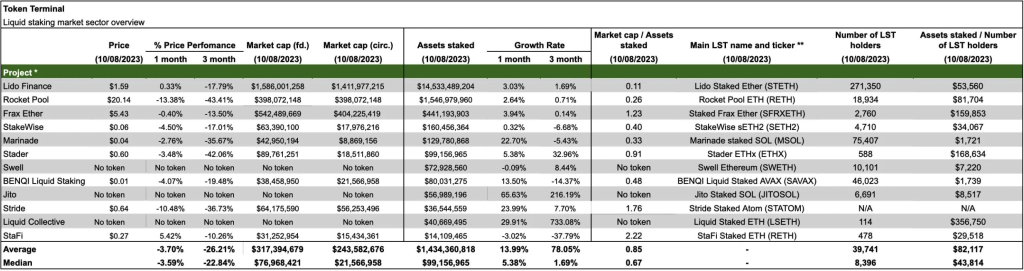

General indicators

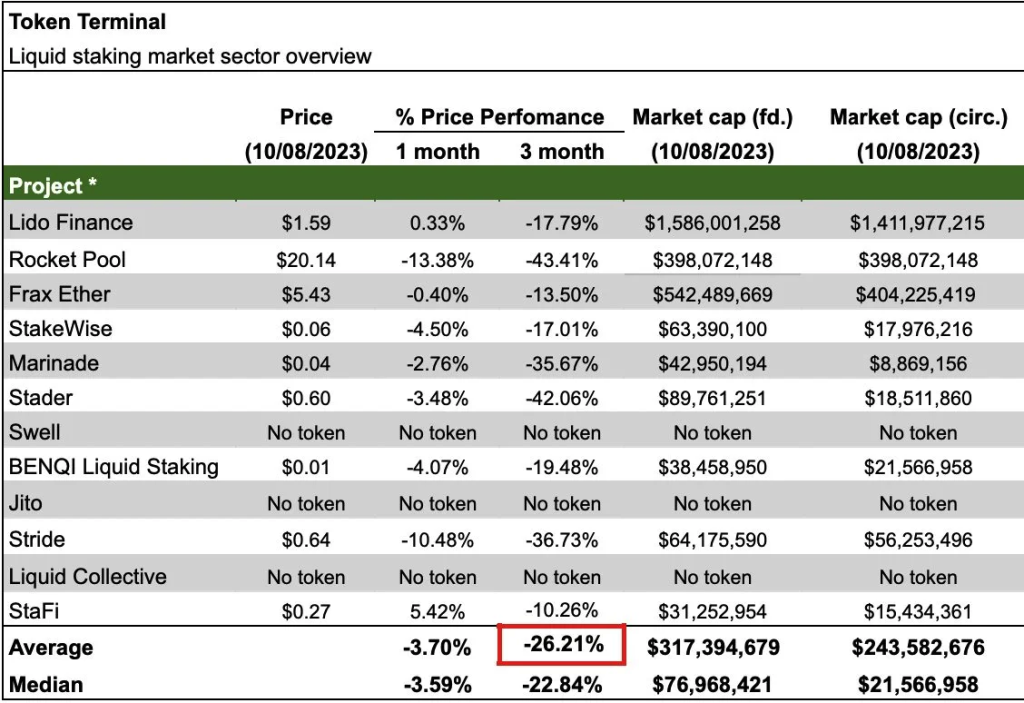

Token price

In recent months, token prices in the sector have decreased significantly. The average 3-month price change was -26.21%.

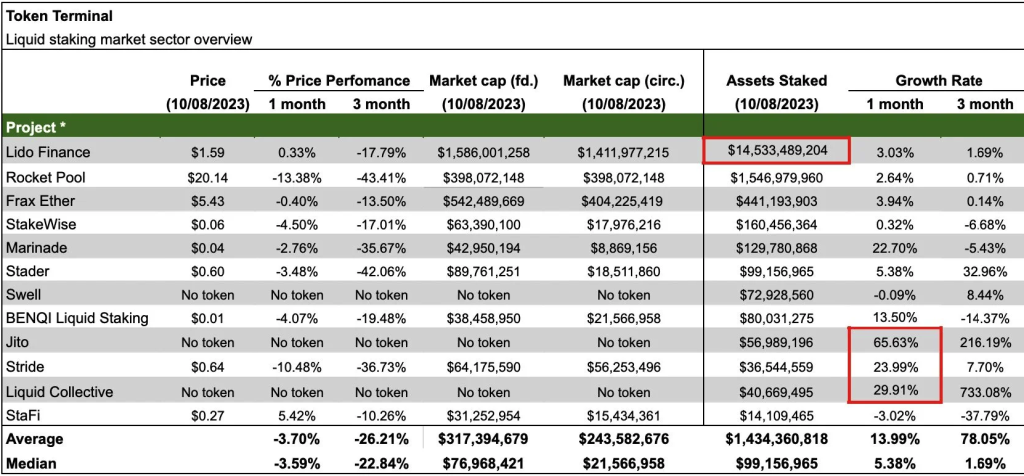

How much is staked

Lido continues to dominate the sector with a market share of 84.4% the size of staked assets (among the projects in the table).

The two fastest growing projects in terms of the volume of assets staked are Jito, Liquid Collective. Over the past month, they have grown by 65.63% and 29.92% (growth in three months was 216% and 733%), respectively, and at the moment they do not have a token. Let's take a closer look at them:

Jito

Jito - first LSD on Solana to include MEV reward. Monitors the price of SOL while calculating staking rewards and MEV.

Recently Jito announcedsaysLiquid Collective is An independent group of crypto teams that includes companies such as Kraken, Coinbase Cloud, Bitcoin Suisse, Acala and Alluvial. It is a decentralized protocol working to create standards for liquid ETH staking.

The main difference between Liquid Collective and other LSDs is that it is more suitable for corporate and institutional users.

Both users and validators need to go through KYC/AML, and the validators the protocol has started working with are Coinbase Cloud and Figment.

There was investment in the Alluvial project, which is working on developing software for the Liquid Collective.

Investment amount - $12 million (Ethereal Ventures, Variant, brevan Howard Digital and others)

Market cap to assets ratio

Lido's market cap/staking ratio is 0.11, which is significantly lower than the average of ~0.85.

Number of LST holders

271,350 addresses own the stETH (Lido) token on Ethereum. This is 14 times more than the number of rETH (Rocket pool) holders.

Non-Ethereum LSTs such as MSOL and SAVAX also have a significant number of LST holders - 75,407 and 46,023 respectively.