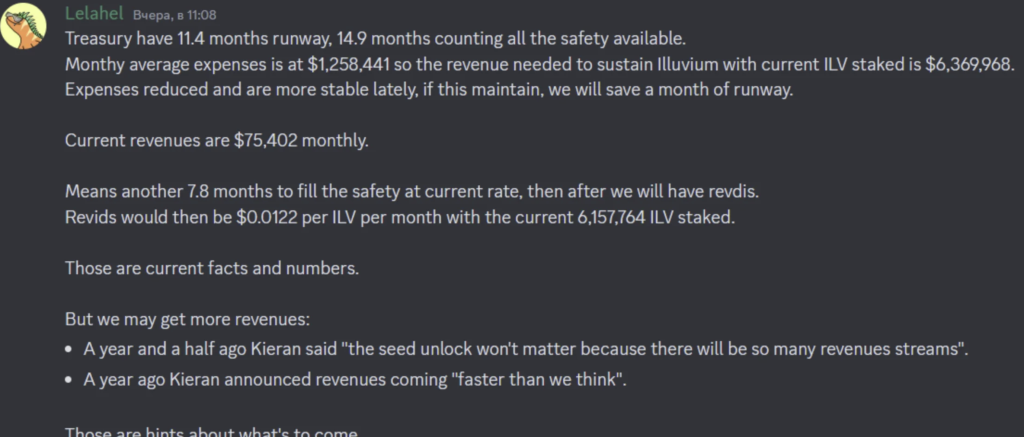

Financial condition

- Treasury reserve for approximately a year. Average monthly expenses are $1,258,441, so maintaining Illuvium with the current amount of ILV staked requires revenues of $6,369,968.

- Costs have decreased and become more stable recently < li> Current income is $75,402 per month.

- After 7 - 8 months of filling the treasury at the current rate, additional income (Revdis) is expected, which will amount to $0.0122 for each ILV per month with the current amount of pledged 6,157,764 ILV.

Activity

Twitter is followed by many influencers. Activity is high. On May 18, a closed beta test of the Overworld game started, and an open beta test is expected in the first quarter of 2024.

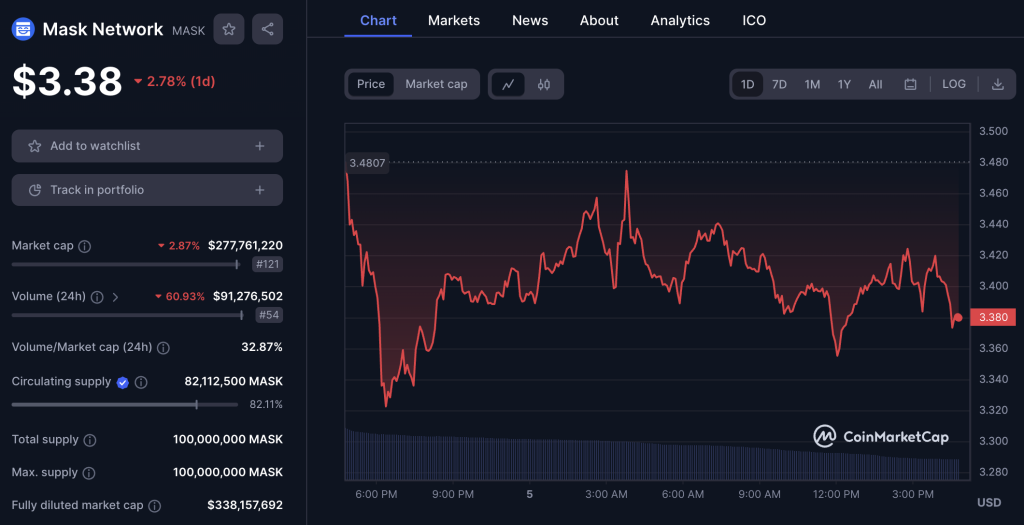

Mask Network

Mask Network is a browser extension that brings privacy and the benefits of Web3 technology to popular social platforms such as Facebook and Twitter. Users can install this extension, log in with Mask ID, and connect their wallet to use Web3 features on Web 2.0 sites. Mask Network allows you to encrypt messages, send NFTs and tokens, and store files on a decentralized network. It also provides services for exchanging fiat money for crypto.

