Before we begin, let us recall that oracles are external services that provide communication between smart contracts and external data, acting as intermediaries between the blockchain and the outside world.

| Project | X to ATH | Investors | FDV | Current supply | Funds | < /tr>

| Chainlink | 4.11x | $32 million | $12.86 billion | 55.85 % | Framework, Hashed |

| The Graph | 20.69x | $79.7 million | $1.49 billion | 86.12% | Coinbase, Multicoin Framework |

| Tellor Tributes | 1.26x | $400 thousand | $326.30 million | 98.21% | Framework Ventures, Binance Labs |

| Band Protocol | 14.54x | $10.85 million | $217, 71 million | 96.86% | Binance Labs, Sequoia Capital India |

| API3 | 6, 52x | $26 million | $200.52 million | 68.96% | DCG, Pantera Capital, Hashed | < /tr>

Chainlink

Chainlink - is a decentralized network of oracles, when the oracle involved in the execution of a smart contract does not just scan the neighboring blockchain, but receives data from the whole a number of other oracles independent of each other.

Many projects are already interacting with Chainlink, and their number is constantly increasing.

Raised $32 million in 2017 with the support of tier 1 funds such as Framework.

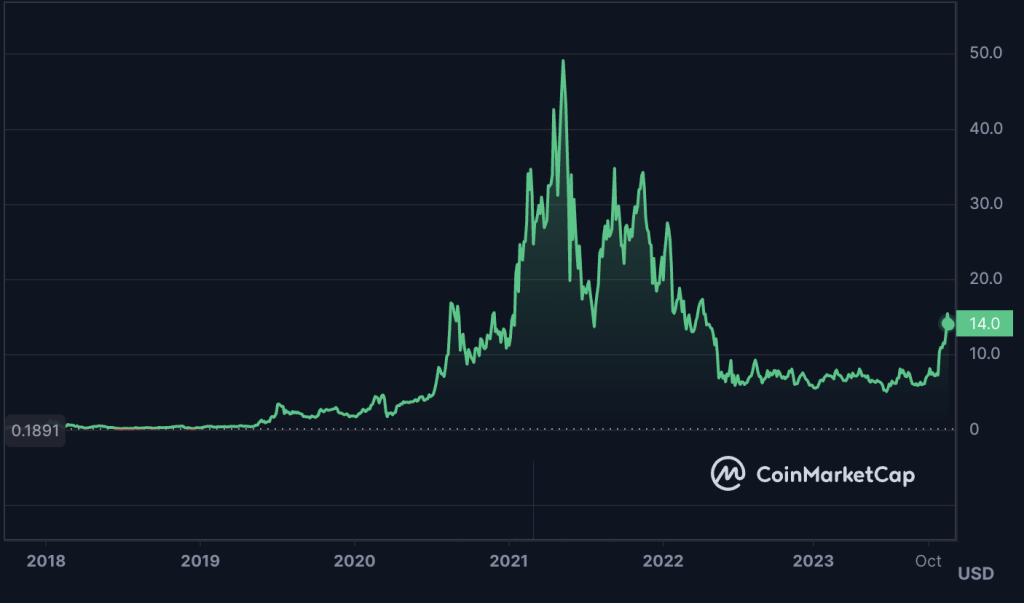

The project performed well in the 2021 bull market, reaching an ATH of $48.1. In October of this year, the price of the token almost doubled, exceeding the $12.50 threshold for the first time since April 2022.

