dYdX DYDX

Report IssueSentiment Neutral

Fundraising Statistics

$0.48 -0.50%

$1

DYDXdYdX

DYDXdYdX

USDCUSD Coin

USDCUSD Coin

Short Review dYdX

Crypto project dYdX (DYDX) is classified as a Trading. dYdX is a Utility token that is hosted on the Ethereum Network. The current total supply is 1,000,000,000 (Circulating Supply + Tokens yet to be released - Burned Tokens). The level of social activity of the dYdX project is assessed as High.

dYdX ICO Overview

Estimated date for the public token sale: 6 September 2021. dYdX (DYDX) price during the token sale: 1 USD.

DYDX Price Chart

The launch of DYDX token trading took place on 8 September 2021.

Fundraising Rounds

Total sold 75.00 M DYDX tokens (0.07% of total tokens). Total amount of funds raised by the dYdX project is $87.00 M.

| Investment Round | Date | Price | Funds Raised |

| Airdrop | September 10, 2021 | -- | -- |

| Series C | June 15, 2021 | -- | $65.00 M |

| Series B | January 26, 2021 | -- | $10.00 M |

| Series A | October 19, 2018 | -- | $10.00 M |

| Seed Round | December 19, 2017 | -- | $2.00 M |

dYdX Investors

1confirmation Tier 1

1confirmation Tier 1 Bain Capital Tier 1

Bain Capital Tier 1 Paradigm Tier 1

Paradigm Tier 1 Polychain Capital Tier 1

Polychain Capital Tier 1 a16z (Andreessen Horowitz) Tier 1

a16z (Andreessen Horowitz) Tier 1 Dragonfly Capital Tier 2

Dragonfly Capital Tier 2 Hashed Tier 2

Hashed Tier 2Detailed review of dYdX (DYDX)

DYDX is a utility token decentralized crypto exchange dYdX. This ERC-20 token became available for purchase at the end of 2021. DYDX facilitates Layer 2, a solution that allows the exchange to handle more transactions while maintaining all the security of the chain on which it is built.