The project has collected more than $98.8 million in investments, including $39.82 million during LBP, $42 million from Binance Labs, Animoca Brands, Dapper Labs, etc., and 5 million from DWF Labs.

The token is traded on all major exchanges - Binance, Coinbase, OKX, HTX, etc. More than 82% of tokens are in circulation. Medium FDV. Over the past month it has grown by more than 15%.

The graph is not depressing. At the end of October and beginning of November 2022, volumes arrived or MM got to work.

Financial condition

Information about their financial condition was not found in the public domain. Question ignored.

At the beginning of the year, Mask received 257,540 ARB, 30% of which, judging by their article in the medium, went to the project treasury. This means there is still a treasury.

Activity

Activity in the media space is high.

- Mask sponsors Web3 Social projects submitted to the Gitcoin Grant. Representatives of the team were among the organizers of Zuzalu City. Participated in Web3 Social House and ETHGlobal NYC.

- In May of this year, Mask Network announced investments in The Open Network (TON).

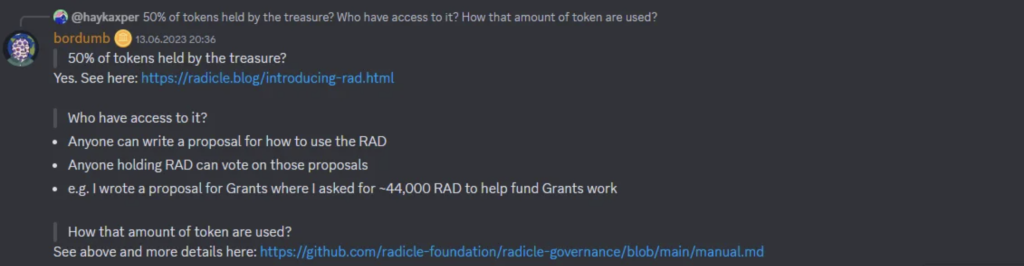

Radicle

Radicle - decentralized analogue of Github.

In February 2021, they raised ~$24.68 million on LBP (at a price of $6.17). Previously, they raised ~$12 million from Electic Capital, Galaxy Digital, ParaFi Capital, Naval Ravikant, etc.

It broke through ATL in August, rose slightly, the unlock of tokens of investors who took the token at $0.6 occurred in February 2022, when the price was ~$5 (~8 x).

Financial status

About ~48 million tokens in the treasury (~$72 million)

Activity

Activity is low, a couple of posts per month on Twitter . In July, they introduced the Radworks network, which operates through a decentralized governance system using the RAD token. Every quarter they report on progress on the stream.

Perpetual Protocol

Perpetual Protocol is a decentralized protocol that allows you to create perpetual contracts for any asset. These contracts are similar to futures contracts, but do not have an expiration date. The protocol uses a virtual automated market maker (vAMM) to provide trading with up to 20x leverage and 24/7 liquidity.

For more than a year and a half, the token apparently has found its bottom and is trading without sharp fluctuations (relative to the general schedule). There was a surge in volumes in September 2023, after which they tapered off.

