Ampleforth AMPL

Report IssueAmpleforth is a protocol for a new type of money, which the creators call smart commodity money. Technically, the project is somewhat similar to a stable coin, although they insist that it is not one. Previously, the project was known as Fragments.

Details

Sentiment

Bullish

Fundraising Statistics

$1.22 +0.17%

$0.98

AMPLAmpleforth

AMPLAmpleforth

USDCUSD Coin

USDCUSD Coin

Short Review Ampleforth

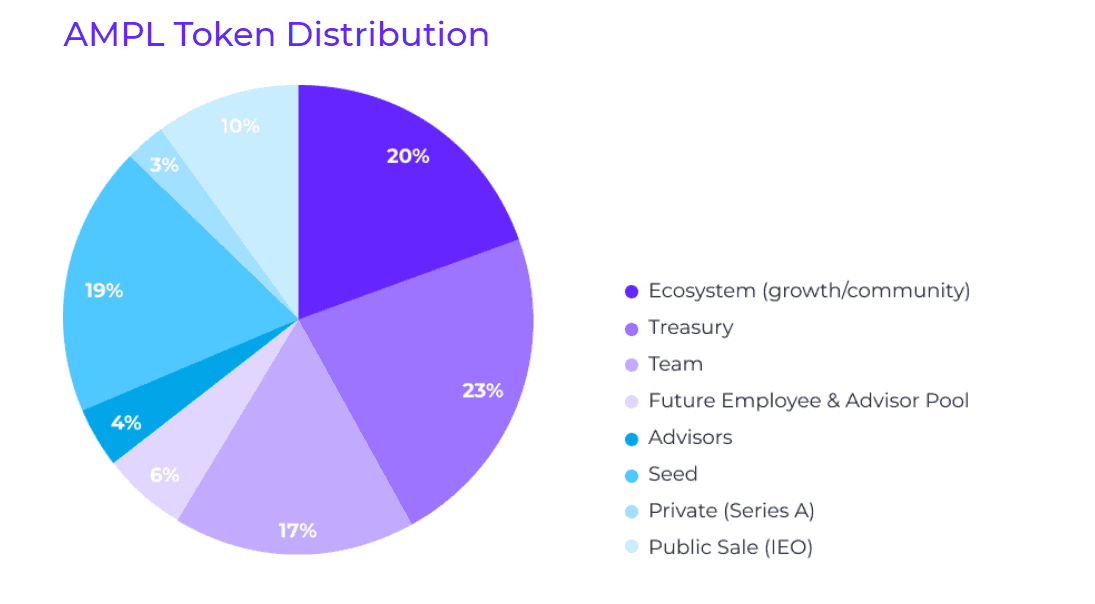

Crypto project Ampleforth (AMPL) is classified as a Protocol. Ampleforth is a Utility token that is hosted on the Ethereum Network. The current total supply is 50.00 M AMPL (Circulating Supply + Tokens yet to be released - Burned Tokens). (10% of total tokens) have been allocated for the public sale.

Ampleforth ICO Overview

Estimated date for the public token sale: 27 June 2019. Ampleforth (AMPL) price during the token sale: 0.98 USD. Min/Max Personal Cap: TBA / 500 USD. You can purchase project tokens for BTC

AMPL Price Chart

The launch of AMPL token trading took place on 28 June 2019.

Total sold 15.90 M AMPL tokens (31.80% of total tokens). Total amount of funds raised by the Ampleforth project is $9.75 M.

Ampleforth Investors

Arrington XRP Tier 2

Arrington XRP Tier 2 FBG Capital Tier 2

FBG Capital Tier 2 Pantera Capital Tier 2

Pantera Capital Tier 2 Slow Ventures Tier 2

Slow Ventures Tier 2Team

Evan Kuo - CEO and co-founder. 500+ contacts (Linkedin)

– Graduated from the University of California with a degree in Mechatronics, Robotics and Automation (2002-2006).

– Worked as a product manager at Yahoo for a year.

– Worked at Sharethrough for two years as Product Director, a startup for marketers and publishers to work and modernize advertising strategies.

– Was a founder at Crowdrally (Facebook advertising), 4 years. No longer exists.

– Worked as a founder and CEO at Pythagoras Pizza for 4.5 years. Development of databases and systems, thermodynamics research, design.

– CEO and co-founder at Ampleforth.