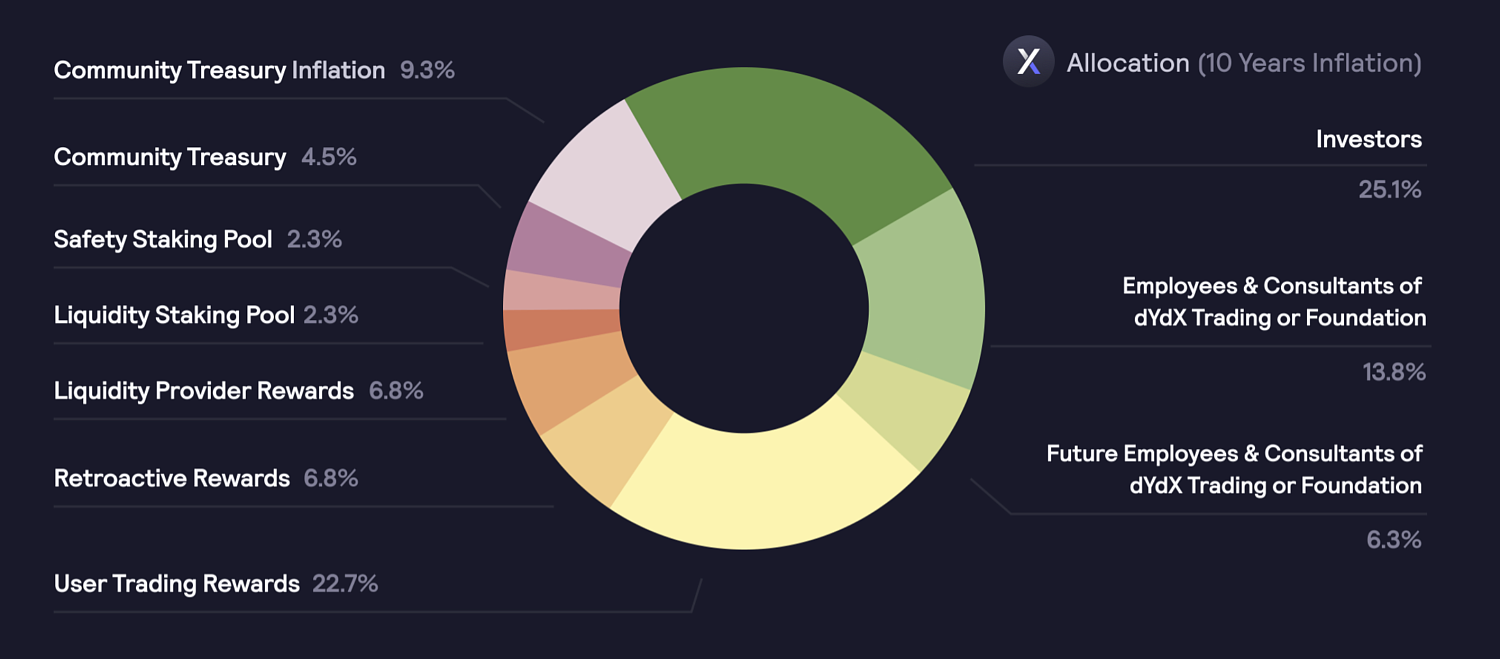

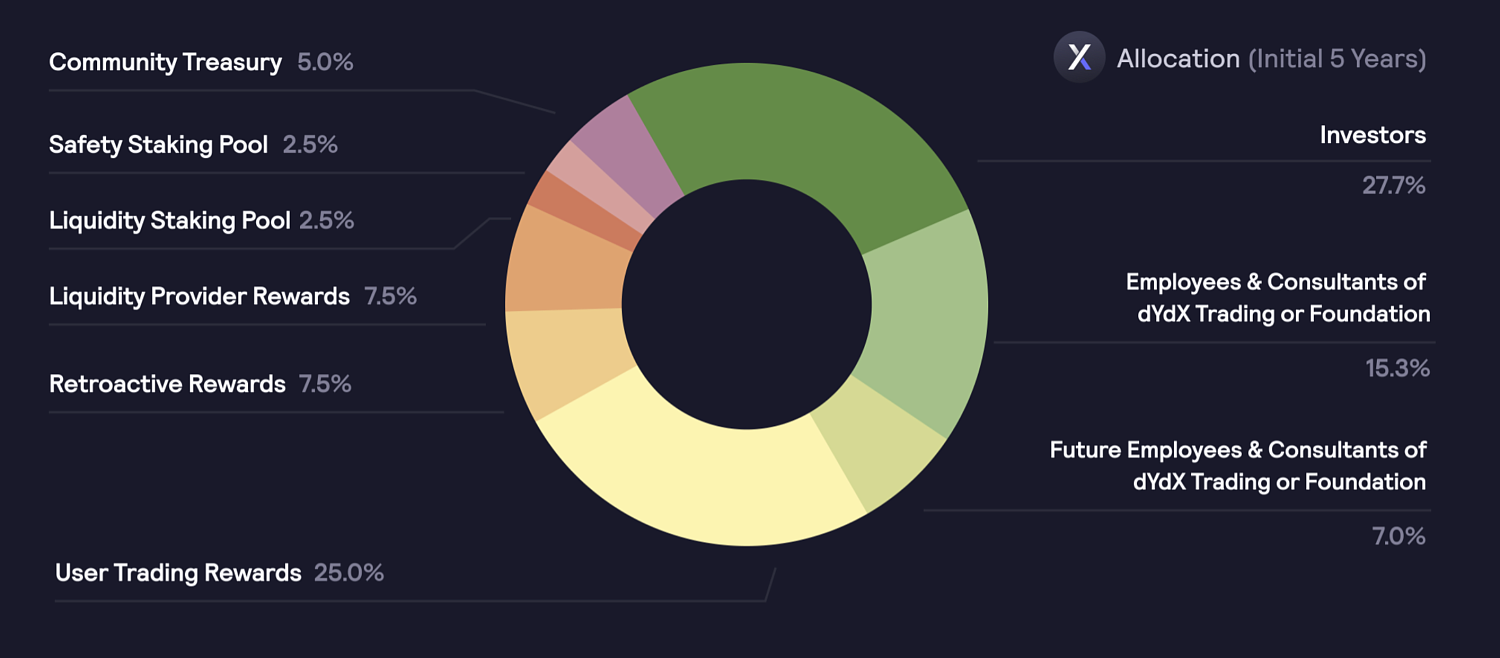

DYDX is issued as a reward for providing liquidity (7.5% of the initial supply of 1 billion DYDX tokens), trading (25%), including past trades (users who traded on dYdX since its launch, have received retroactive rewards based on their trading performance) and for staking the USDC stablecoin into the liquidity pool (2.5%).

In addition, the more DYDX tokens users have, the greater the discount they receive on trading fees.

In terms of spending DYDX on the platform, the main function of the token is to help users manage dYdX. However, simply holding DYDX to be able to propose changes is not enough: the strength of users' proposal is determined by the amount of DYDX they own, have staked, received as a delegate, and the amount they have delegated.

dYdX Project (DYDX)

dYdX was founded in 2017 and launched two years later, in 2019. The two main creators of the project are head of operations Zhuoxun Yin and CEO Antonio Giuliano, a Princeton computer science graduate who entered the world of crypto in 2015 working for none other than Coinbase.

The idea that then became dYdX thanks to its founder Antonio Giuliano was simple: he saw the next step in the evolution of decentralized finance in derivatives trading. It was clear to him that this feature would require a base layer, so dYdX became that base. It continues to support new products the team creates, such as margin trading, perpetual futures (futures without an expiration date), and NFT hedges.

Advantages of dYdX (DYDX)?

- A token that works. There are several ways to receive funds when using cryptocurrency, depending on the project - rewards for mining, node support, liquidity provision and many others. dYdX users are lucky in this regard: you just need to make a deposit into your dYdX account to start earning interest. And this is in addition to margin trading, which makes trading in large volumes more accessible, and instant loans. It's no use denying at this point that crypto projects like dYdX are indeed nipping at the heels of banks and fiat currency exchanges. Once cryptocurrency gains enough trust among the general public by proving itself to be more user-friendly and secure, traditional banks and exchanges as we know them will eventually become a thing of the past.