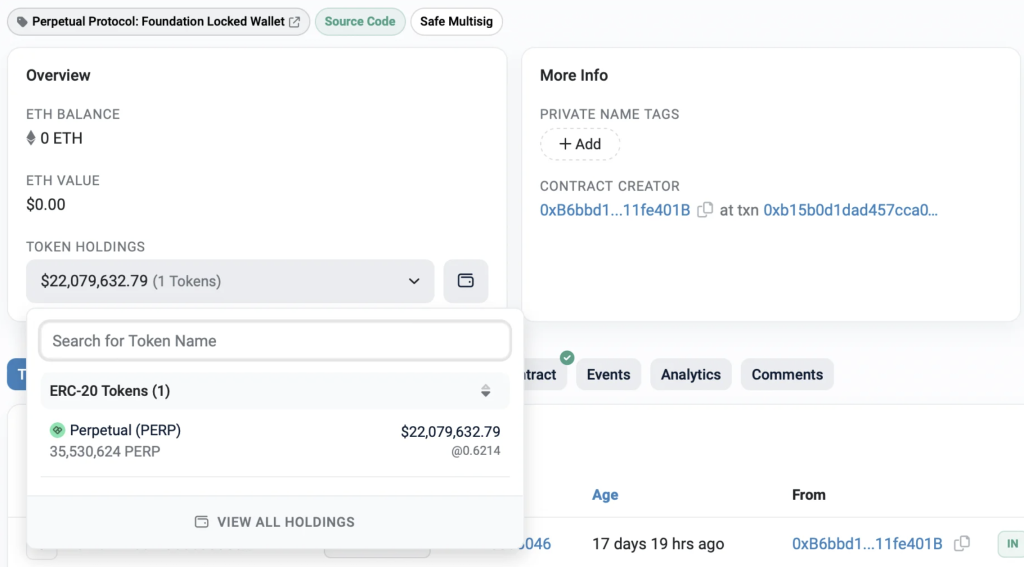

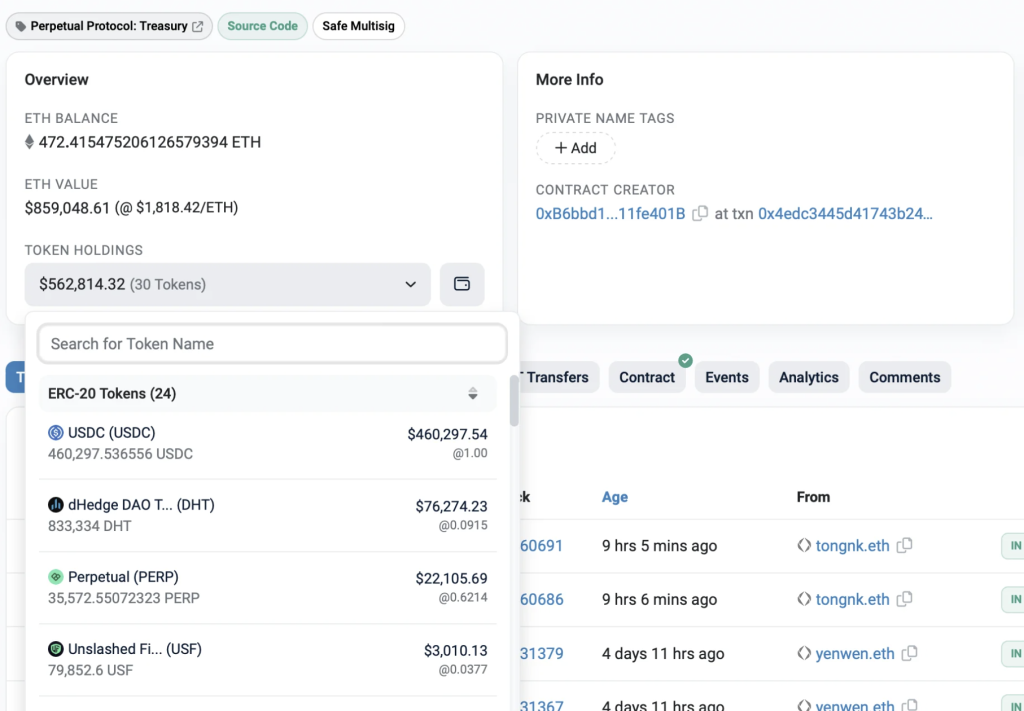

Financial status

There is no report on their treasury. Question ignored.

