Maverick Protocol MAV

Report IssueSentiment Neutral

Fundraising Statistics

MAVMaverick Protocol

MAVMaverick Protocol

USDCUSD Coin

USDCUSD Coin

Short Review Maverick Protocol

Crypto project Maverick Protocol (MAV) is classified as a DeFi. Maverick Protocol is a Utility token that is hosted on the Ethereum Network. The current total supply is 2.00 B MAV (Circulating Supply + Tokens yet to be released - Burned Tokens). (1.50% of total tokens) have been allocated for the public sale.

Maverick Protocol ICO Overview

Public sale of tokens will take place on the Binance Launchpad. Estimated date for the public token sale: 14 June 2023. (MAV) You can purchase project tokens for USDT BNB

MAV Price Chart

Fundraising Rounds

Total sold 30.00 M tokens (1.50% of total tokens). Total amount of funds raised by the Maverick Protocol project is $8.00 M.

| Investment Round | Date | Price | Funds Raised |

| Binance Launchpool | 14 Jun 2023 | -- | -- |

| Strategic Round | 17 Feb 2022 | -- | $8.00 M |

Maverick Protocol Investors

Jump Crypto Tier 1

Jump Crypto Tier 1 CMT Digital Tier 2

CMT Digital Tier 2 Pantera Capital Tier 2

Pantera Capital Tier 2 The Spartan Group Tier 2

The Spartan Group Tier 2Maverick Protocol (MAV) Cryptocurrency

Maverick is a composable decentralized financial infrastructure that allows builders and liquidity providers to achieve high capital efficiency and implement their desired liquidity provision (LP) strategy.

MAV is the Maverick Protocol's native utility token that can be used for the following functions:

- Governance: MAV token holders can stake to receive veMAV, which will be used for voting on protocol governance decisions.

- Voting: veMAV will give the community voting rights, including the distribution of protocol incentives for certain pools or positions in Maverick AMM.

The protocol consists of the following main components working together:

Maverick AMM: The first AMM with dynamic allocation. A smart contract that allows users to allocate liquidity in arbitrary allocations and naturally automates the movement of users' liquidity in accordance with price changes.

Strengthened Positions: A smart contract that sits on top of an AMM contract, allowing protocols to add token rewards to certain dynamic allocations to attract liquidity with surgical precision.

Voting Escrow: a smart contract that facilitates voting on strengthened positions and management of Maverick.

The project raised $17,460,000 through three rounds of private token sales, during which 360,000,000 of the 2,000,000,000 MAV tokens were sold. In the last round of the private token sale, the MAV price was $0.1.

As of June 13, 2023, the total supply of MAV tokens is 2,000,000,000, and the circulating supply after listing will be 250,000,000 (~12.5% of the total token supply).

Maverick Protocol (MAV) Project

Maverick is a composable decentralized financial infrastructure that allows builders and liquidity providers to achieve high capital efficiency and execute the desired LP strategy. At its core, Maverick AMM, the first dynamic allocation AMM, gives liquidity providers greater flexibility in where they allocate their liquidity and allows them to automatically move their liquidity according to price.

Maverick's mission is to eliminate the inefficiencies of decentralized finance by helping users place their liquidity where it can do the most work. Maverick AMM supports a wide range of LP strategies, including strategies that improve capital efficiency for both constant product and range AMMs. Moreover, by natively automating a suite of liquidity strategies, Maverick enables all classes of users to benefit from dynamic, concentrated liquidity.

Maverick Value (MAV)

For protocols: New protocols need liquidity on the network to thrive. Maverick allows protocols to use precise incentives to shape global liquidity distribution in line with their goals.

For liquidity providers: LPs in existing AMMs are limited in that only a small set of LP strategies are available to them. Maverick changes this by adding new degrees of freedom to the LP toolbox and allowing them to collect stimuli from protocols.

For traders: The highly concentrated nature of Maverick pools means traders receive extremely competitive prices with low slippage.

Maverick Highlights

Dynamic AMM Allocation: The key innovation of Maverick AMM is built-in liquidity automation. Previously, if a liquidity provider wanted to keep its liquidity in range at all times, it had to constantly monitor its liquidity position and pay gas to move it manually. Maverick AMM removes this complexity by allowing users to select a move mode that will move their liquidity for them.

- The right mode moves liquidity to follow the price of the underlying asset upward, expressing a bullish view of the price.

