Current indicators and behavior of the STX token

Project from the old guys, held the first round financing and ICO back in 2017. It began trading at the beginning of 2020 at a price lower than the ICO price ($0.12).

In 2021, he followed BTC, showing the first highs in April 2021, and already updated the ATH in November.

In February 2023, volumes appeared and STX grew more than five times, demonstrating local highs of this year. This rise is likely due to the NFT hype on BTC on Ordinals.

The project is relatively heavy - FDV is $1.28 billion. 78.27% in circulation, although it could be more, given the age of the project.

In a good market, Stacks can show 2-3x from current levels, but judging by the chart, the token is unlikely to be able to start a trend growth outside the market.

Traded on all top exchanges.

STX can be staked on exchanges (Binance with APR 5.7 % and OKX), both in pools (Xverse pool, LockStacks, etc.) and independently (usually more than 100,000 STX is needed).

It is worth noting that Stacks was the first to conduct an ICO approved by the Securities and Exchange Commission in accordance with Reg A+.

Team

Muneeb Ali is the founder of Stacks. He is also the CEO of Hiro PBC, a public benefit corporation that develops Stacks developer tools. Hiro (formerly Blockstack PBC) was included in CNBC's 100 Promising Startups list.

Muneeb is one of the key characters in George Gilder's book "Life After Google" and a technical advisor to the HBO show "Silicon Valley".

Ryan Shea is the second co-founder of Stacks. At the same time, he is working on Opus, a cryptocurrency wallet for social payments.

Invested early in several unicorns, including Lattice, Mercury, OpenSea, Anchorage, CoinTracker, etc.

Current Products

sBTC Testnet

Stacks released the sBTC Developer Release on October 20, which allowed select developers to build and test an early version of sBTC, a version of BTC with 1:1 support at the stack level. The sBTC testnet allowed users to begin testing sBTC input and output streams, and Bitcoin L2 ecosystem developers were able to integrate these input and output streams into their applications using a simple API and wallets such as Leather and Xverse. The testing phase ended on November 20.

| Name | sBTC | wBTC |

| Class of solutions | Collateral secured by smart contracts and an open set of validators | Collateral, backed by a central custodian and a closed federation of merchants |

| Protocol | Stacks | Ethereum |

| Expected launch Q2 2024 | January 2019 | |

| Circulating supply | None | ~163,000 |

| Commission | BTC + STX transaction fee. No additional commission for deposit and withdrawal | BTC + ETH transaction fee. Deposit/withdrawal fees vary depending on the merchant (wrapped or unwrapped) |

| Protocol Details | sBTC deposit requires 6 confirmations, approximately 1 hour, with normal traffic on the Bitcoin network. Withdrawals from sBTC are processed in each BTC block, but the time may vary depending on traffic on the BTC network. End users buy and sell wBTC directly from authorized merchants, often taking less than 5 minutes, but the initial registration process may take several days. Deposits and withdrawals in wBTC can only be made by authorized merchants and custodians | |

| Summary | BTC settlements via Stacks, BTC L2 | Ethereum settlements |

sBTC is expected to have faster transactions after the Nakamoto update than wBTC (which runs on ETH and is currently faster ). Settlements on BTC with BTC security is the team's priority.

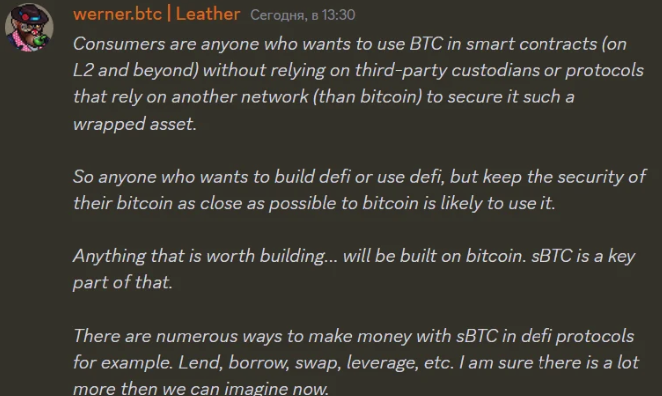

sBTC consumers are anyone who wants to use BTC in smart contracts (at L2 and beyond) without relying on third-party custodians or protocols that rely on another network (not BTC) to provide security for such a wrapped asset.

So anyone who wants to build DeFi or use DeFi but keep the security of their BTC as close to BTC as possible will likely take advantage of this.

Anything worth building... will be built on Bitcoin. sBTC is a key part of this.

There are many ways to make money with sBTC, such as in defi protocols. Lending, borrowing, swap, leverage, etc. I am sure there is much more than we can imagine now.

There are educational program Nakamoto Education Series, consisting of 6 sessions. The release of the "Ultimate Nakamoto Study Guide" and the release of the literacy quiz "Nakamoto and sBTC" are planned for December 1. Educational sessions with developers are planned for January 2024

Starting from December 1, Hiro Hacks will be held for 3 weeks - a series of coding tasks, projects and hack sessions for Web3 developers at the intersection of BTC and Stacks. The prize fund is 12 million satoshi.