But in the discord there were two addresses marked Perpetual Protocol: Foundation Locked Wallet and Perpetual Protocol: Treasury, with a total of more than $23.5 million:

Activity

Activity in discord and medium is average. Twitter mainly publishes market data and indicators of its platform. Calls and AMAs are held periodically.

HOPR

HOPR is a protocol that ensures metadata confidentiality at the network level for all types of data exchange. It is an open mixed network with an incentive system where users can earn tokens by running and managing nodes. The protocol focuses on ensuring confidentiality and security during data transfer.

In total, the project collected more than $23.2 million in investments, including $2.4 million through the public presale, to which testnet participants were allowed, $19.8 million during the LBP and 1 million in seed-round led by Binance Labs.

Since Binance Labs was included in HOPR and it is still not traded on Binance, there remains hope for listing and growth in the future. There are over 93% of tokens in the market that are likely already in the right hands.

Since listing in February 2021, the token has been in decline. Judging by the chart, the token has found another bottom - ATL was a few days ago. It has been trading in the range of $0.1 - $0.03 for almost a year and a half. Not alpha behavior.

Financial condition

There is no publicly available information about their financial condition. The question was ignored.

Judging by their discord, there is a community treasury where, for example, unbranded tokens for nodes are returned.

Activity

- Activity in the media space is very high. They conduct community calls on discord and arrange airdrops for nodes.

- Twitter mainly covers technical issues and achievements. We introduced the SafeStaking solution, thanks to which web3 projects will be able to safely freeze their tokens. An audit of this decision was also conducted.

- Will speak at the Devconnect conference on November 16 in Istanbul.

Kine Protocol

Kine - DEX, supports Ethereum, BSC, Polygon and Avalanche.

In March 2021, they raised ~$10.33 million on LBP (at a price of $3.68). Before this raised ~$7 million from Blockchain Capital, 3Commas, HyperSphere Ventures, Naval Ravikant, etc.

The token came out of ATL in December 2022 and gave 3.5 x, but the current price is still less than the investors’ purchase price ($0.366 and $0.2) . The bulk of their tokens were unlocked in February-March 2022, when the price was $0.3.

