Have you ever thought about the environmental friendliness of cryptocurrency? This is definitely a good idea if you care about our planet. Now this has become possible with the development of modern technologies, and, of course, with the increased level of human responsibility.

Recently, the sustainability trend has been actively spreading to the investment sector. The result is the concept of ESG. Today we'll learn what this acronym means, why it's so important, and how it's impacted crypto and businesses around the world.

What is ESG?

Now let's delve into the topic. To understand ESG, we need to break down each letter of the acronym, as each has its own important meaning.

E for the environment

Both fiat and cryptocurrency can be used to purchase products and services, but they differ greatly in the material they are made from. While regular fiat is made from linen and cotton, cryptocurrencies require a PC, an internet connection and, of course, electricity. Both fiat and cryptocurrency require different amounts of energy to create.

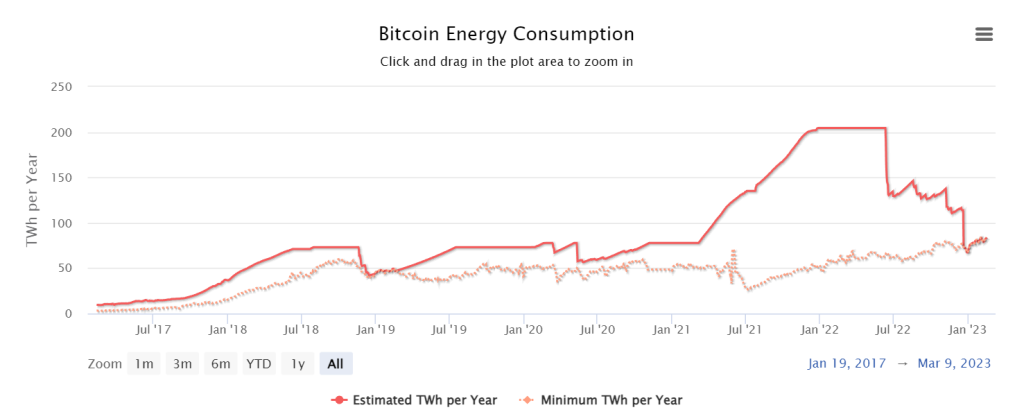

Bitcoin's energy consumption is high and it leaves a huge carbon footprint. Most mining facilities on the BTC network run on fossil fuels:

According to Digiconomist, a single BTC transaction consumes 1,449 kWh. This equates to about 50 days of electricity for the average US household. This is one of the reasons why some countries have completely abandoned the idea of accepting cryptocurrency and have restricted its use and mining. However, we talked about so many countries that allow cryptocurrencies and support technological progress: Germany, South Korea, Indonesia, India, Vietnam, Argentina, Portugal, Japan, Philippines, Iceland and many more.

Of course, not all mining is an enemy of the Earth. Some crypto projects are now being created taking into account the eco-trends of the 21st century. One of the most popular cryptocurrencies, Ethereum, has switched to PoS, which does not require powerful hardware or capacity.

S for society

While the cryptocurrency is decentralized, some doubt the safety of investors and protection from hacking. However, today decentralization is more loved than hated. People claim that this helps make transactions fast, cheap and even censorship-free.

A book called “Cryptocurrency Mining for Dummies” states:

Is cryptocurrency social? There is no definite answer yet, as opinions are divided. In-depth research is needed to understand whether the pros or cons outweigh the benefits from a social perspective.

G for Governance

Today, most countries have some regulations regarding cryptocurrency to govern its security, production and use. But let's not forget that the structure of cryptocurrency is initially decentralized. Two scenarios are possible: the emergence of uniform rules for all crypto-assets or special laws for each country. Now we see the second option more often than the first.

Simply put, there are three ESG criteria: environmental - looking at the sustainability and impact of the cryptocurrency, social - to demonstrate a positive impact on individuals and governance, which relates to the cryptocurrency's ability to expand the reach of capital markets through decentralized delivery of products and services.

ESG rating

When we talk about ordinary ESG for business, then the rating is one, and when it comes to cryptocurrency, then another . Let's take a look at both to compare.

The ESG rating is compiled by independent research agencies - Bloomberg, S&P Dow Jones Indices, MSCI, Refinitiv and others. They evaluate companies based on the criteria mentioned above—E, S, and G—and score them on a 100-point scale.

MSCI divides firms into 3 categories: leaders; companies with an average rating; and laggards. There is no single approach to rating formation. Everyone uses open company data for analysis, but they calculate the scores differently. Therefore, ESG ratings from different companies can vary greatly.