- Trading has become affordable.For many, trading remains a pipe dream due to high deposit requirements. Luckily, some trading platforms offer leverage, which can significantly increase your profit potential. dYdX promotes margin trading as one of its key features, and there are several leverages available. However, traders should keep in mind that leverage magnifies both possible gains and losses: positions created with leverage may exit with a loss faster than positions without it.

Disadvantages of dYdX (DYDX)?

- Short-term success, long-term failure. dYdX used a very successful technique to attract new users: transaction mining. The more users traded at level 2, the more DYDX they received as rewards. The prospect of profit excited traders so much that at one point the volume of exchange transactions reached $9,500,000,000. What could go wrong? However, dYdX distributed DYDX 3,800,000 transaction mining rewards every 28 days, which increased the token's liquidity but, unsurprisingly, also decreased its price and number of active users. The fewer users, the fewer trading orders, and the fewer trading orders, the more difficult it is to trade on the platform. Adding alternative products and using tokens could save the platform, but can dYdX return to its former glory?

- In the Shadow of Giants. There are several well-established cryptocurrency exchange platforms, and dYdX does not can offer as much as they do. Of course, it was created with a focus on derivatives trading and certainly has its adherents, but it is difficult to survive on one successful product. dYdX launched Testnet and Hedgies, NFT avatars for exchange users. It remains to be seen how these new products will help dYdX compete with the giants in the field.

ByBit

ByBit  Binance

Binance  Gate

Gate  Score

Score