Trading bots in the Telegram messenger have become popular among crypto traders who prefer to operate assets on decentralized exchanges (DEX). These bots provide a more convenient way to conduct fast and accurate trades, bypassing the sometimes inconvenient interfaces inherent in blockchain trading platforms. It is important to note that the use of bots involves giving them access to wallets (keys), which may raise trust issues.

In 2023, many new TG bots appeared. Even though this niche is still not that popular, it still solves many user needs. At the moment, the majority of the TG bot market is occupied by Unibot, whose token has shown rapid and significant growth.

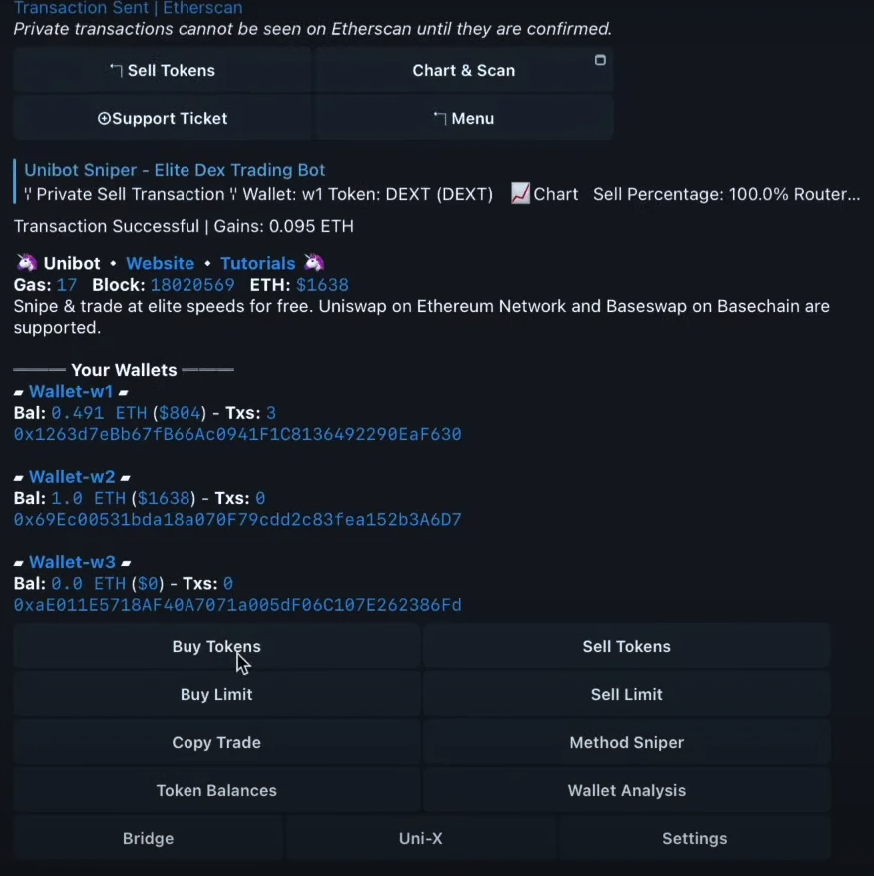

Unibot is a TG bot developed based on the open Telegram framework. It provides users with a user-friendly interface and efficient trading services. Users can control token trading on Uniswap by sending commands to Telegram. In addition, Unibot provides user-friendly features such as limit trading, copying other users' transactions, closed trades, sniper and data monitoring.

According to the data, by the end of August - beginning of September, the total volume of Unibot transactions had already reached ~$300 million, the average daily volume of transactions was ~$4 million, the total number of users was about 140 thousand, the number of active users per day was ~1000. As one of the pioneers in this new field, Unibot performs well, although it is not as big as some of its older brothers. It continues to grow steadily.

How do TG bots make money?

- Paid subscription model for participants< br> Similar to other apps with paid features or functionality, users must pay a subscription fee to use the TG bot.