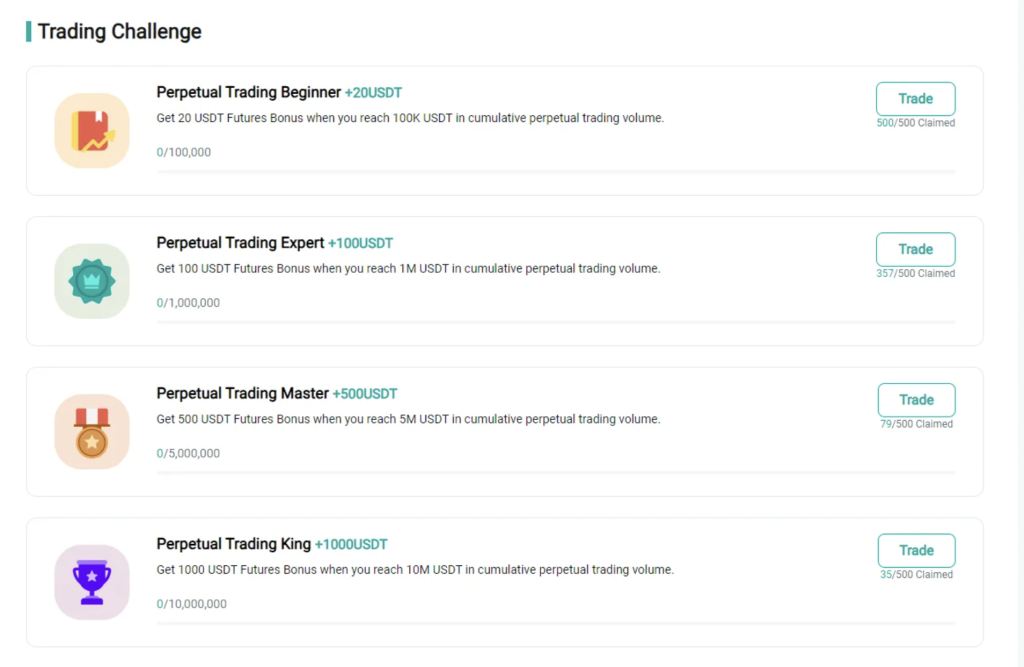

Activity

Activity on Twitter is high, they release monthly reports on updates ( September ). They add various functions for users, such as a center rewards .

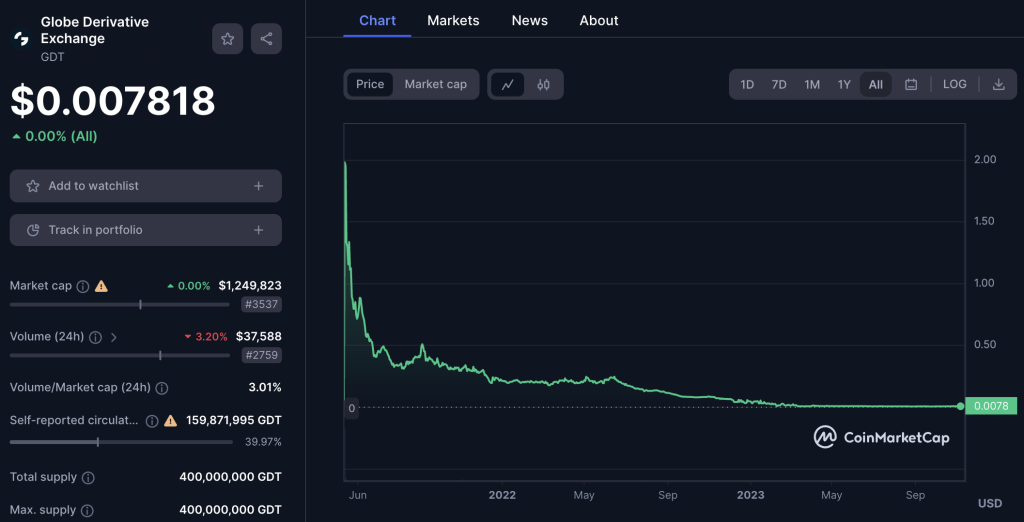

Globe Derivative Exchange

< a target="_blank" href="https://back2crypto.com/projects/ico/globe/">Globe is a cryptocurrency derivatives exchange where institutions and consumers transact digital currencies through a perpetual futures contract.

Raised $3 million in a seed round in 2020 with the participation of Y Combinator and Pantera Capital. LBP raised $42 million

In recent months, the token price has been stable and fluctuates within 10%. Since the beginning of the year, the price has fallen 4-5 times.

Financial condition

Reports on financial activities have not been released. They didn’t ask this question on the discord, or they cleared it out.