- Left mode moves liquidity downward with the price of the underlying asset, expressing a bearish view of the price.

- Mode Both moves liquidity to follow price movements in either direction, which is suitable for stablecoins and other highly correlated pairs.

Customizable liquidity distributions: Maverick AMM supports uneven liquidity distributions within a user-defined range. This opens up a new degree of customization for liquidity providers, who no longer have to settle for single allocations or open multiple positions to customize the allocation to suit their needs.

Liquidity Generation: With leveraged positions, projects can stimulate liquidity in Maverick with surgical precision. Under prevailing incentive models, token incentives are distributed among liquidity providers throughout the pool, rewarding liquidity that is never used and may even be counterproductive to the project's goals. By incentivizing a stronger position on Maverick, the project can attract liquidity providers to a certain concentration in the pool, maximizing the effectiveness of their incentives.

Automatic commission accrual: All trading commissions generated by a liquidity position are automatically offset back into that position. This saves liquidity providers gas fees that they would otherwise spend taking the commission and adding it back to their position.

Native LST Support: Maverick AMM is the only AMM built to natively support Liquid Staking Tokens (LST). AMMs with static range and stable replacement are not designed to handle income-generating assets such as LST.

- Price Following: Maverick AMM with its dynamic movement modes is the ideal solution for maintaining ranged liquidity throughout the LST yield curve.

- Protocol support: LST protocols - both large and small - compete for market share. Maverick is the most efficient platform on which this competition can occur: LPs can effectively provide liquidity, and protocols can effectively incentivize their desired liquidity allocation.

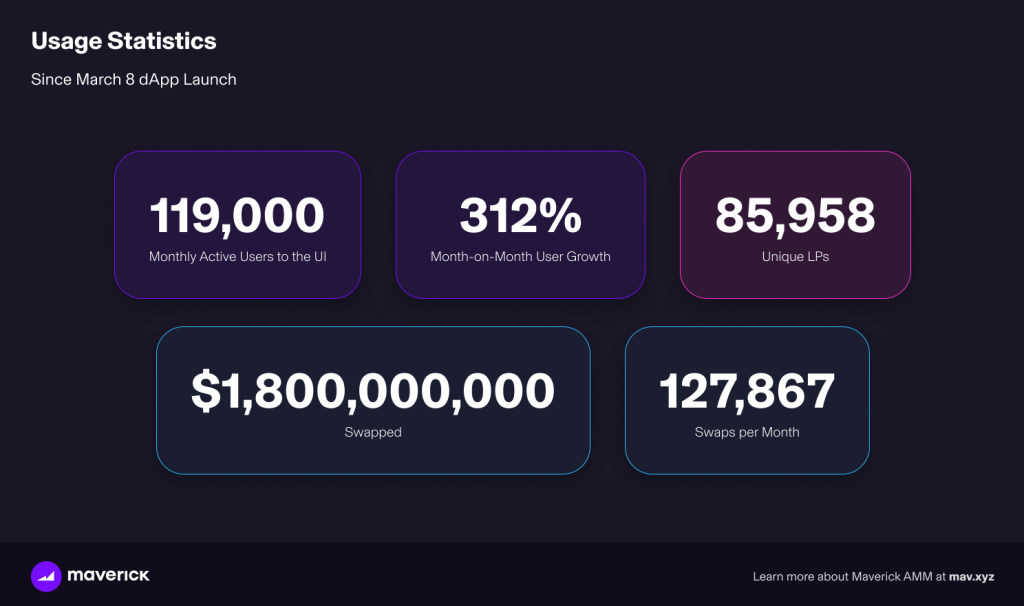

Summary of usage statistics from the launch of the Maverick dapp on March 8, 2023 to June 8, 2023

