Pendle PENDLE

Report IssueSentiment Neutral

Fundraising Statistics

$3.46 +2.55%

$0.8

PENDLEPendle

PENDLEPendle

USDCUSD Coin

USDCUSD Coin

Short Review Pendle

Crypto project Pendle (PENDLE) is classified as a DeFi. Pendle is a Utility token that is hosted on the Ethereum Network. The current total supply is 251.06 M PENDLE (Circulating Supply + Tokens yet to be released - Burned Tokens).

Pendle ICO Overview

Public sale of tokens will take place on the Binance Launchpad. Estimated date for the public token sale: 3 July 2023. Pendle (PENDLE) price during the token sale: 0.8 USD.

PENDLE Price Chart

The launch of PENDLE token trading took place on 28 April 2021.

Fundraising Rounds

Total sold 51.66 M tokens (20.58% of total tokens). Total amount of funds raised by the Pendle project is $15.53 M.

| Investment Round | Date | Price | Funds Raised |

| Binance Launchpool | 4 Jul 2023 | -- | -- |

| Liquidity Bootstrapping Pool | 28 Apr 2021 | $0.7971 | $11.83 M |

| Private Round | 16 Apr 2021 | $0.1394 | $3.70 M |

Pendle Investors

CMS Holdings LLC Tier 2

CMS Holdings LLC Tier 2 Lemniscap Tier 2

Lemniscap Tier 2 Mechanism Capital Tier 2

Mechanism Capital Tier 2 The Spartan Group Tier 2

The Spartan Group Tier 2Cryptocurrency Pendle (PENDLE)

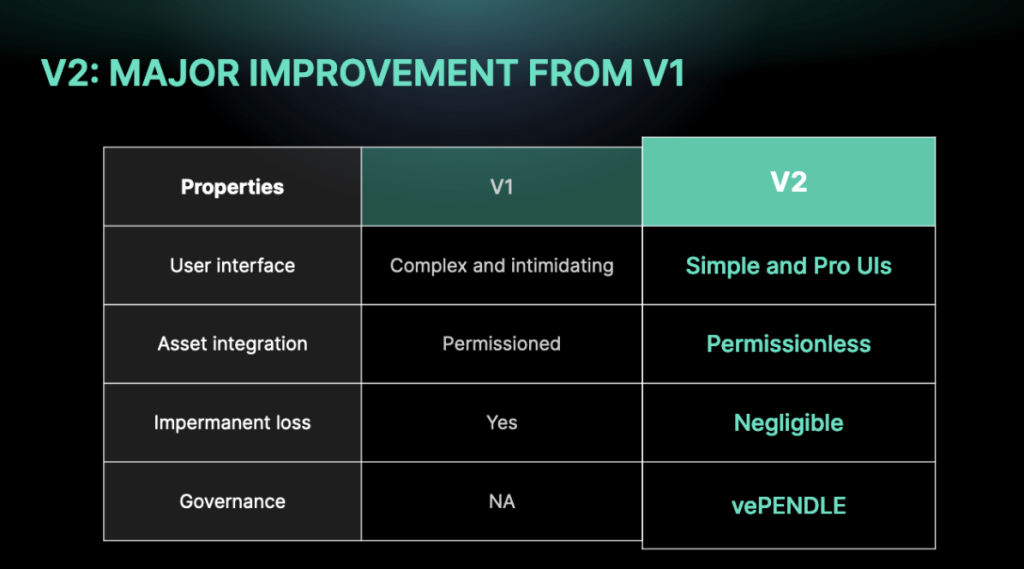

Pendle is a non-secure yield trading protocol that allows anyone to make targeted bets on fluctuations in market returns. The income generating assets are divided into the main token (PT) and the yield token (YT), allowing users to earn fixed or flexible returns on AMM Pendle v2.

- PT entitles you to the principal portion of the underlying revenue-generating token and can be redeemed upon redemption. PT can be traded at any time, even before maturity.

- PT will always trade at a discount to the underlying asset due to the extracted yield component. In TradFi, it can be thought of as a "zero coupon bond" and the "fixed return" is represented by a guaranteed increase in price to full value at maturity.

