Chainflip FLIP

Report IssueChainflip is a decentralized protocol that allows cross-chain transfers between different blockchains. Chainflip aims to connect major ecosystems such as Bitcoin, Ethereum, Polkadot, Solana or Cosmos so that users can navigate the growing multi-chain space.

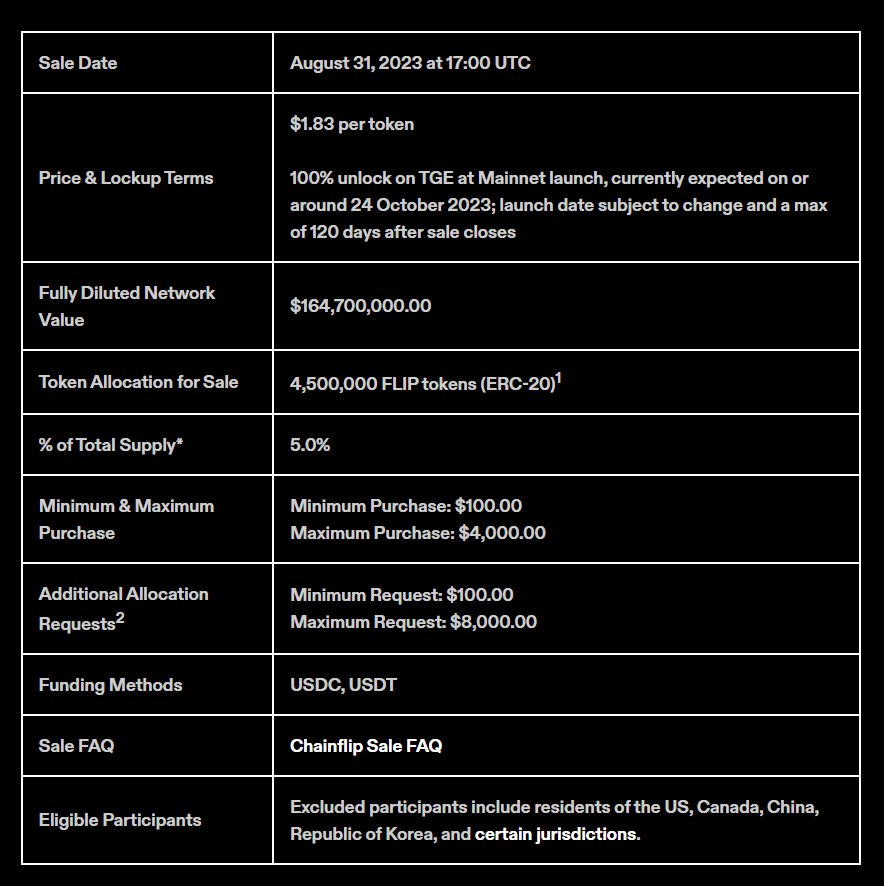

Details

Sentiment

Bearish

Fundraising Statistics

$0.32 -2.05%

$1.83

Blockchain Capital Tier 1

Blockchain Capital Tier 1 Coinbase Ventures Tier 1

Coinbase Ventures Tier 1 Delphi Digital (Delphi Labs... Tier 1

Delphi Digital (Delphi Labs... Tier 1 FLIPChainflip

FLIPChainflip

USDCUSD Coin

USDCUSD Coin

Short Review Chainflip

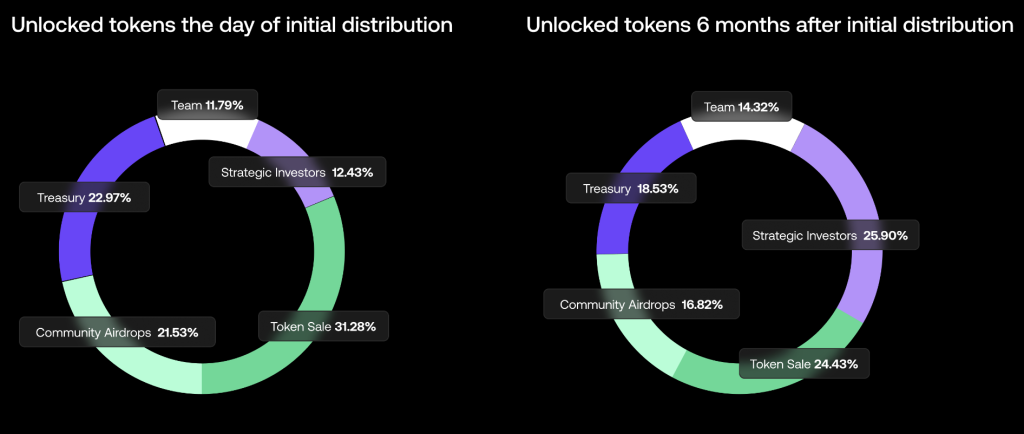

Crypto project Chainflip (FLIP) is classified as a Protocol. Chainflip is a Utility token that is hosted on the Ethereum Network. The current total supply is 4.50 M FLIP (Circulating Supply + Tokens yet to be released - Burned Tokens). (5% of total tokens) have been allocated for the public sale.

Public sale of tokens will take place on the Coinlist Launchpad. Chainflip (FLIP) price during the token sale: 1.83 USD. Min/Max Personal Cap: 100$ / 8000$. You can purchase project tokens for USDT, USDC

FLIP Price Chart

Fundraising Rounds

Total sold 4.50 M tokens (5.00% of total tokens). Total amount of funds raised by the Chainflip project is $24.24 M.

| Investment Round | Date | Price | Funds Raised |

| Public Sale | 31 Aug 2023 | $1.83 | $8.24 M |

| Funding Round | May 2022 | -- | $10.00 M |

| Seed Round | 19 Aug 2021 | -- | $6.00 M |

Chainflip Investors

Blockchain Capital Tier 1

Blockchain Capital Tier 1 Coinbase Ventures Tier 1

Coinbase Ventures Tier 1 Delphi Digital (Delphi Labs) Tier 1

Delphi Digital (Delphi Labs) Tier 1 Framework Ventures Tier 1

Framework Ventures Tier 1 Distributed Global Tier 2

Distributed Global Tier 2 Hypersphere Ventures Tier 2

Hypersphere Ventures Tier 2 Mechanism Capital Tier 2

Mechanism Capital Tier 2 Morningstar Ventures Tier 2

Morningstar Ventures Tier 2 Pantera Capital Tier 2

Pantera Capital Tier 2Chainflip Cryptocurrency (FLIP)

Chainflip is a cross-chain decentralized exchange coordinated through its own application-specific blockchain. It is designed with amazing prices, support for both native BTC, EVM and substrate networks, as well as many other types of chains. It also supports cross-network messaging to maximize compatibility with current and future solutions to maximize asset coverage for users.