Financial position

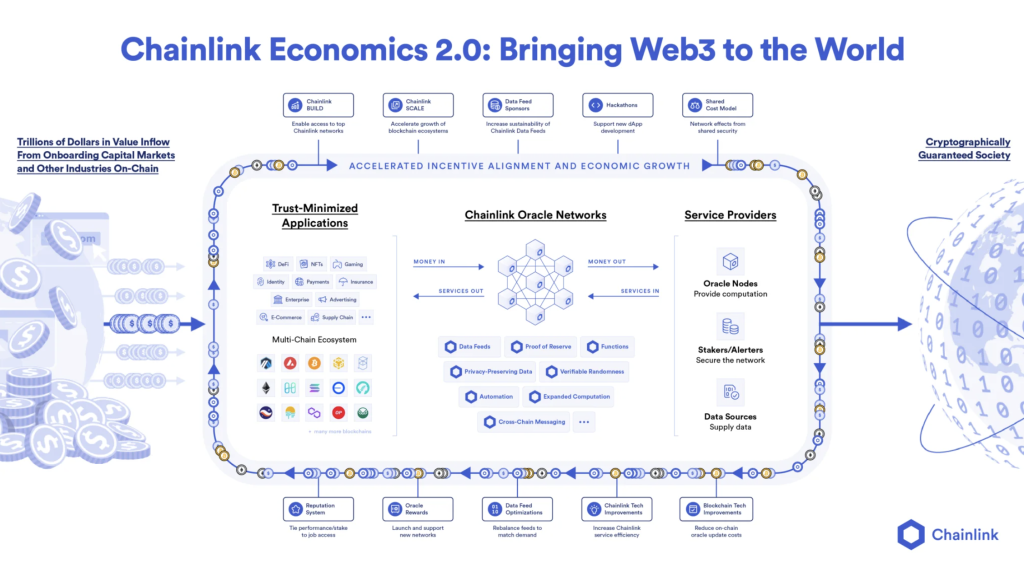

Launched a year ago Chainlink Economics 2.0 program, introducing v0.1 LINK staking for users and expanding the structure. The initial pool consisted of 25 million LINK tokens and yielded 4.75% APY for node operators.

Now the updated staking v0.2 is coming.

Staker node operators will be able to count on ~7% APY.

Community stakers will be able to count on 4.75% APY.

When will LINK provide its own proof of its reserves? Can we get a live dashboard providing more transparency about the state of the token, network usage, treasury, operating expenses, revenue, etc. and so on.?

The question asked in the community regarding our own Proof of Reseve and dashboard remained unanswered.

Grayscale Chainlink Trust (GLNK), a regulated product that allows US investors access to LINK, is trading at a 200% premium to spot prices, indicating institutional demand.

Activity

The project is very active, takes part in offline conferences, enters into partnerships, and expands the ecosystem.

From November 8 to December 10, a hackathon will be held " Constellation" with a prize pool of $500 thousand. Sponsors include Avalanche, Polygon, SteelPerlot, Tencent Cloud.

From the latest events:

- Launch of the Data Feeds solution in the Scroll and Linea networks

- Chainlink token (LINK) will be listed on the Hong Kong exchange on November 10.< /li>

