Anchor Protocol ANC

Report IssueAnchor Token (ANC) is the governance token of the Anchor Protocol. ANC tokens can be deposited to create new governance polls in which users who have staked ANC can vote. Anchor is a savings protocol offering low-volatility returns on Terra stablecoin deposits. The anchor rate is based on a diversified stream of staking rewards from major proof-of-stake blockchains and can therefore be expected to be much more stable than money market interest rates.

DetailsSentiment Neutral

Fundraising Statistics

Delphi Digital (Delphi Labs... Tier 1

Delphi Digital (Delphi Labs... Tier 1 Jump Trading Tier 1

Jump Trading Tier 1 Dragonfly Capital Tier 2

Dragonfly Capital Tier 2 ANCAnchor Protocol

ANCAnchor Protocol

USDCUSD Coin

USDCUSD Coin

Short Review Anchor Protocol

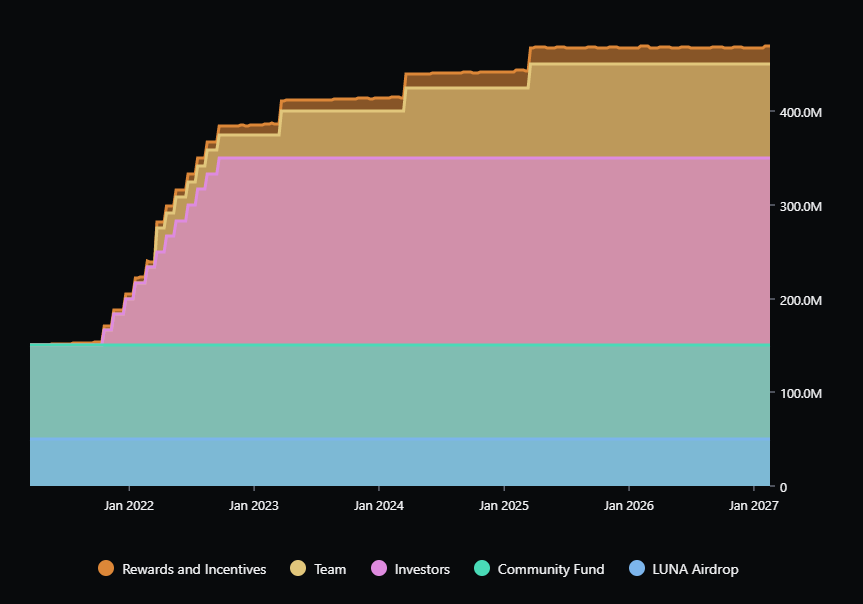

Crypto project Anchor Protocol (ANC) is classified as a Protocol. Anchor Protocol is a Utility token that is hosted on the Terra Network. The current total supply is 1.00 B ANC (Circulating Supply + Tokens yet to be released - Burned Tokens). (20.00% of total tokens) have been allocated for the public sale. The level of social activity of the Anchor Protocol project is assessed as Medium.

Anchor Protocol ICO Overview

Public sale of tokens will take place on the Binance Launchpad. Estimated date for the public token sale: 25 February 2022. (ANC) You can purchase project tokens for USDT

ANC Price Chart

The launch of ANC token trading took place on 17 March 2021.

Fundraising Rounds

Total sold 202.00 M ANC tokens (0.20% of total tokens). Total amount of funds raised by the Anchor Protocol project is $20.00 M.

| Investment Round | Date | Price | Funds Raised |

| Launchpool | January 26, 2022 | -- | -- |

| Private Sale | March 17, 2021 | $0.10 | $20.00 M |

Anchor Protocol Investors

Delphi Digital (Delphi Labs) Tier 1

Delphi Digital (Delphi Labs) Tier 1 Jump Trading Tier 1

Jump Trading Tier 1 Dragonfly Capital Tier 2

Dragonfly Capital Tier 2 Galaxy Digital Tier 2

Galaxy Digital Tier 2 Hashed Tier 2

Hashed Tier 2 Pantera Capital Tier 2

Pantera Capital Tier 2Anchor Protocol (ANC) cryptocurrency

Anchor Protocol is built on the Terra blockchain and is designed to generate passive income based on Terra stablecoins. This product pays investors a constant DeFi interest rate determined by the yield of the Proof-of-Stake blockchain with the highest demand. The Anchor Protocol is a fully decentralized fixed income instrument. Let's look at the main aspects of its functioning. The APY rate that the protocol seeks to pay out to contributors is set by ANC token holders. They vote for the rate they think is fair. Under the hood of the project, it is essentially a classic market, but with the difference that the collateral is reserved for liquid derivatives for staking on the main PoS protocols, so the rewards are based on real assets. .Real income depends on the real profitability of PoS. If the real yield is higher than the rate, then the excess is held in reserve. If on the contrary, then profit is made from it. The Anchor protocol can be divided into the following components: Bond assets (bAssets) - tokenized representations of pegged PoS assets (this could be bLUNA and bETH); The money market, which connects lenders and borrowers; A liquidation agreement that controls the liquidation of undercollateralized credit positions.

ANC is the platform's native governance token that holders can use to create new governance polls for those who have staked ANC. Users who own the ANC token receive payment for the protocol in proportion to their stake. So it gives them an extra incentive.

Anchor Protocol (ANC) Review

Terrats has built an ecosystem of 3 protocols, one of which was Anchor. The Anchor Protocol was launched on March 17, 2021. Terraform Labs was created in January 2018, its founders are from South Korea. Judging by how quickly the platform is developing and how many features it provides, the developers are very talented and persistent.

Advantages of Anchor Protocol (ANC)

- Fast transactions. It is worth noting that transactions on Terra occur in a second, and the cost of commissions when interacting with smart contracts, it is also significantly lower.

- Speed of use. It begins to work in a situation where there are more depositors than borrowers. Thus, the borrowing rate is reduced to encourage the provision of more loans and collateral to repay depositors. It also works the other way around.

- The project is decentralized. Anchor Protocol has no intermediaries in its work and is considered decentralized, as well as very secure.

Disadvantages of Anchor Protocol (ANC)

- Volatility of returns in case of a crash or bear market scenario. For example, if the price of the LUNA token falls, the amount of interest the protocol earns to pay out to investors decreases as the number of borrowers paying interest decreases.

ByBit

ByBit  Gate

Gate  Score

Score  Ethereum

Ethereum