Chainflip does not build another bridge. Chainflip takes the best of all current interchain solutions and makes further optimizations unavailable to any of them. Chainflip is at the forefront of a new generation of AMM projects, allowing the protocol to leverage existing on-chain and off-chain spot markets to provide users with a truly revolutionary experience.

Chainflip Highlights

150 core validators and a scalable signature algorithm. A truly decentralized network requires a large set of validators to ensure redundancy, security, and censorship protection. Chainflip uses 150 validators per vault, optimizing overall economic security compared to other cross-chain systems. Additionally, Chainflip's use of Schnorr signatures and an innovative signature scheme allows these 150 validators to support multiple assets and multiple parallel signing ceremonies without incurring excessive hardware costs.

New JIT AMM design to improve capital efficiency. Chainflip's JIT (Just-In-Time) AMM solves cross-chain issues by minimizing slippage and offering accurate pricing. It efficiently leverages liquidity for large trades, acting as a decentralized aggregator across all markets. This makes Chainflip akin to an open and transparent decentralized over-the-counter service, often outperforming other cross-chain services on price.

Generalized interconnectivity. Chainflip provides users with an unauthorized method to exchange assets between arbitrary chains and networks (L1, L2, etc.) without introducing new wrapped assets, fragmenting liquidity, leaving users with tail risk, or excessive confirmation times.

Extensive token economy design. Strong token design and well-modeled value capture mechanism. Fees are charged in USD and are used to automatically purchase the FLIP token from AMM. Given enough volume, FLIP, even with incentives, can be a deflationary asset.

Chainflip Tokenomics (FLIP)

The FLIP token is the upcoming ERC-20 protocol token of the decentralized exchange Chainflip. Although Chainflip has its own blockchain, the multi-chain nature of the project allows the FLIP token to be listed on Ethereum for ease of use and adoption. Staking performed on the Ethereum State Chain Gateway contract loads these tokens into the Chainflip state chain for use in the application chain environment.