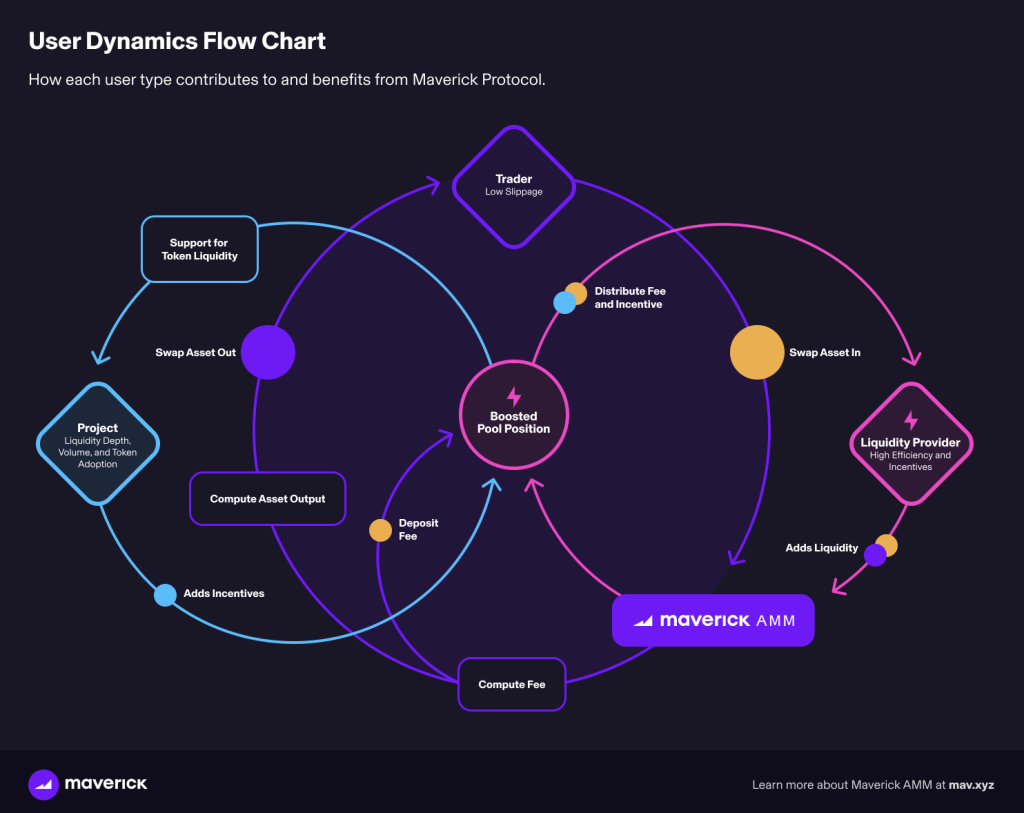

This diagram shows how each the type of users that contribute to and benefit from the Maverick protocol.

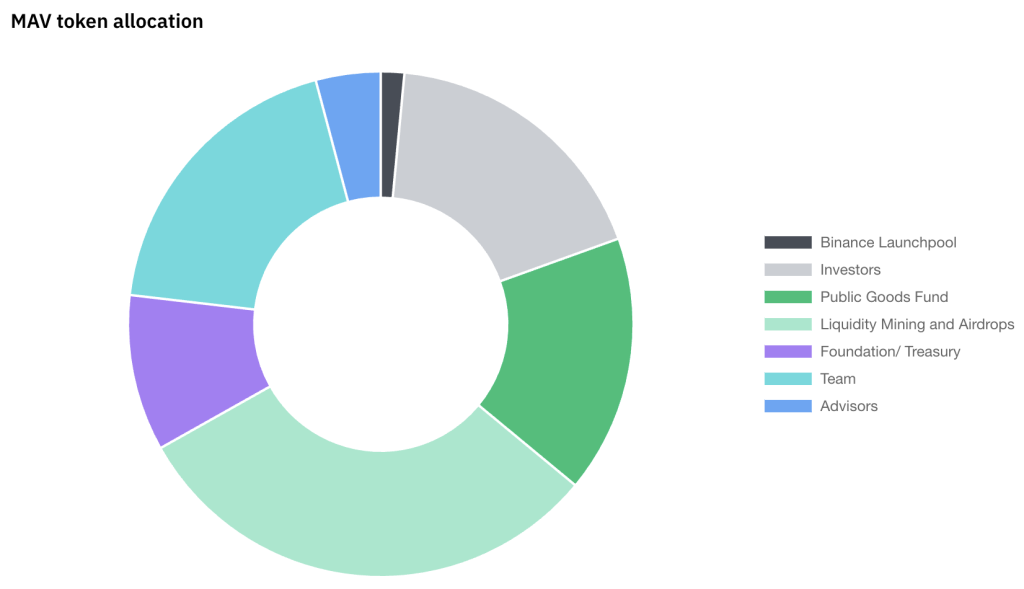

Tokenomics Maverick (MAV)

