Current status of CBDC

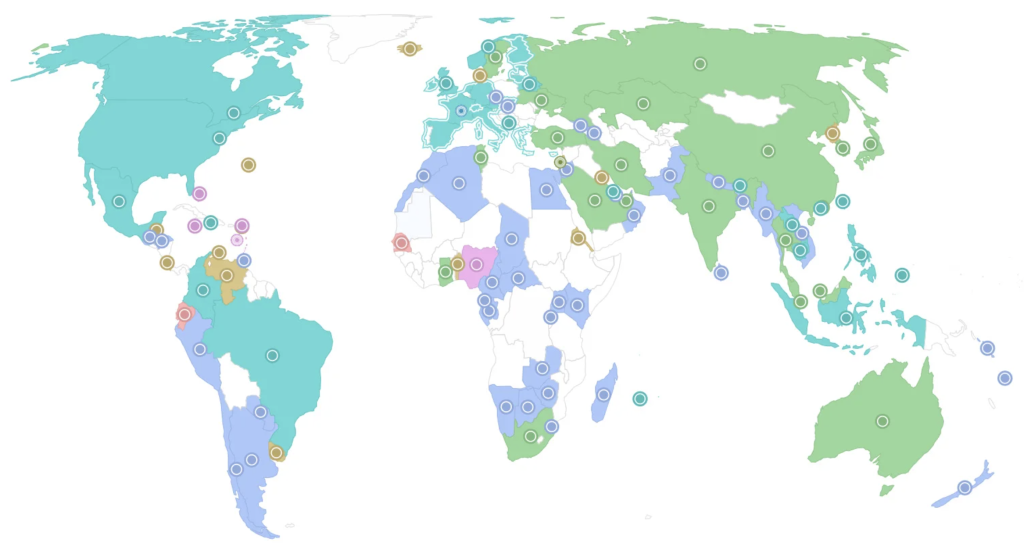

Currently, 130 countries are considering CBDC:

- 11 Launched (pink)

- 21 in pilot (green)

- 33 in development (blue)

- 47 in research (blue)

- 16 inactive (gold)

- 2 canceled (red)

Large economies:

- China: Has been developing the digital yuan for a long time, the implementation of the digital yuan has been carried out through a distributed ledger not connected to the blockchain, but the results have not been impressive yet. The main goal is to create an alternative payment route not controlled by the US.

- Japan: Conducting a pilot program for a digital yen through commercial banks.

- Brazil: Delayed the start of its pilot program due to problems with privacy.

- USA: Developing a digital dollar with and without blockchain. Projects include intermediaries such as commercial banks.

- Europe: Still in the research phase. The European Central Bank is awaiting an update on this matter.

Benefits of a CBDC

In each jurisdiction, the benefits offered are described as follows way:

- Fast settlement

- International payments

- Cost reduction

- Ongoing work

- Democratization of access to financial services

- The ability to stimulate the economy (the catalyst here was Covid)

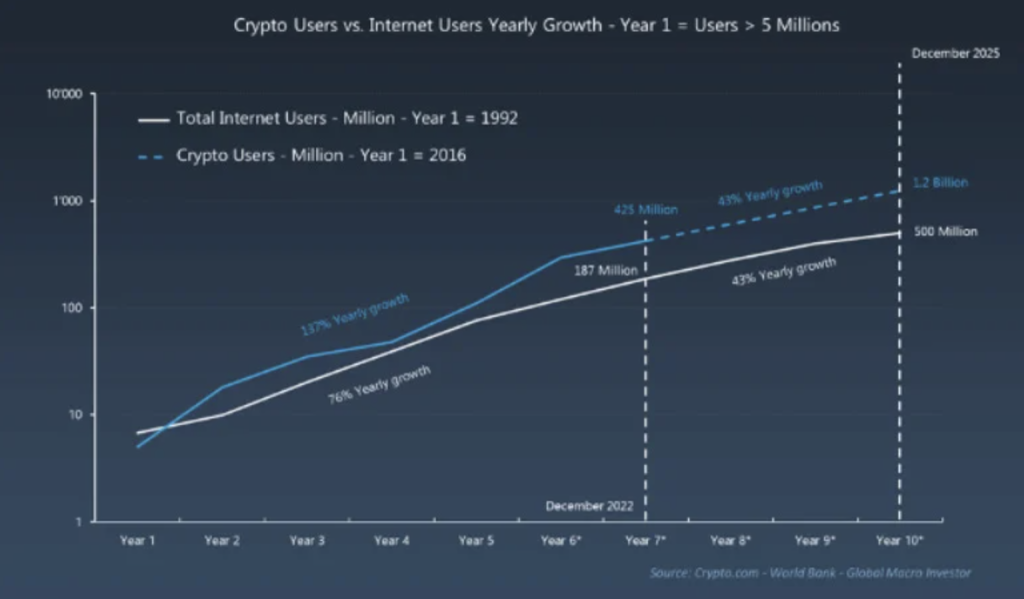

More than 10% of people in the US, Europe, UK, UAE and Australia own or have owned cryptocurrencies. Hundreds of millions of cryptocurrency users live in China, Japan and India.

Globally, cryptocurrencies continue to grow faster than the Internet:

Potential Impacts

It could be said that we are entering a period of currency wars. Of course, the dollar isn't going away anytime soon. But history says that money has always changed. Reserve currencies changed in the same way. Therefore, the dollar has probably already seen its best days.