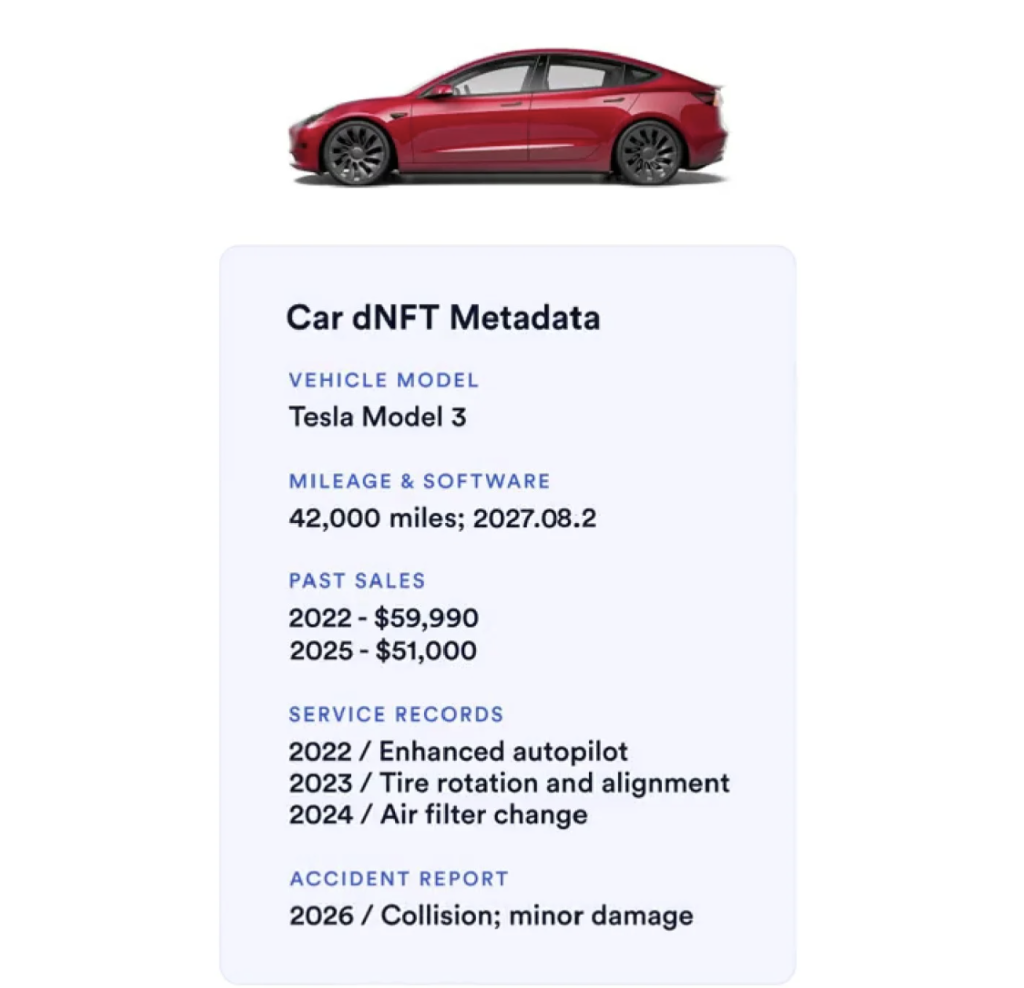

- We showed an example of tokenizing a Tesla car as a dNFT, with access to its verifiable history in real time

The Graph

The Graph is a protocol for indexing queries on networks such as Ethereum and IPFS. Anyone can create and publish open APIs, called subgraphs, that can be used to query data that is difficult to obtain directly from the blockchain.

The project raised $12 million in several rounds in 2020 with the participation of Tier 1 funds Coinbase, Multicoin Framework, Fabric. In 2022, he raised another $50 million.

Performed well in the bull market 2021. The project fell heavily during the bear market, reaching ATL in November 2022. Over the past month it has grown by ~50%. There is potential for growth.

On November 22, 2023, it is planned to release rewards for the MiPs program (the number is not known, but not large). And by the end of 2024, the final release of curated tokens in the amount of ~85 million GRT will be made.

Financial Position

The Graph launched a $205 million ecosystem fund for development teams with the support of Digital Currency Group, NGC, HashKey.

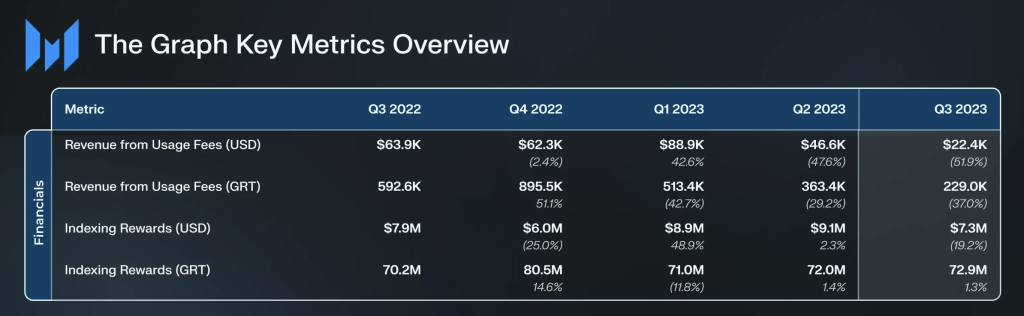

The Graph metrics from the Messari report

In the third quarter, query revenue in $ decreased by 52% compared to the previous quarter due to optimization of pricing for requests. Indexing fee revenue decreased 19% quarter-over-quarter to more than $7.3 million in the second quarter of 2023.

GRT can be staked at ~7.25% APY.

Support for large language models (LLM) may be a driver of token growth.

Activity

- The project is very active. Takes part in online and offline conferences.

- The Graph recently introduced a new roadmap.

- Support for large language models (LLM) was announced, which may be a growth driver in the future.

Tellor Tributes

Tellor Tributes is a decentralized oracle protocol that provides data to decentralized financial applications (DeFi). The Tellor Oracle allows you to query, verify, and store information on the blockchain without permission, with data reporters competing for TRB rewards.