Maverick (MAV) Token Distribution:

< img alt="Maverick Token Distribution (MAV)" src="/upload/medialibrary/b18/uhgzbtw4cwy57hkbdoar7ab8oooe6c2c.png" title="Maverick Token Distribution (MAV)">

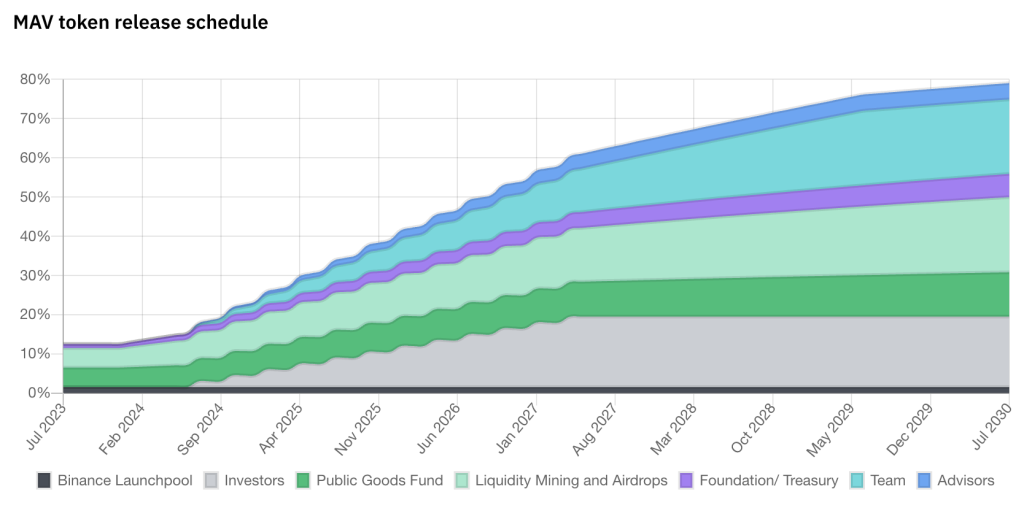

Maverick (MAV) Token Unlocking

Maverick (MAV) Token Unlocking Schedule:

Maverick (MAV) Roadmap< /h2>

Q3 2023:

- Deploy on BNB chain

- Launch escrow and management contracts

Q4 2023 (subject to DAO voting):

- Run accelerated pool voting

- Launch AMM on more networks

Q1-Q2 2024 (subject to DAO voting):

- Launch AMM in more networks networks

- Support for MAV LayerZero in more chains

Maverick (MAV) development progress

LST protocols: Maverick plays an important role in supporting LST and liquidity protocols. There are several LSTs available on Maverick such as wstETH, frxETH, swETH, rETH and cbETH.

- Lido: launched wstETH-ETH pool on Maverick, and Lido DAO approved incentives from its treasury for strengthened Maverick positions.

- Frax: launched frxETH-FRAX pool on Maverick and is providing weekly incentives to leverage this pool.

- Swell: Launched the swETH-ETH pool on Maverick and is providing weekly incentives to leverage this pool, bringing $4.24 million in concentrated liquidity into the active price range.< /li>

Stablecoins: Maverick AMM Both mode has achieved strong market compliance for stable pair liquidity. There are several stables available on Maverick such as LUSD, FRAX, GRAI, USDC, USDT and DAI.

- Liquity: Launching LUSD-based pools on Maverick on both Ethereum and zkSync Era.

Trade Aggregators:Maverick AMM is integrated with trade aggregators on both the Ethereum Mainnet and zkSync Era, such as 1inch, Paraswap, Odos, Cowswap and OpenOcean.

Other:

- Tokemak: liquidity aggregation platform. Tokemak announced that Maverick Pools will be an important component of the Tokemak v2 Liquidity Management Pools product, particularly through proven Maverick AMM optimizations for LPing Liquid Staking tokens.

- Galxe: Web3 Credential Data Network. Maverick and Galxe have collaborated on several NFT campaigns, and Galxe launched the GAL-wstETH pool on Maverick, designating Maverick as the main DEX for the GAL token.

- Layer Zero: Omnichannel collaboration protocol. The MAV token will be supported as a bridge asset via the OFT bridge.

ByBit

ByBit  Binance

Binance  Gate

Gate  Score

Score