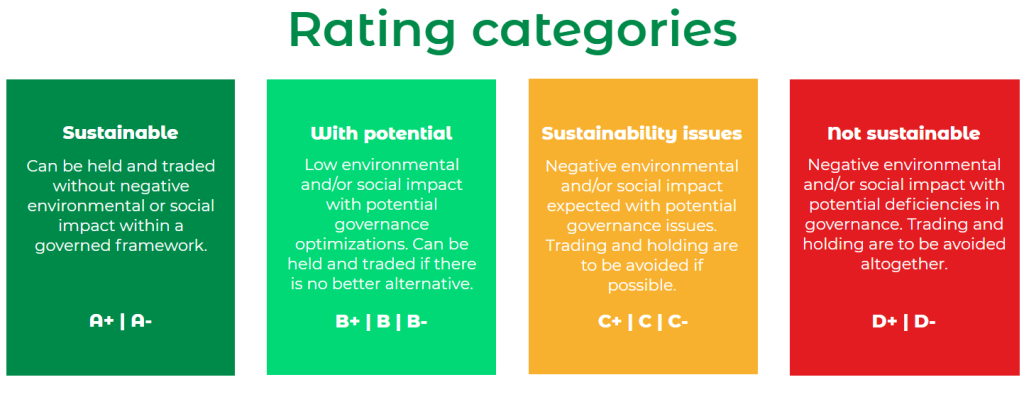

When it comes to cryptocurrencies, ESG ratings are a little different. For example, Greencryptoresearch offers the following categories:

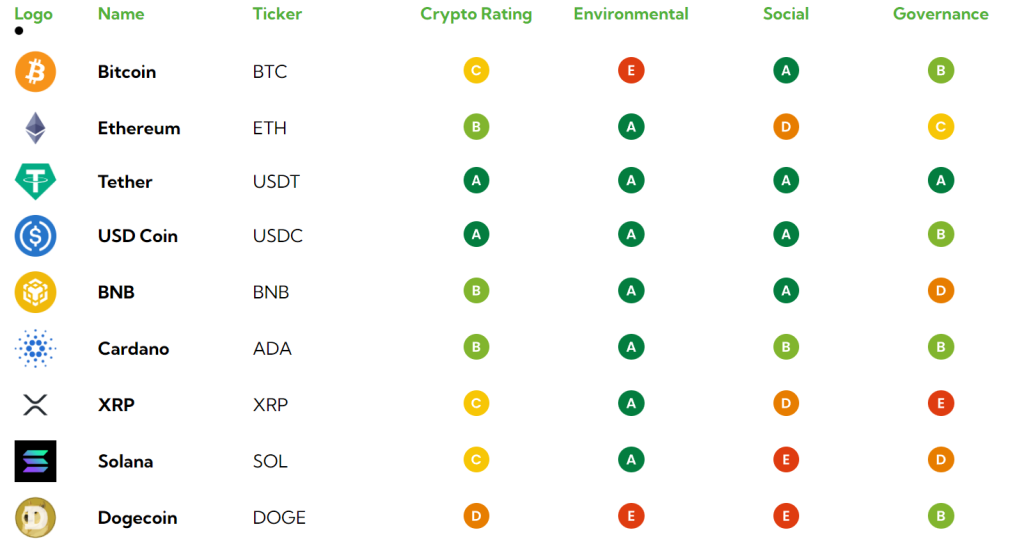

When we visit another ESG ratings website, Cobepal, we see more defined and well-structured measurable points: sustainable operations and consensus models, scale and interoperability, social impact, financial inclusion. However, they use almost the same letters: A (leader), B (desirable), C (average), D (lag) and E (drag).

Here is the rating of popular crypto assets from ESG:

Environmentally sustainable assets

Even though ESG is new to crypto, there are quite a few projects that align with the idea of sustainability . Here are some of them:

The developers consider this project to be the most sustainable and used public network for a decentralized economy. This gives users the ability to launch powerful DApps. In an environmental impact study conducted by UCL comparing other distributed ledger networks, Hedera is considered the most sustainable network.

Ripple (XRP)

This project is well known in the crypto community. It is an open source blockchain (list of blockchains). Transaction speed is 3-5 seconds. According to their website, Ripple wants to make its blockchain carbon neutral by 2030.

Signum (SIGNA)

Signum's founders call it the first truly sustainable blockchain. Signum bills itself as the first fully sustainable blockchain. As in Chia (XCH), transactions are verified through the hard drive space of network users, that is, using the PoC+ algorithm, without the need mining

You, You've probably heard of TRX. This project was created in Singapore. Its goal is to make the network completely decentralized. Back in 2018, they bought BitTorrent for $140,000,000, giving it 100 million daily active users on which to test scalability.

Conclusion

Currently, there are no official ESG guidelines for cryptocurrency. The most important point is that it must use renewable energy and PoS for mining. The rest remains to be adjusted. ESG technology is a new phenomenon in the crypto world - it is critical for investors to stay up to date with its updates to identify risks associated with potential investment outcomes.