- Trading commission model

TG bots such as Unibot, use this model, taking a commission of 1% on each user transaction (at the same time, the transaction itself on Uniswap also takes a commission). This fee model, which may seem high and repetitive, is modeled after the economic model of Unibot's own coin. Unibot distributes 40% of the commission among the holders of its coin. - Combined model

This model combines the two previous ones: paid subscriptions and trading commissions. For example, Maestro, a large TG trading bot, uses this model.

Are TG bots safe?

TG bots like Unibot have a closed trades feature, which is reminiscent of Tornado Cash. It is highly likely that closed transactions from TG bots can be used as a tool for money laundering. In this case, the founders and developers of the bots may be accused of facilitating money laundering.

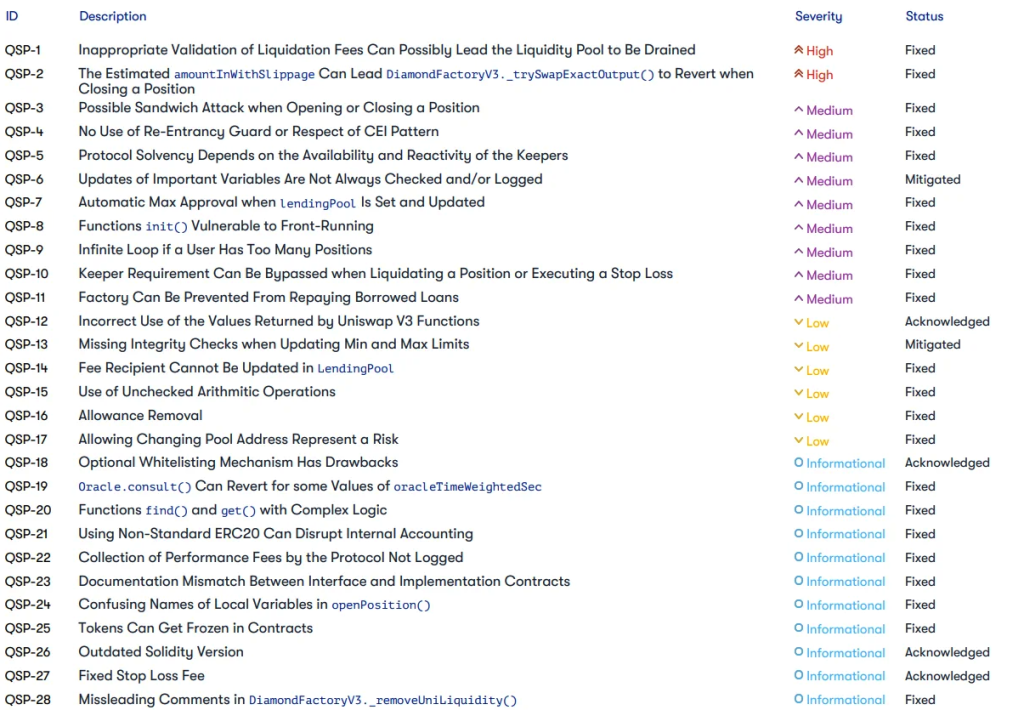

Also, we cannot say that bots are safe, Unibot was audited in July Quanstamp, which revealed several vulnerabilities, such as incorrect calculation of fees, which could lead to a decrease in the liquidity pool (it was resolved) or some important data is not always verified or recorded by the bot.

Issues found after the audit

Do not forget that all this happens in regular Telegram, which we also use for personal purposes, for example for reading purposes chats, viewing news, etc. The number of phishing links on Telegram has increased fivefold over the past six months. Most often, the goal of scammers is to steal your Telegram account, where your Unibot private keys may be located.

Recently, the TG bot Banana Gun was launched, after the launch of which an error was discovered in the contract, which led to a drop in the price of the token by 99%.

Conclusion

TG bots are very convenient compared to CEX, and the simplicity of trading allows, for example, to quickly buy tokens that are not yet on exchanges, or copy transactions of successful traders to make money. It is important to understand here that you should not use your main wallets for trading with bots, and you should not store assets on these addresses, exposing them to additional risks.