Tellor raised a total of $400 thousand in three rounds of funding with the participation of Framework Ventures and Binance Labs. The third round of financing took place on April 5, 2020 as part of purchases from the secondary market, the amount of financing was not disclosed.

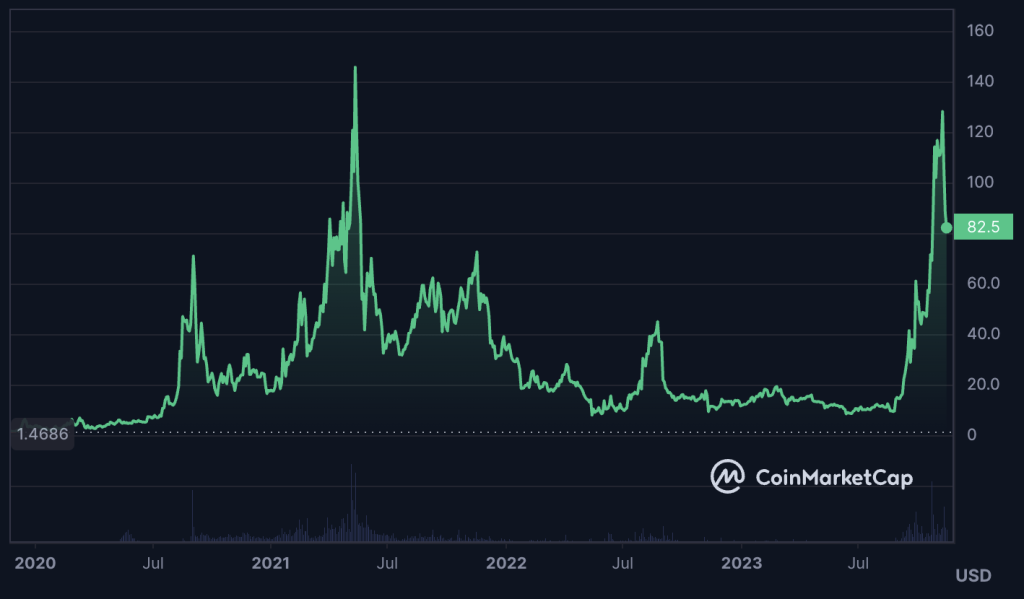

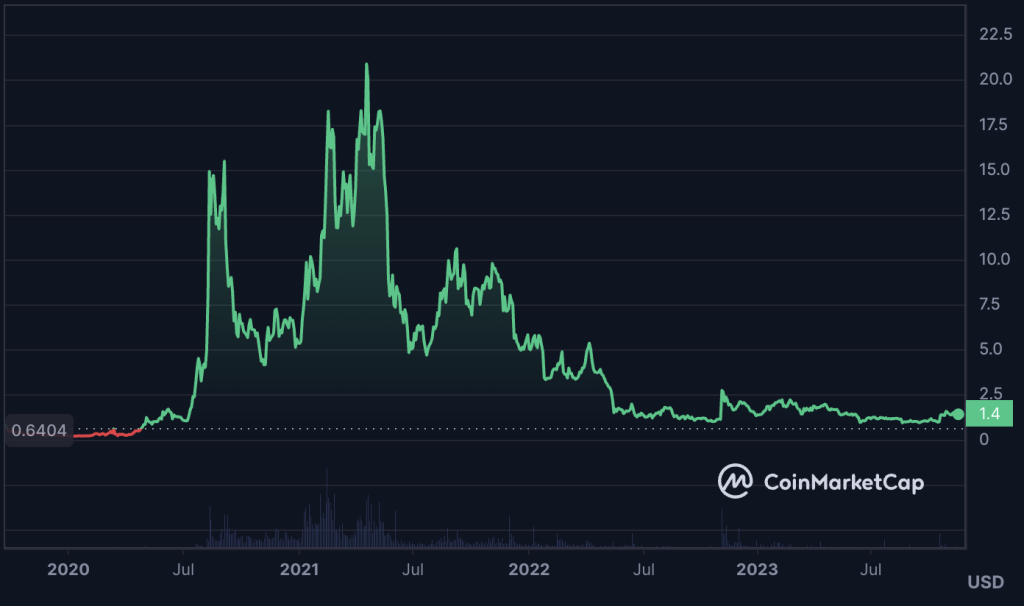

Over the past three months, the token has grown by more than 900% and has practically renewed its ATH is $128.02 versus $128.79 in May 2021 (on Binance it reached $161 at the same time). Volumes returned and MM took up his business again after the summer holidays. And all because of the announcement of its Tellor Layer network on the Cosmos SDK.

