Uniswap UNI

Report IssueSentiment Neutral

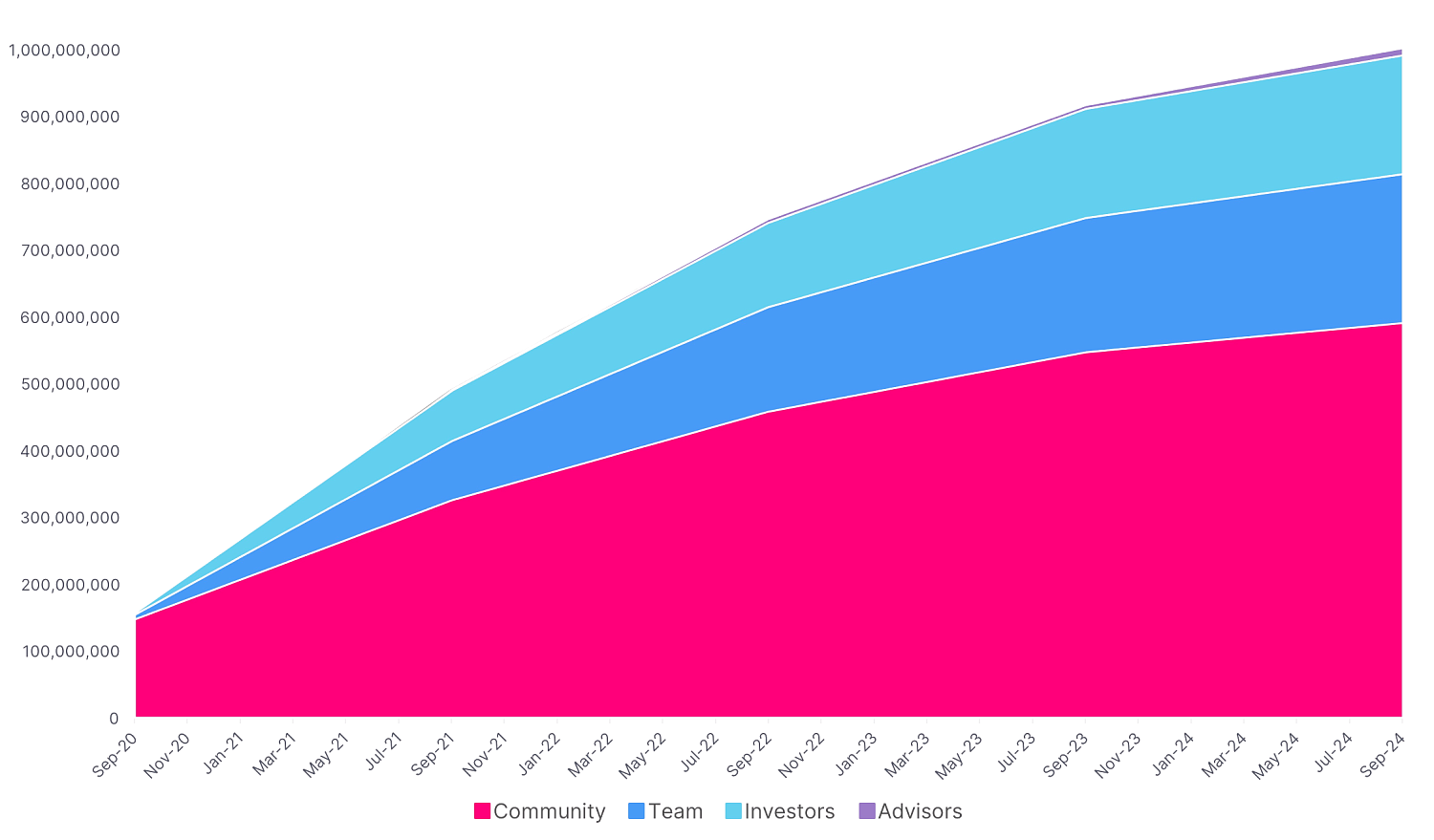

Fundraising Statistics

Blockchain Capital Tier 1

Blockchain Capital Tier 1 Paradigm Tier 1

Paradigm Tier 1 Polychain Capital Tier 1

Polychain Capital Tier 1 UNIUniswap

UNIUniswap

USDCUSD Coin

USDCUSD Coin

Short Review Uniswap

Crypto project Uniswap (UNI) is classified as a DEX. Uniswap is a Utility token that is hosted on the Ethereum Network. The current total supply is 1.00 B UNI (Circulating Supply + Tokens yet to be released - Burned Tokens).

