Mint Cash

On November 24, former Terra developer Daniel Hong publishedMint Cashto complete Terra's business.

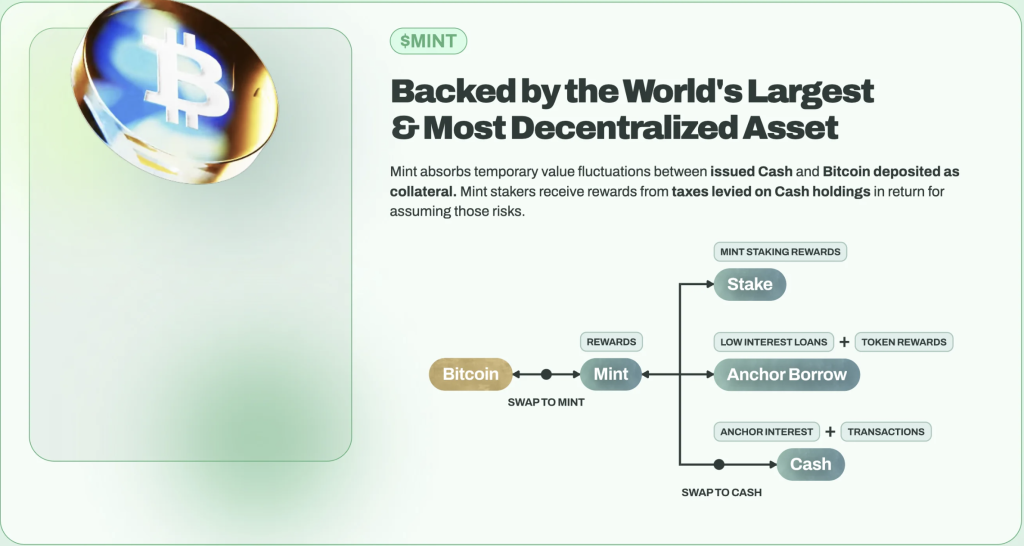

Mint Cash is based on the original Terra Classic code library, which means it is still based on the Cosmos SDK. Unlike the purely algorithmic UST system, Mint Cash uses BTC as collateral to create a new Cash stablecoin. At the same time, Mint Cash will use the modular Celestia blockchain as a DA layer and introduce IBC support for nBTC developed by Nomic, a BTC sidechain company, to connect with the Cosmos ecosystem. Compared to algorithmic stablecoins, Mint Cash is positioned closer to DAI.

The Mint Cash logo design is considered a reference to the algorithmic stablecoin Basis Cash. Do Kwon was its anonymous member.

Mint Cash is being developed under the leadership of former Terraform Labs developers Daniel Hong and Junho Yeo, as well as Aleph Research. Aleph Research's development core will be responsible for developing the stablecoin protocol. They are also involved in the development of a new version of the Anchor Protocol called Anchor Sail, which will be a key part of the growth of the stablecoin and its establishment in the Mint Cash ecosystem. They also plan to collaborate with the smart contract platform CosmWasm and the EVM L1 blockchain platform Berachain to create and support Polaris EVM based on the Cosmos SDK.

It is important to note that there is no information on the existence of partnerships with the Mint Cash project, just as there is no information on project financing.

The sharp rise in USTC occurred after Daniel said that Mint Cash would launch an airdrop as compensation for the collapse of the Terra ecosystem. It will be possible to participate in which one of the conditions is met:

- If you held UST or LUNA before the collapse of Terra on May 10, 2022;

- If you block and burn USTC through a special created contract for Terra Classic. Next, there will be a proportional distribution of $1 for each USTC (at that time this would be a discount of up to 99%).

Burning USTC for a new coin is like participating in an ICO. But if all USTC is burned, the new project will not be able to support the almost $10 billion market capitalization. This will only be possible if only a small portion is exchanged, but it is more like launching a new project under the UST flag.

USTC currently has a supply of 9 billion tokens. Many use this number to directly push the valuation of new projects to almost $10 billion, but it is clear that not all of the circulating USTC will be included in the new project, but only a small part of them.

Mint Cash is only in the whitepaper stage and has not officially launched yet.

Differences from MakerDao?

Instead of following the old path of algorithmic stablecoins, Mint Cash uses Bitcoin as an asset for collateral to create stablecoins. This idea is easily reminiscent of MakerDAO's overcollateralization model.

Is there anything unique about Mint Cash's design?

Judging by official documents, published by Shin and Mint Cash, there are indeed differences between their projects and MakerDAO projects in terms of collateral assets, stability and capital efficiency:

- Pledged Assets: MakerDAO provides an over-collateralized approach through its $DAI stablecoin. Users are required to deposit more than $DAI worth of crypto assets (such as Ethereum) as collateral for the loan. Mint Cash takes a different approach: its stablecoin is fully backed by BTC and generated using a synthetic swap mechanism. This method avoids traditional lending positions and instead allows users to use BTC as collateral to receive the equivalent value of Mint Cash's stablecoins.