CBDCs are becoming political

Politicians have attempted to ban CBDCs in the United States. The Republican presidential debate began a few weeks ago. Cryptocurrencies and CBDC have not risen yet. Trust in government in America is at an all-time low, where it has been for a decade.

What will people think of BTC when they learn more about money and that the government now wants to issue its own “crypto token”? In this sense, CBDCs could become a global advertising campaign for BTC.

The dollar and international trade

The dollar may lose its importance in international trade if other countries are the first to introduce CBDC and set prices for their goods in these currencies and begin trading with each other in these currencies.

What does the creation of a CBDC mean for banks?

The introduction of a CBDC will lead to a restructuring of the banking system and may change the role of commercial banks.

Privacy and control

The government can gain more control with CBDC if they control the issuance of coins. It is possible that funding will be directed to politically advantageous initiatives and enterprises, while cutting off funding to others.

CBDC on public vs private blockchains

Problems of private blockchains

< p>Private blockchains have limited ability of different blockchains or distributed ledger systems to communicate and function together, and also have complex governance.Private blockchains are not suitable for CBDC due to the loss of decentralization and transparency. The New York Federal Reserve has identified difficulties in creating a common network on private blockchains. There is no guarantee of consistency across the tech stack and standards.

Benefits of public blockchains

Public blockchains such as Ethereum provide a more secure and efficient solution for CBDC with pre-existing standards and the ability to interoperate with other blockchains . Public blockchains provide security and decentralization. An alternative way is to create “private networks” as L2 layers on public blockchains.

Identification and biometrics

Identification problems have not yet been solved with CBDC. Projects such as Worldcoin are exploring this area and making progress in it. But Wordlcoin is only available on public blockchains.

Conclusion

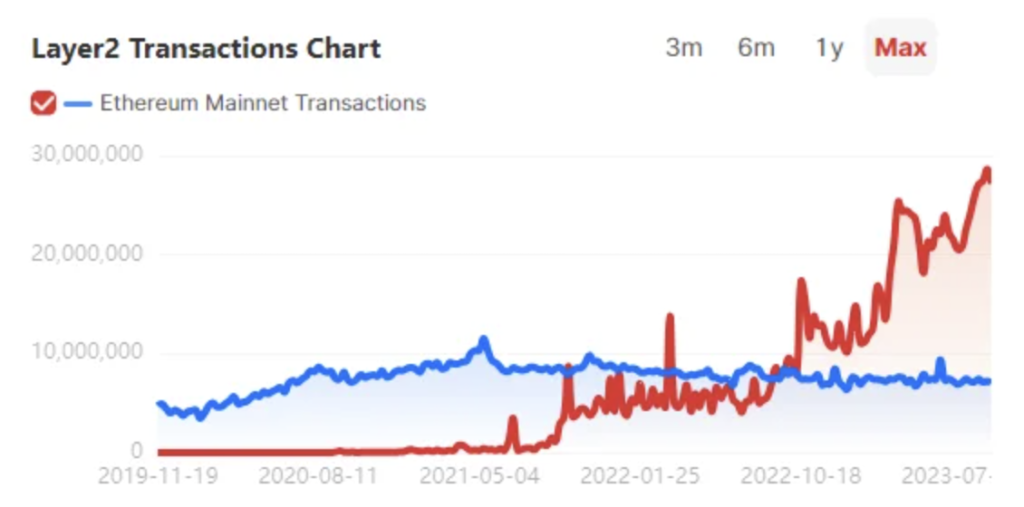

The most optimal choice for CBDC will be Ethereum and L2 blockchains. L2 will be chosen as a solution to the scalability problem. Also, don’t forget about Moore’s law, the Internet did not immediately give us applications like YouTube, Zoom, etc., everything comes with time.

Two years ago, the volume of L2 was about 100 times less than the volume of Ethereum.

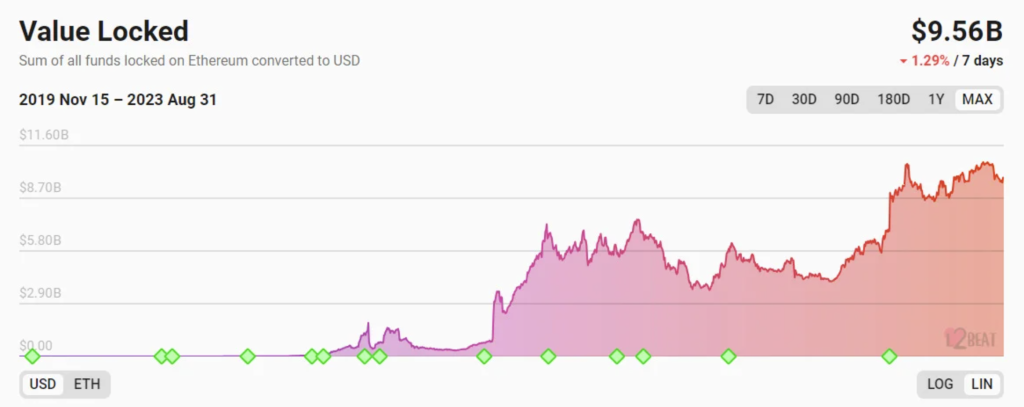

TVL

TVL  Quantity transactions. Red - L2, Blue - Ethereum

Quantity transactions. Red - L2, Blue - Ethereum Central Banks will be testing CBDC for a long time, the reports that are published by each central bank can give the feeling that “someone from above ordered something to be done.” People given these tasks may find themselves in an unusual situation. They actively work and share their results. So you can see some promotional gains here and there.