Uniswap ICO Overview

Estimated date for the public token sale: 16 September 2020. (UNI)

UNI Price Chart

The launch of UNI token trading took place on 17 September 2020.

Fundraising Rounds

Total sold 150.00 M UNI tokens (0.15% of total tokens). Total amount of funds raised by the Uniswap project is $177.90 M.

| Investment Round | Date | Price | Funds Raised |

| Series B | October 13, 2022 | -- | $165.00 M |

| Community Token Distribution | September 16, 2020 | -- | -- |

| Series A | July 2020 | -- | $11.00 M |

| Seed | April 2019 | -- | $1.80 M |

| Grant | August 2018 | -- | $100,000.00 |

Uniswap Investors

Blockchain Capital Tier 1

Blockchain Capital Tier 1 Paradigm Tier 1

Paradigm Tier 1 Polychain Capital Tier 1

Polychain Capital Tier 1 Union Square Ventures (USV) Tier 1

Union Square Ventures (USV) Tier 1 Variant Tier 1

Variant Tier 1 a16z (Andreessen Horowitz) Tier 1

a16z (Andreessen Horowitz) Tier 1 ParaFi Capital Tier 2

ParaFi Capital Tier 2 SV Angel Tier 2

SV Angel Tier 2Detailed overview of Uniswap

UNI is the governance token of the Uniswap exchange service . It was only added to the platform in September 2020 and is believed to be a path towards greater potential for the service. UNI owners have the right to vote on changes to the platform, such as future updates, and participate in the decision-making process.

Now let's look at Uniswap as a whole. It is a decentralized exchange built on the Ethereum blockchain, so it provides the ability to exchange ERC-20 tokens. Uniswap has a number of features that distinguish it from other popular exchanges. Instead of a traditional order book, this service uses an automated market making (AMM) algorithm that allows traders to transact online. Essentially, AMM is a system of smart contracts that contain a pool of liquidity. An important part of the system are liquidity providers, responsible for funding liquidity pools. Anyone can join the group of liquidity providers as long as they can deposit two tokens.

Where did Uniswap (UNI) come from

It was launched in 2018. However, the idea appeared earlier. Vitalik Buterin, the founder of Ethereum, proposed the idea of a decentralized exchange service that would allow the exchange of assets on the network. However, Vitalik Buterin is not the one we know as the founder of Uniswap.

Hayden Adams, a former Siemens engineer, brought this idea to life. Uniswap was announced on November 2, 2020. The project gained popularity at a very high speed and soon became one of the hottest events in the crypto world in 2020. It's the largest decentralized exchange in terms of volume, and Hayden doesn't seem to be stopping. His plan calls for Uniswap to work on scaling and governance.

The huge success is supported by the fact that Uniswap already has a copycat SushiSwap, which ironically has become the platform's main competitor.

Benefits of Uniswap (UNI)

- No intermediaries. Automated liquidity protocol helps avoid third party involvement in the exchange process.

- No listing fee. Since the Uniswap protocol is decentralized, there is no listing process required.

- No need to reveal your identity. Uniswap protects the anonymity of users, for no personal information is required for exchange.

- Full control over your own assets. Since there is no third party, no one other than the owner of the asset has control over it.

Disadvantages of Uniswap (UNI)

At first glance, Uniswap may seem like an ideal service, but let's look at some points that can be attributed to its disadvantages:

- Only supports ERC-20 tokens. It would be nice to take advantage of this exchange for a wider variety of tokens and coins. Unfortunately, this is currently only possible for ERC-20 tokens.

- Chance of counterfeit tokens. Uniswap allows anyone to stake tokens. There is a possibility that scammers will post fake tokens to obtain funds from users. It is important to remember that transactions are irreversible, so this can be considered a serious disadvantage.

ByBit

ByBit  Binance

Binance  Gate

Gate  Score

Score