- YT entitles you to the income generated by the underlying token yielding income, and the income generated can be queried at any time from the Pendle dashboard. YT can be sold at any time, even before maturity.

- Buying YT can be thought of as "coupon payments" in TradFi, and it allows users to buy the yield of an asset and make a profit when the yield received is higher than the cost , paid to purchase YT.

Yield is a core component of DeFi, and LSD-Fi is the fastest growing market segment since the launch of ETH staking. Pendle aims to become the leading DeFi marketplace for yield management and also aims to increase the liquidity of yield-producing asset protocols.

Pendle Features

-

One of the early pioneers of revenue trading: V1 mainnet launches June 2021 with over 350 million trading volume dollars.

-

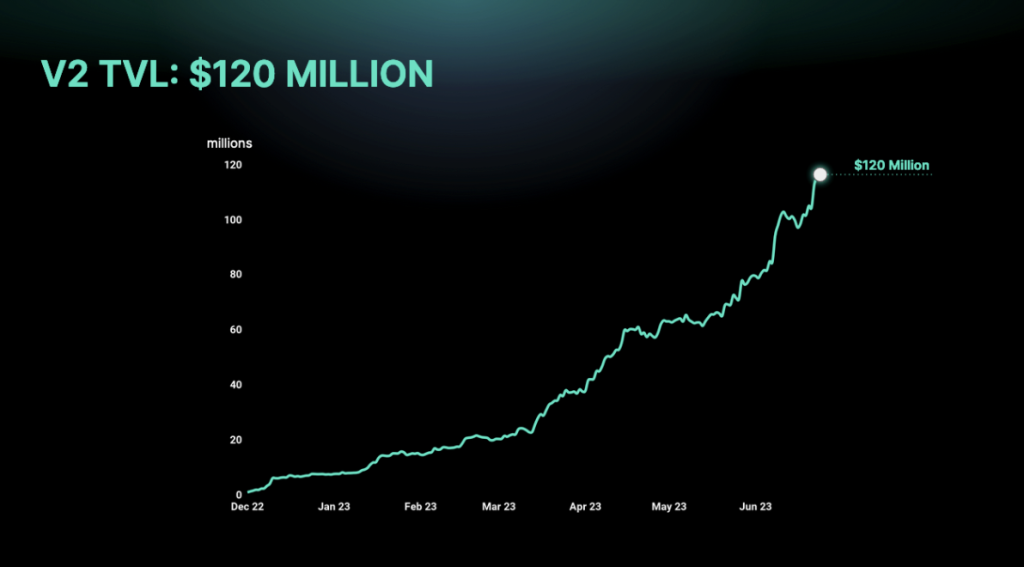

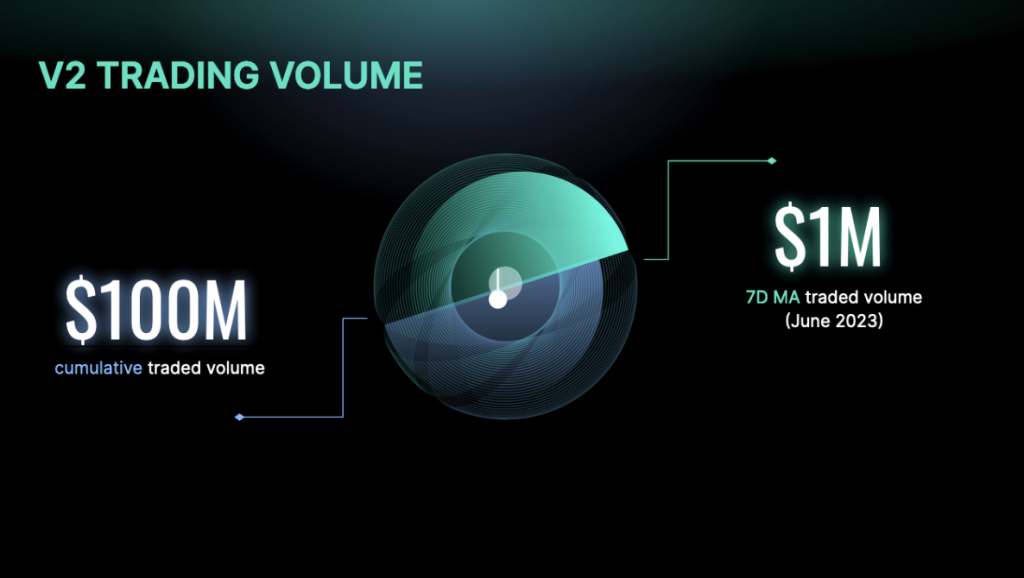

Version 2 Upgrade: V2 Main Network launched in Q4 2022 with newly updated AMM V2 model delivering up to 200x faster capital efficiency compared to version 1. As of June 2023, Pendle v2 has exceeded $100 million in TVL and $100 million in total trading volume.

