Do you think that simply buying and holding crypto is boring? Staking your ETH can add variety to your investments and give you more firepower when bullish times return.

Now, if you, dear readers:

- Have installed market alerts on your phone;

- Keep an eye on quotes; < li>And named their firstborn after their favorite altcoin.

This advice may not be for you! But for those 90% of crypto investors who don’t want to constantly worry about their portfolio.

Let's have a little history lesson.

If you can't beat the major cryptocurrencies, you're losing!

A significant portion of my portfolio is still in BTC and ETH:Their annual inflation rate is very low. Potential losses are limited (in my opinion , both assets will likely not return to their 2022 lows). Those altcoins that seem promising today could disappear within a year . I prefer to wait for retail investors to return and then bet big on altcoins.

The DeFi Investor (@TheDeFinvestor) September 25, 2023

Common sense dictates that we need to look not only for profitability, but also take into account the level of risk. This means that for every additional level of risk we take (for example, by buying an altcoin), we should expect an additional return compared to safer assets.

In other words, if we decide to invest in a project with a higher level of risk than BTC or ETH, that project is bound to offer a significantly higher return. Otherwise, what's the point?

The problem is that most projects simply won't be able to beat these assets. Not convinced? Let's take a look at some data.

2019 VS today

If you closely monitor the situation, you have probably noticed that many are comparing today's conditions on the market with those that were in 2019. There was a bear market then, a year before the halving and a year before the US elections. While this is not a perfect comparison, we can use the experience of 2019 to understand how the crypto market might evolve in the future.

Let's go back to the fall of 2019. At that time, the main topic of discussion was Brexit, and cryptocurrencies were in the background. BTC cost a little over $8 thousand, ETH was less than $200. Tether volume was around $4 billion, and Bitcoin Cash (BCH) and Bitcoin SV (BSV) were still in the Top 10. If you were active in the crypto world in 2019, would you consider investing in any of these projects?

CoinMarketCap historical screenshot from fall 2019

The survivor effect may distort your view of those times - let's approach this objectively. If you randomly selected projects from the TOP 200 by capitalization, how would they perform? Maybe it would be smarter to stay with ETH or BTC?

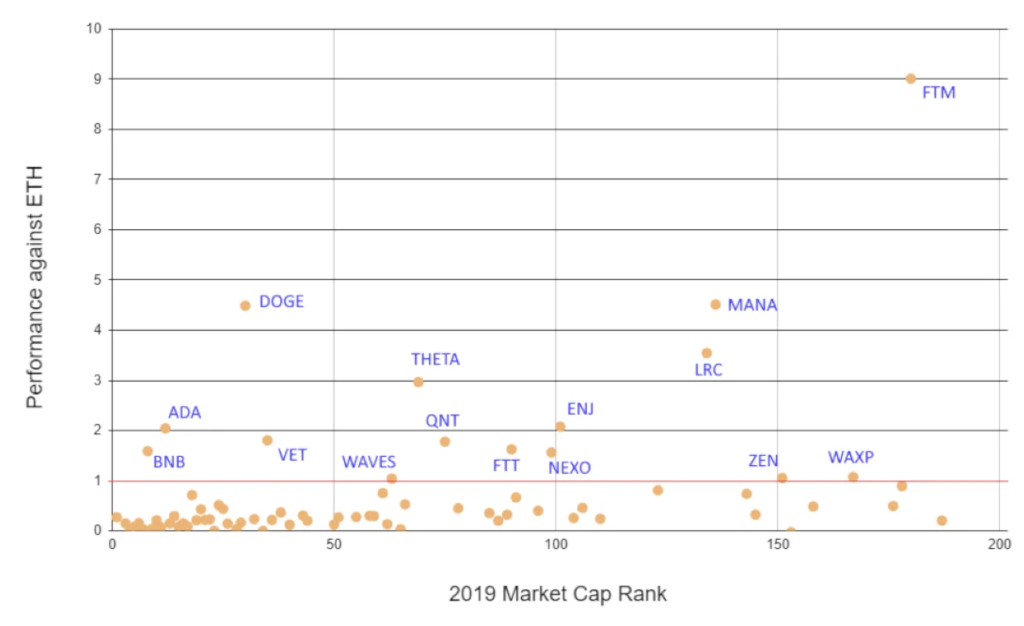

Let's take a look at the performance of the TOP 200 assets by market cap from September 2019 to BTC's approximate all-time high in November 2021. The results were very sad. The chart below shows that projects that outperformed ETH are above the red horizontal line.

Performance of the TOP 200 assets compared to ETH from September 2019 to an all-time high in November 2021 < /p>

Only 15 assets from the TOP 200 performed better than ETH (in the case of BTC it was 40), which demonstrates how strong the survivor effect is in our industry. You may notice that the dots become sparser as we move down the cap rankings (from left to right). Why? It's simple. Many projects simply ceased to exist.

Of the 200 projects reviewed in the 2019 screenshot, 63% were no longer in the TOP 200 by November 2021. Crypto markets are capitalism taken to its maximum, where there is no mercy for weak projects.

"But this time it's different"

There are undoubtedly more legitimate crypto projects today than in 2019 . But look at today's Top 50 and ask yourself: How many of them have enough product-market fit to continue to exist for years or even decades?

Only Bitcoin and Ethereum (at least for now) have demonstrated their resilience for several cycles in a row, attracting more and more users, increasing trading volume and integrating into various projects. Over time, the list of “low-risk” investments in cryptocurrencies may expand (and you probably already have several promising candidates), but today there are not many such projects.

Many of the successful projects of the past bull market did not exist at all during the lull in the 2019 bear market. Large investors who invested millions in initial rounds avoided issuing tokens during periods of decline. And who can guarantee that the situation will change now?

There is a high probability that the most successful tokens of the next cycle have not yet been released. This is why it is so important to keep available funds in reserve. Don't build your portfolio solely based on current assumptions, rather prepare for opportunities that may arise in the future.

Miles Deutscher (@milesdeutscher), September 27, 2023

Found a gem among the garbage?

Let's say you're one of those 10% who likes to dive into details and look for gems. But to find undervalued projects, you need to conduct a fairly in-depth analysis. Do you think the people who bet on altcoins in 2019 all picked the 15 projects out of 200 that outperformed ETH? Or perhaps it would be more profitable for them to simply hold large cryptocurrencies for the long term?

You might think you've found the next big thing, and you might be right. But remember to keep an eye on smaller projects, as their fundamentals often change much faster than larger ones.

- Is the team sticking to its roadmap?

- Are key performance indicators moving in the right direction?

- Are they on track to achieve product-market fit?

- Are any of your criteria for deinvestment activated?

Participating in project communities can be fun, especially during down market periods. At such moments, all the tourists leave and only real enthusiasts remain.

Remember: don't get too attached to your altcoins, and when in doubt, stick to the major cryptocurrencies.