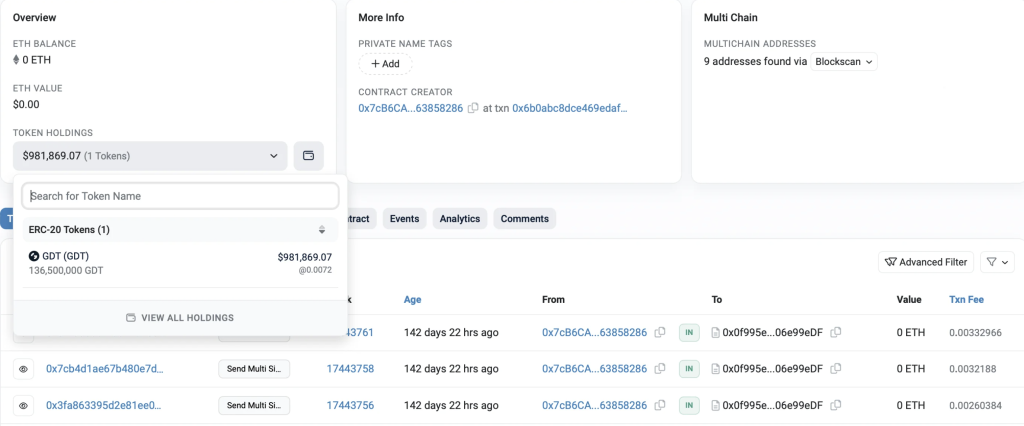

However, tokenomics and wallet addresses are available:

GDT distribution among wallets

| Company < /td> | 0x8875893035A93A3589795f59362Ab2D962728D6E |

| Team | 0xBEd4099A07fd58115E6cc427070eAF2669DfB791 | Ecosystem | < td> 0xB7F824cD975FEaA8666a5C54b8a3d178555055fe

| Presale Stacked | 0xc35A761f544b8da05123c9127508a1e79b9E1E1d | User Acquisition | Unve sted | 0x0f995e992e7DFc2058E1f64C559483BE06e99eDF |

Activity

Activity is average.

Tidal Finance

Tidal is positioned as an insurance marketplace (like Balancer) on Polkadot, allowing users to create custom insurance pools across multiple assets.

In March 2021, they raised ~$20 million on LBP (at a price of $0.019-0.045). Before this raised ~$1.8 million from HyperSphere Ventures, Spartan Capital, Kenetic Capital and QCP Capital.

The coin fell significantly (30 times) when compared with the price from public IDO ($0.00375). Updated ATL in October. The entry price for investors is unknown.

Financial status

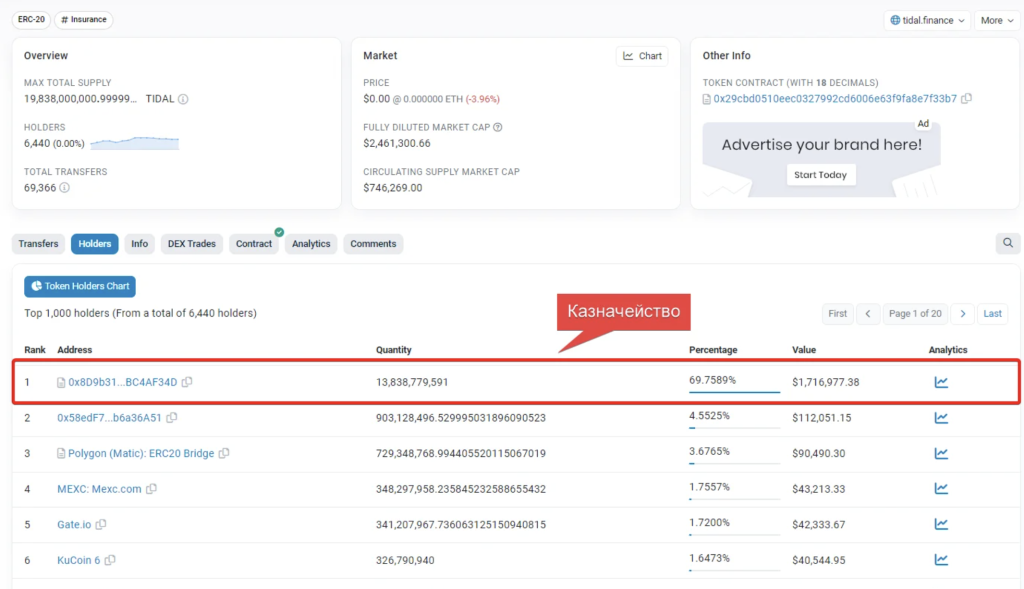

At the moment, they have ~14 billion tokens (~$1.7 million) in their treasury.

Activity

Despite the strong fall, the project’s Twitter lives and posts various news. In July launched