Writes about himself: A lover of art and mathematics. Has extensive experience in developing products for auctions and working with venture capital. He received his bachelor's degree from the University of California, Berkeley, where he studied a combination of ME & CS and robotics research.

Skills: startups, online advertising, software development.

Brandon Iles - co-founder. 339 contacts (Linkedin)

– Studied at Rice University, computer science. (Bachelor's, Master's)

– Worked for 2 years at ESI as a software engineer (Software for controlling photonic equipment used in semiconductors.)

– Almost 6 years at Google. Senior software engineer in search results.

– Uber, senior software engineer for almost 3 years.

– Cofounder in Ampleforth.

Writes about himself: worked for more than 5 years in Google Search Ranking and Machine Intelligence, and then worked at Uber in the ranking and relevance group. Loves the intersection of systems, data and intelligence. He received his bachelor's and master's degrees in computer science from Rice University.

Skills: Corporate search, Natural Language Processing Search

There are publications and patents.

Ahmed Naguib Aly — Engineer / Backend. 282 contacts (Linkedin)

– Graduated from the Arab Academy for Science. Bachelor of Science (BS), Specialization: Computer Engineering

– On Google and Facebook by I completed an internship as a software engineer for three months.

– Software engineer at Google, for 5 years.

About himself: Previously at Google, Ahmed worked for more than five years as a software engineer in the search and indexing groups. His passion for coding and algorithms began with competitive programming in high school and earned a bronze medal at the International Computer Science Olympiad. Ahmed received his Bachelor's degree in Computer Science from AAST in Alexandria, Egypt.

Skills: C++, algorithms, Software Engineering

Having a number of awards: 1st place in ACM's Arab and North Africa Regional Programming Contest, 4th place in ACM's Arab and North Africa Regional Programming Contest, Bronze medal in the International Olympiad in Informatics

Aditya Sarawgi — Engineer / Backend. 500+ contacts (Linkedin)

– Graduated from Mumbai University and Stony Brook University

– Intern 3 months at Yelp.com and 3 months as an infrastructure engineer

– 5 years at Uber as a software engineer

Writes about himself: Earlier at Uber, he began developing an end-to-end pricing system, and then launched a project for finding places with autofill, destination prediction, and current location prediction. He eventually moved on to research advanced technologies to generalize Uber's multimodal robotic networks. He holds a Master of Science in Computer Science and a Bachelor of Science in Electronics and Telecommunication Engineering from the University of Mumbai.

Skills: C, C++, Java

Nithin Krishna — Engineer / Backend. 367 contacts (Linkedin)

– University of Southern California Master's Degree, Data Science

– Started as a software engineer at Codebrahma in Bangalore, India

– Various companies where He was engaged in programming and data science

Writes about himself: At USC he was a research engineer in the information and data retrieval laboratory. He has worked on applying machine learning to big data problems such as traffic forecasting, recommendation systems, content mining, and text mining. He has worked on the application of data solutions in areas such as sports, science, traffic and e-commerce. He has worked on creating products in areas such as online payments, video streaming, peer-to-peer lending, big data analytics and social networks.

Skills: python, Data Science Machine Learning

Publications available.

Jessica Yen — Branding / Organizational Manager

She was a co-founder of Pythagoras Pizza. Works at the intersection of technology and the humanities. She holds an MFA in Copywriting and a BA from UCLA.

Richy Qiao — Business/Organizational Manager

Spent 4 years in New York as a consultant, managing over a dozen projects for clients such as Morgan Stanley, DTCC and Visa . In 2017 he moved to Beijing to IDG Capital. Currently a Venture Partner at FBG Capital. He received a bachelor's degree in economics from Yale University.

Skills: Data Analysis, Research, Strategy

Simon Manka — responsible for development

Previously worked at IOSToken. Simon led the promotion of the business and helped IOST become a Top 50 cryptocurrency according to coinmarketcap. He holds a bachelor's degree in history from the University of Virginia.

Advisors

Joey Krug —Co-Chief Investment Officer at Pantera Capital

Investment Director of hedge funds specializing in cryptocurrencies

Sam Lessin —Fin, Facebook

Co-founder of Fin, GP Slow Ventures, Intern at The Information, Worked for 4 years at Facebook as Vice President (Product Management)

< p> Niall Ferguson — Hoover Institute, StanfordProfessor at Harvard University

Noah Jessop — Honey Miner, Massachusetts Institute of Technology

Tech entrepreneur from Silicon Valley .

