Behavior of the SKL token

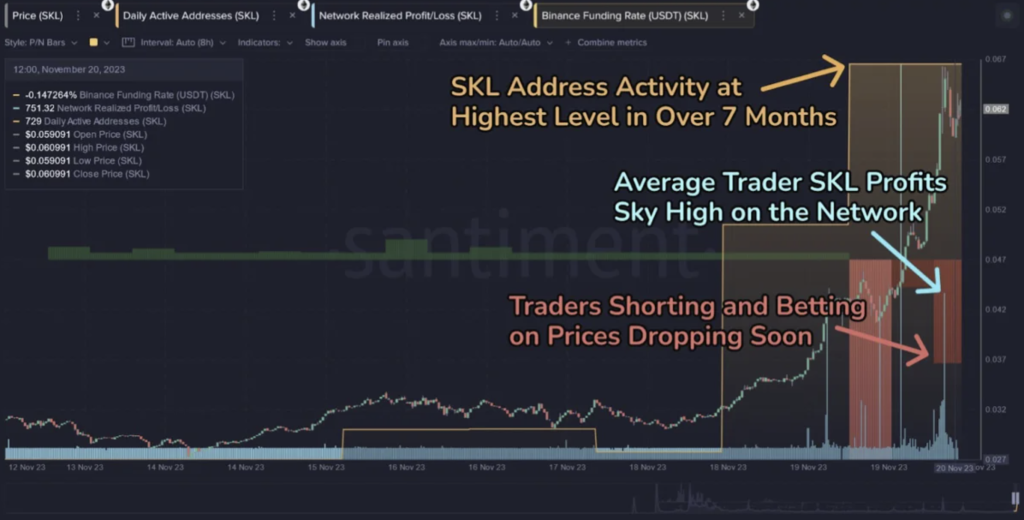

If you look at the chart for 2023, the SKL token has almost updated its highs on volumes.

Let's look at the entire graph. We see that there is a good upside:

Taking into account the good circulation (92%) and reasonable FDV ($231 million), the token has minimal 4-5x to the unicorn. You definitely shouldn’t count on new ATHs yet.

If you compare Skale with its closest competitors - Ronin (FDV – $1.58 billion, circulation – 27.73%), Beam (FDV – $1.25 billion, Circulate – 74.61%) and Injective (FDV – $2.43 billion, Circulate – 84.26%), then the upside is visible from 5x to 10x from current levels.

The project is not very popular, after the ICO it was traded on several X's, everyone who wanted it left.

The project felt very well the time to launch in 2020. It held an ICO, let everyone exit (at 3-5x), launched MM and began to grow. In the end, everyone was happy - both the ICO participants and those who purchased from the market. So now there is a feeling that the team knows what they are doing.

Traded on all top exchanges. There are Binance and Coinbase.

The SKL token has three uses:

- Paying for a subscription in the SKALE network;

- Ensuring the security of the network (through staking validators); < li>Participation in management (voting).

The SKL token can stakeICONIUM ;(Italian venture capital firm, invested in Aave in August 2023).

In 2021, we took part in investing in Ruby Exchange.

But at the moment they are no longer investing in new projects; all grants are aimed at growing and supporting the network.

Data about the treasury is not publicly available. When asked about it, they provide links to the website and the token contract.

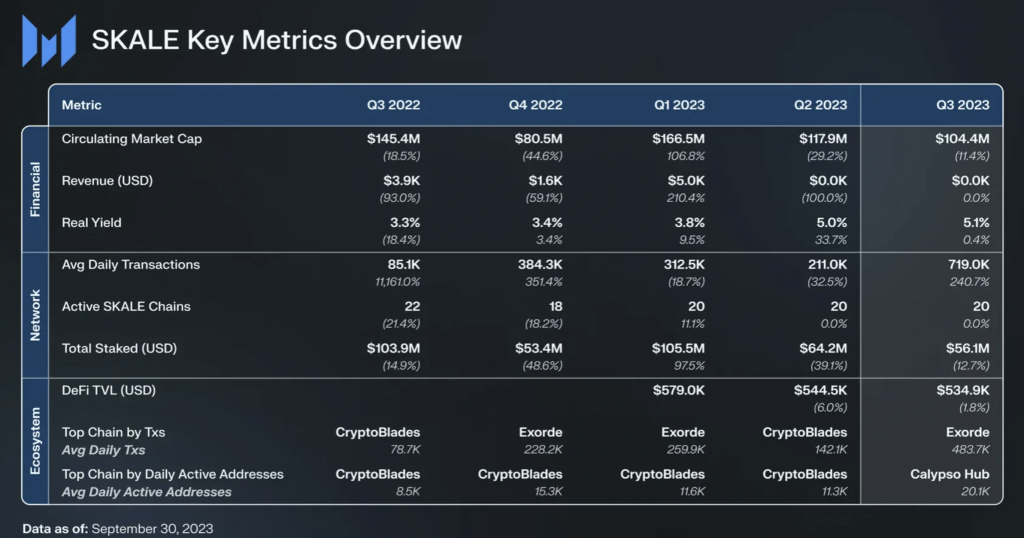

The volume of transactions across all SKALE networks in Q3 has grown and the bulk of transactions come from the Exorde protocol.

Currently, blockchain is not profitable. The accepted SIP 1 proposal will allow developers to charge $3,200 - $4,100 in SKL per SKALE chain per month. This is expected to last 8-12 months. After this, it is planned to introduce a dynamic blockchain fee for developers (up to $1 million per year, depending on the use of SKALE).