Utilities of the FLIP Token

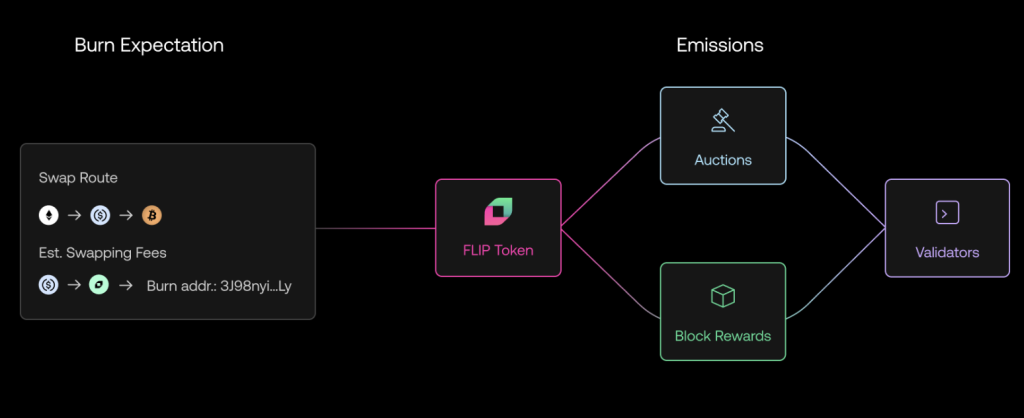

The primary utility of the FLIP Token lies in its role as collateral for Validator auctions. Validators require large stakes to economically secure funds in the system and securely manage storage and accounting logic, receive block reward rewards, and maintain the Chainflip state chain.

The rewards that validators earn are offset by the DEX automatically converting network fees collected in USD into FLIP and then automatically burning them into the protocol. This is done without having to purchase FLIP yourself. This deflation mechanism helps ensure the security and throughput of the protocol.

FLIP is also required as gas to provide liquidity and other services for processing instructions on the decentralized exchange protocol. All transaction fees on State-Chain are forfeited.

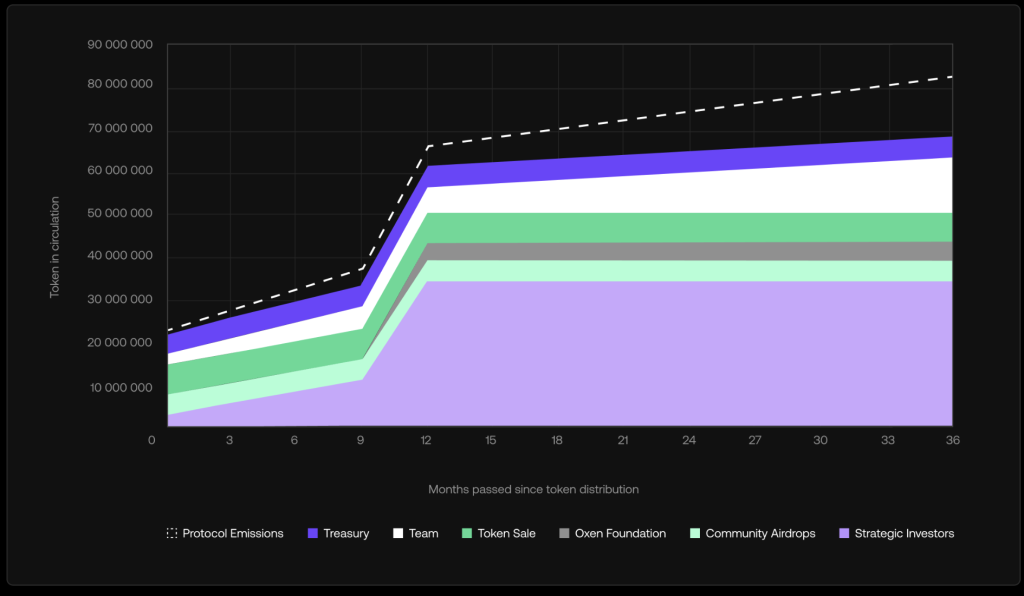

FLIP Token Release Schedule

This release schedule shows the expected distribution of token unlocks within 36 months of token launch . Please note that this is an estimate based on date estimates and may be affected by changed dates and other events.

Road map

ByBit

ByBit  Gate

Gate  Score

Score