- Stability: DAI's stability has a lot to do with it depends on the market performance of collateral assets and the volatility of the entire crypto market; Mint Cash relies directly on BTC, which increases the risks associated with Bitcoin market volatility.

- Capital Efficiency: DAI's overcollateralization mechanism means users need to lock up more capital than the value of the DAI they provide, which may reduce capital efficiency. Mint Cash's so-called "synthetic swaps" could theoretically use BTC as collateral without requiring additional capital investment, increasing capital efficiency.

Taken together, Mint Cash and MakerDAO demonstrate two different methods and concepts generation of stablecoins. MakerDAO's DAI focuses on providing stability through overcollateralization and partial dependence on centralized stablecoins, while Mint Cash emphasizes the use of decentralized attributes of BTC through a synthetic exchange mechanism.

Attempts to restore the USTC peg to the dollar

In September of this year, the Terra Classic community accepted proposal 113204 "Re- anchor LUN to UST", which is aimed at restoring the LUNC anchor and restoring the USTC price to $1. It describes a working framework for redefining the USTC at the code, consensus, and governance levels.

Shortly thereafter, the Terra Classic community voted to stop minting all Terra Classic USD (USTC) with 59% approval. The proposal aims to protect "the community and outside investors who are destroying the USTC to restore the peg."

The network claims that the increase in the price of USTC may be associated with the strategic purchase of Terra Classic Labs in the amount of $500 thousand. According to the data, Terra Classic Labs acquired about 25.6 million USTC at an average price of about $0.021 per token in as part of an initial strategic investment. However, the official Terra Classic Labs account denies this information, stating that only $1 million was invested in USTC for individual community members.

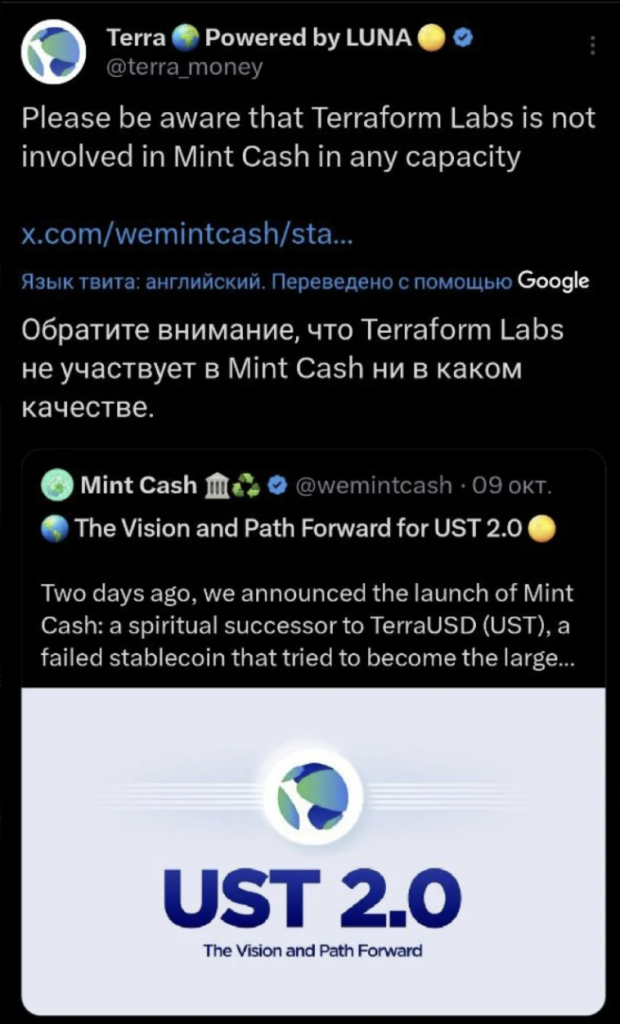

On November 28, the USTC price fell almost in half after the official Terra account reported that their company is not associated with the Mint Cash project < /p>

Thus, the sharp rise in USTC is based on various rumors related with the Mint Cash project, promising to return the token peg in the range of $0.2-1. It can be assumed that the team does not have any serious money or projects behind it, especially since the Terra team has already renounced its connection with Mint Cash. Listing on Binance Futures is not an indicator of the exchange’s interest in the project, but only a desire to make money on the wave of hype for the project. This pattern often works in the case of Binance, when after a drop in interest in the asset, Binance splits the coin. At the moment, buying USTC from the market remains extremely risky and speculative.