Financial situation

In May, questions were already asked about the project’s funds, as the admin on the discord assures – “I think they still have enough funds to work "

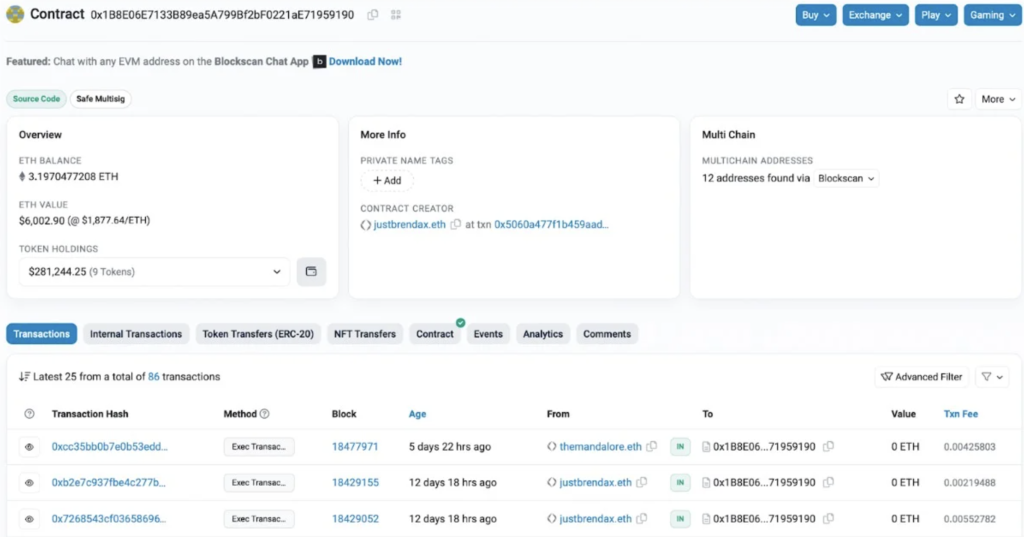

The admin also provided two team wallets.

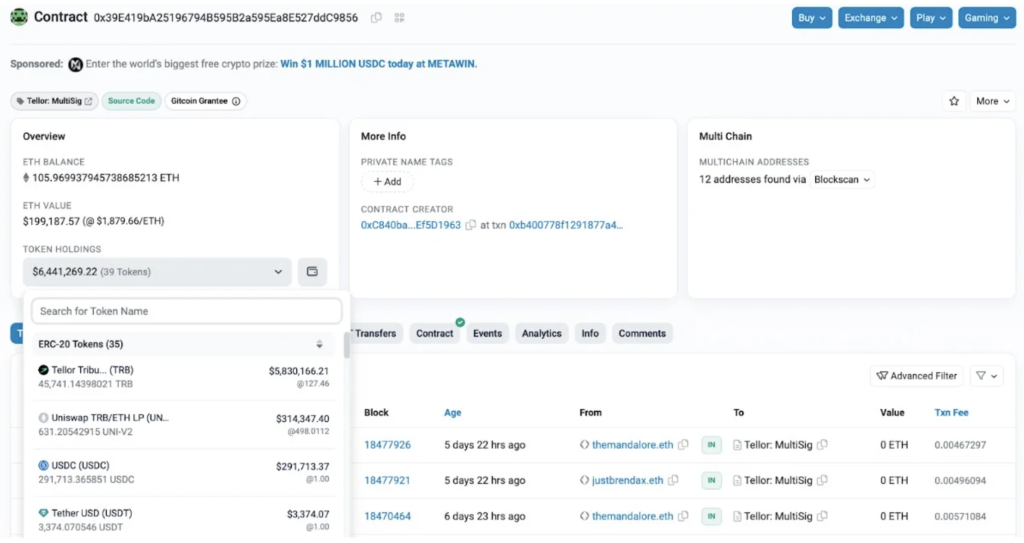

The first is the team's multisig wallet, which stores more than $6.6 million in tokens:

And the second wallet, with just over $280 thousand:

Activity

Judging by the graph, the project’s activity is high, which is confirmed by social networks.