-

Capital Efficient AMM: The AMM Pendle design allows PT and YT swaps to be conducted through a single liquidity pool by implementing pseudo-AMM with flash swaps. Users can earn lower slippage fees with higher liquidity, while liquidity providers earn fees on both PT and YT swaps, doubling their returns.

-

Minimum Time Loss (IL): Pendle v2's design ensures that IL is negligible as Pendle's AMM takes into account the natural rise in PT price, shifting the AMM curve to push the PT price towards its base value over time.

Pendle tokenomics

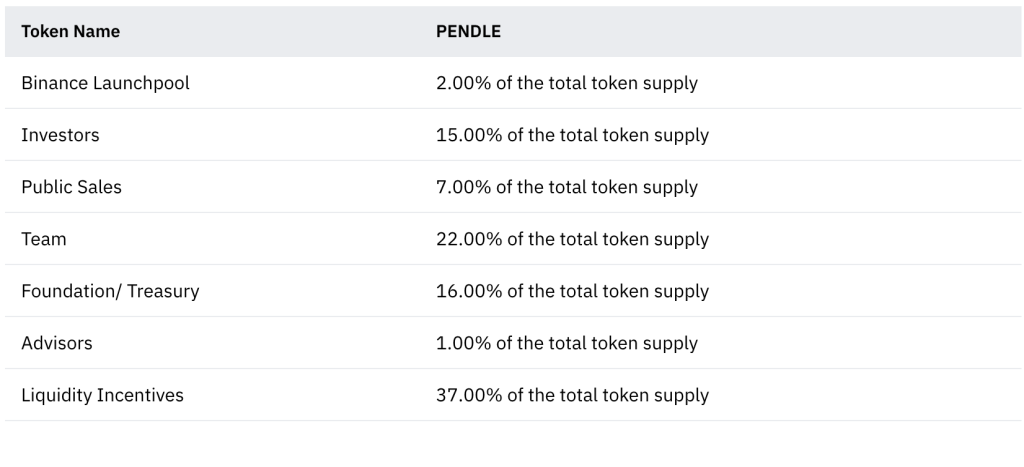

Tokenomics and distribution of Pendle tokens.

PENDLE Token Release Schedule

PENDLE Token Release Schedule - All categories have been fully secured after April 2023.

- Pendle will be moving to perpetual emission model. Currently, weekly emissions are around 460 thousand.

- Weekly emissions will gradually decrease by 1.10% per week until April 2026. At the moment, current tokenomics allows for a final inflation rate of 2.00% per year for stimulus.

Current Roadmap

Q3 2023:

- Deployed on the BNB network, enabling income trading within the BNB network ecosystem.

- New simplified user interface that offers a decentralized flat rate product using PT tokens.

Q4 2023:

- Pendle permissionless listing, allowing any protocol to create a yield market

Commercial and business development progress

- LSD-Fi sector: The Pendle protocol is integrated with major blue-chip LSD protocols such as stETH from Lido, rETH from Rocket, ankrETH from Ankr and sfrxETH from Frax, which provides deep liquidity for LSD assets.

- vePENDLE War: Penpie XYZ, Equilibria and StakeDAO launched a liquid derivative for vesting on top of Pendle.

- Perps / Derivatives: Pendle allows users to trade both GMX GLP returns and gDAI Gains Network returns, offering the ability to hedge or long returns on traders' fees.

- DEX Liquidity : Pendle has created a yield market for LPs in the Stargate USDT pool, a new pool for Camelot PENDLE/ETH LPs, and Aura Finance LPs & Balancer to accumulate additional income with the same liquidity.

Score

Score