Ecosystem

There are no gas fees in ecosystem projects.

Exorde network is an information platform that encourages users to collect and share data from social networks. In Q3, it accounted for the bulk of transactions on the SKALE network.

EXD token, FDV - $13.85 million

Investors $1.2 million with the participation of Outlier Ventures, Protocol Labs, Black Dragon Capital and other investors.

Cryptoblades - is a multi-chain P2E PVP game.

SKILL token, FDV $800 thousand

Investors $4 million with the participation of Animoca Brands, Oracles Investment Group, Tenzor Capital, Ankr and other investors.

Nebula - gaming hub on SKALE. There is a currency within the NEB platform.

There is no token.

Calypso - NFT hub on SKALE.

There is no token.

CricketFly - Web3 play2win cricket game with 2+ million downloads on Google Play. There is no mention of Skale on the game's website.

There is no token.

Ruby Exchange - DEX from AMM to SKALE. SKALE previously invested in it. Works quickly, nice interface.

RUBY token, FDV - $3.35 million, TVL $800 thousand.

Raised $2.8 million with the participation of SKALE, NGC, Flow Ventures, Wintermute, Hashkey and other investors

Raised $2.8 million with the participation of SKALE, NGC, Flow Ventures, Wintermute, Hashkey and other investors

p>

Activity

At the beginning of December, a vote was held (SIP 1) to change the pricing in the dApp (Chain Pricing). dApp developers will be able to deploy chains for a predictable monthly fee based on the load on the chain. Thanks to this, users will not be charged for use.

In October it became known that the team is building an AI-powered chatbot to help developers run pre-trained AI models on smart contracts.

At the end of September, the SKALE Ecosystem Accelerator Program (SEA Program) was launched in partnership with Magic Square. Later, NFTb (in the future PixelRealm), an omnichain gaming platform, Yoda Labs, and game content makers joined the partnership for the ambassador program.

In June, they released Levitation Protocol, designed for ZK-based scaling.

Also at the end of May, the cross-chain Metaport Bridge was released (which was updated to Metaport 2.0 in November).

They constantly enter into partnerships, for example with The Juice Team, a gaming platform.

In general, there is a feeling that the work is being done for the sake of posts on social networks to show some kind of activity. Clearly the goal is not to improve the world; apparently, they feel the market again.

Santiment noticed that the activity of addresses on the highs for 7 months.

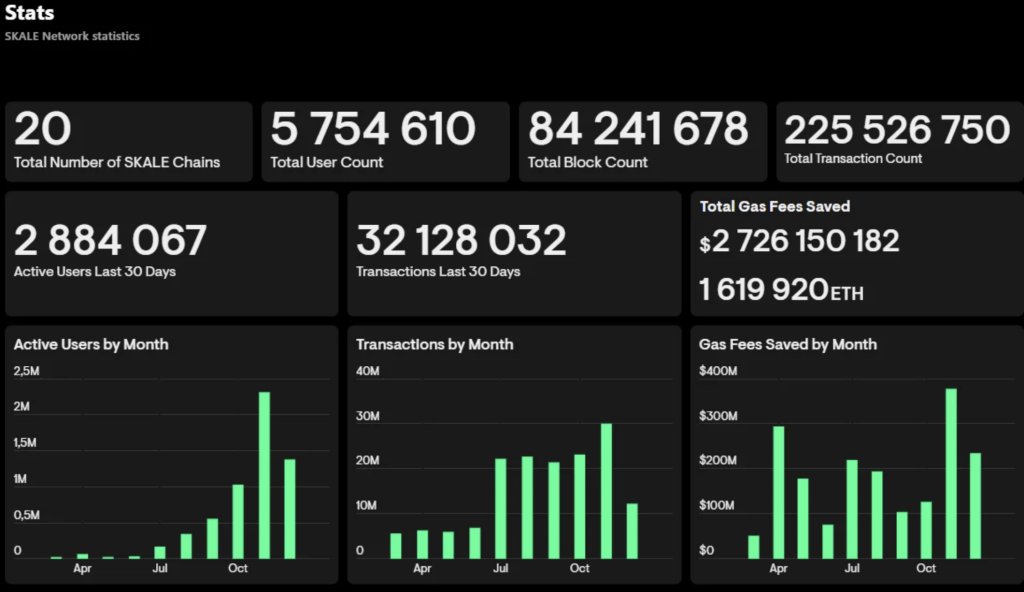

Compare themselves in terms of indicators with large blockchains:

The metric looks bloated. On site only general statistics are shown for the entire Skale, but they could not find them for individual blockchains. They keep their statistics on Dune.

Judging by the infographic from Skale, due to the absence of gas fees in ecosystem projects, $2.7 billion was saved:

< hr style="height: 4px; width: 4px;">

< hr style="height: 4px; width: 4px;"> Result

Growth drivers

- The network launch is scheduled for January 1 no commissions on Europa Skale Chain.

- Now positioning themselves as a gaming blockchain.

- Large ecosystem of projects.

- Severely undervalued compared to competitors.

Cons

- Judging by the reports, there is no income.

- In a year they want to collect up to a million dollars per year from developers for using their network.

- Do not disclose treasury data.

- Use the same narrative for promotion as in the past (network without gas fees for users) .

Conclusion

Skale is an established project from 2020, it performed well at the last bull run and, apparently, survived the market drop without any problems. By all indicators, it has every chance of repeating success - infected, small FDV, good circulation.

The project team has a good feel for the market, began to be active in advance, and in all likelihood this should bring results.