On the first of September the project announced Tellor Layer, which is an evolution of the Tellor protocol and is being developed as an autonomous network using the Cosmos SDK and the CometBFT negotiation mechanism.

Otherwise everything is the same as everyone else. They shine their faces at offline conferences (Cosmoverse in Istanbul, DappCon Berlin, unStableSummit), partner (MantaNetwork) and hold calls.

Band Protocol

About Band Protocol we already wrote in material about projects from Binance Launchpad. But since he is among the top 5 oracles, it is worth noting him again.

Band Protocol is a data management protocol, a cross-chain oracle that aggregates and connects real-world data and APIs to smart contracts.

Raised $5 million in several rounds with the participation of Binance Labs and Sequoia Capital India and $5.85 on Binance Launchpad.

In the 2021 bull market, the project showed good results. The circulation is 96%, and the remaining distributions of the remaining ~4% for the team occur in August 2024. With ATH over 14x, there is still time to grow. And we all know how Binance loves to pump its coins.

Financial condition

The project is in excellent financial condition, according to the community manager. There is a grant program for developers, researchers, community and infrastructure.

You can stake your tokens to validators and receive part of the reward for their work. The reward amount depends on the number of staked tokens and the validator’s commission.

Activity

Activity in social media. networks are high, the project is recruiting new developers to the team, entering into partnerships and taking part in hackathons.

From the latest news:

- We have closed applications for the Band Protocol Foundation validator program for the 4th quarter of 2023.

- We have become a sponsor of the BANGKOK BUIDL conference 2023, and also took part in the Cosmoverse 2023 event.

- Successfully integrated with Horizen EON - a scalable EVM-compatible blockchain and smart contract platform.

- We are recruiting for the ambassador program.< /li>

- We provided a new one sethttps://tracker.api3.org/treasury< /p>

The first wallet, called Primary, contains almost 19 million API3 tokens, which is equivalent to more than $29.6 million:

The second wallet contains more than 5.2 million in USDC and 4 thousand ETH ($7.5 million):

The third wallet contains 825 thousand API3 ($1.29 million):

API3 staking option available with 6.7% APY:

Activity

Social networks are active, but only news participation and organization of conferences (ETHChicago in September, Ethereum London in October, ETHGlobal in November), expansion to new networks (Linea, Base, Kava, Avalanche, etc.) and holding workshops. In August, managed dAPIs were launched on the API3 Market.

The project is working and developing, but there is no dominant news.

What is the result?

In this material, two echelons are distinguished:

- Chainlink vs The Graph

- Tellor Tributes vs Band Protocol vs API3

Chainlink will have a hard time climbing, given their FDV ($12.86 billion) and small supply ( almost 56%). It will undoubtedly grow, and if the market is favorable, it will give a couple of X's and get closer to Solana.

The Graph is Chainlink's first competitor, but The Graph has a number of advantages over Chainlink. Firstly, FDV ($1.49 billion), which immediately gives 8-10 x upside to FVD Chainlink. Secondly, the current supply is approaching 90%. The remaining tokens will be unlocked next year, but given the loyal community, chances are there will be minimal pressure on the glass.

Regarding Tellor Tributes, Band Protocol and API3. Tellor Tributes is a normal project, with excellent circulation, they don’t hide their wallets, they don’t hide their faces, they actively answer questions, they are sawing something, they returned to ATH. They are among the top 5 oracles, they may well be worth 1 billion in a good market, and that’s at least three more X’s. But what’s confusing is that it has already grown 10 times. Band Protocol is a great project with Binance under its belt, they can easily surprise you. Circulate approx. There is a chance to become a unicorn in a bull market, and that is just under 5 lawsuits. API3 is a project with a working product, constantly expanding and shining its face offline. Among the minuses, we can note the lack of tier-1 funds and a small circulation rate of 68.96%. I am impressed by the openness of information about the fund - there is definitely money for work. 1.5 - 2 x in a good market may well be.