Currently Lead Data at Clearing House, a marketing company.

He previously co-founded a mobile games and technology company based in Boston. He studied mathematics, computer science and finance at the Massachusetts Institute of Technology, where he was student body president.

Paul Veradittakit — Pantera

Negotiates new deals, manages operational tasks, incl. portfolios.

Searches for new technologies and products. Closed 40 venture investments. Engaged in building relationships with incubators, startups and institutions.

Manuel Rincon Cruz — Hoover Institute, Stanford

Investors

A complete set of cryptocurrency funds, ranging from top ones (Pantera, FBG, DHVC, Huobi) to few familiar (Spartan, Nima, Skunk - all with websites and portfolios).

Let's single out Slow Ventures and Founder Collective as ventures from the classic market and Brian Armstrong - co-founder & CEO at Coinbase

Technology and idea:

WP was written on May 20, 2019 and mainly contains a description of the mechanism for adjusting the price and emission of tokens (called Amples).

What I would like to note:

- the goal of the project is to create an asset class that would not correlate with either the price of Bitcoin or the price of other assets. To put it very simply, this is something like a stablecoin that changes its emission, maintaining a stable price per token (for 1 Ample)

- the main feature is that the protocol, taking into account the price of the token, changes not only them current and future supply, but also the balances of holders, while there is no unified programmatic influence on prices.

- changes in supply occur when the price deviates in the area “Pt − δ” or “Pt + δ”, the goal is to return the price to the specified range Pt.

- Amples exchange rates will be collected from trusted providers (oracles) into a single weighted rate in the Aggregator. Simply put, the oracles will report to the Aggregator how much Ample is currently worth on trusted exchanges and, based on their data, a decision will be made to regulate the issue and the current number of tokens in the hands of holders.

- proposal changes occur once a day and are open to the community. The user's control panel will show the time and planned changes.

- price equilibrium is also achieved due to market participants acting faster than others when selling or buying tokens during periods of increased or decreased supply. That is, knowing the changes, they will be able to make money on arbitrage and get ahead of the algorithm, pushing the price in the right direction.

- the protocol works on the basis of smart contracts on Ethereum (a contract that executes the increase or decrease of tokens; a contract responsible for collecting data on the price of a token; a contract with the help of which any network participant can initiate the function of collecting information on the price and activating a change in the offer, is executed automatically once every 24 hours).

- the Ampleforth protocol will be launched on Ethereum once, coexistence is allowed on other networks.

The AMPL token itself will be sold through the IEO. The investor's potential profit is possible if the token price increases due to the fact that the smart contract will create new tokens in addition to the existing stack (after all, the price per unit will tend to stability). That is, your tokens will generate more tokens as demand increases.

They see the main point of creating this type of asset in the fact that the world needs a stable class of assets, independent of the financial, stock and cryptocurrency markets.

MVP / Github

The code is open, on Github with two main repositories: smart contracts oracles and, in fact, the smart contracts of the protocol themselves. Judging by the fact that the last commits were made 2+ months ago, we can conclude that the protocol has already been written.

As is clear from the above, the Ampleforth protocol is a set of smart contracts.

Development began in the spring-summer of 2018.

3 programmers worked on the protocol: Nithin Krishna (on GitHub since 2014, worked on blockchain projects since 2017), Ahmed Naguib Aly (worked on Chainlink), Brandon Iles (according to Github, I only worked on Ampleforth) - the comments to the commits look adequate.

A code audit was conducted from SlowMist (they audited OKEX, Huobi Security, imToken and TrueUSD) and from Trail of Bits (they audited MakerDAO and the Parity client).

Conclusions/opinion

The most important question that arises when getting acquainted with the project: why is it needed and who will use it. This is not stable in the usual sense and volatility will be present, albeit in a form that is unusual for us. They say the main advantage is resistance to inflation and decoupling from other assets, a kind of hedge. But it seems to us that the project looks too experimental and unpredictable for a hedge. How convenient will it be for the user to observe changes not in the price of a token, but in the number of tokens in his portfolio? How fundamentally different is this from just having a token go up in value? Does this kind of approach have any practical value? Any questions.

But it will definitely be interesting to see what they come up with.

ByBit

ByBit  Gate

Gate  Score

Score