Ecosystem

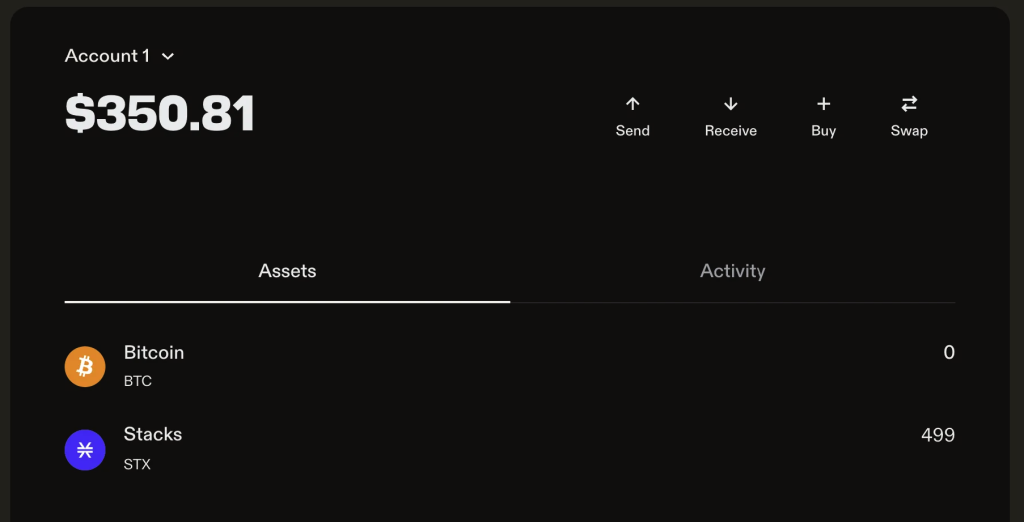

Leather Wallet

Works quickly and clearly, nice design.

ALEX

The ALEX protocol creates the financial structure of Stacks. Rebranded into the financial layer of Bitcoin and launched the Bitcoin Lab ecosystem fund. In September, they introduced on-chain indexer for BTC TVL protocol $16.7 million.

The application works quickly, has a laconic design. You can add funds to the pool, make swaps, etc.

You can stake your STX tokens through this protocol.

Arcadico

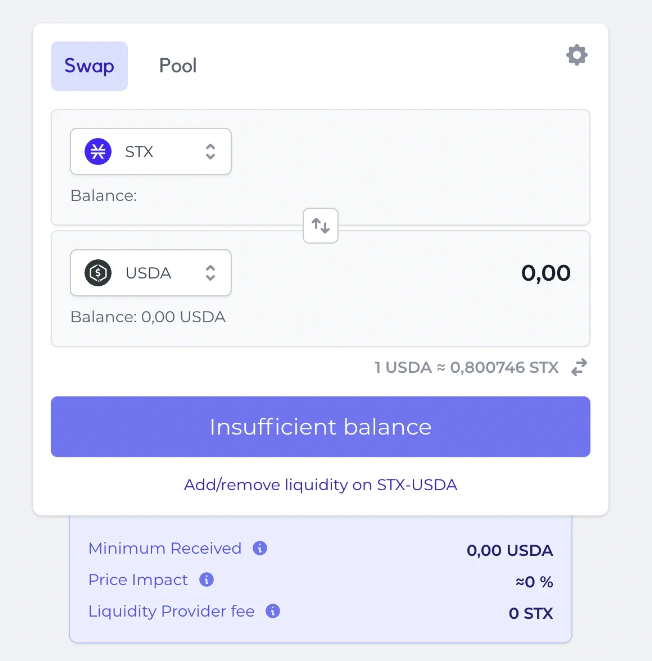

The Arcadico protocol is a decentralized, collateral-free liquidity protocol in which users can pledge their assets and mine USDA stablecoin. TVL of the protocol $4 ,95 million

The application also works quickly, laconic design You can borrow funds, add to the pool, make swaps, etc. /p>

Xverse application for Bitcoin wallet launched Ledger support for STX in September.

Launched sBTC swaps on the Bitflow testnet.

Financial status

Stacks market value has increased by 53.3% since the beginning of the year (according to the report for Q2) thanks to Ordinals and other activity on BTC

In the second quarter, STX's working market capital decreased by 25.8% compared to the previous quarter - from $1.29 billion to $955 million, which lags the growth. of the total market capital of cryptocurrencies by 0.4%.

Revenue is measured as the total transaction fee and is distributed to miners through the PoX mechanism in Stack. Quarterly revenue for Q1 was $65,000. In Q2, revenue was $42,000. and down 35.5% from the previous quarter, still up 105.5% from the previous year.

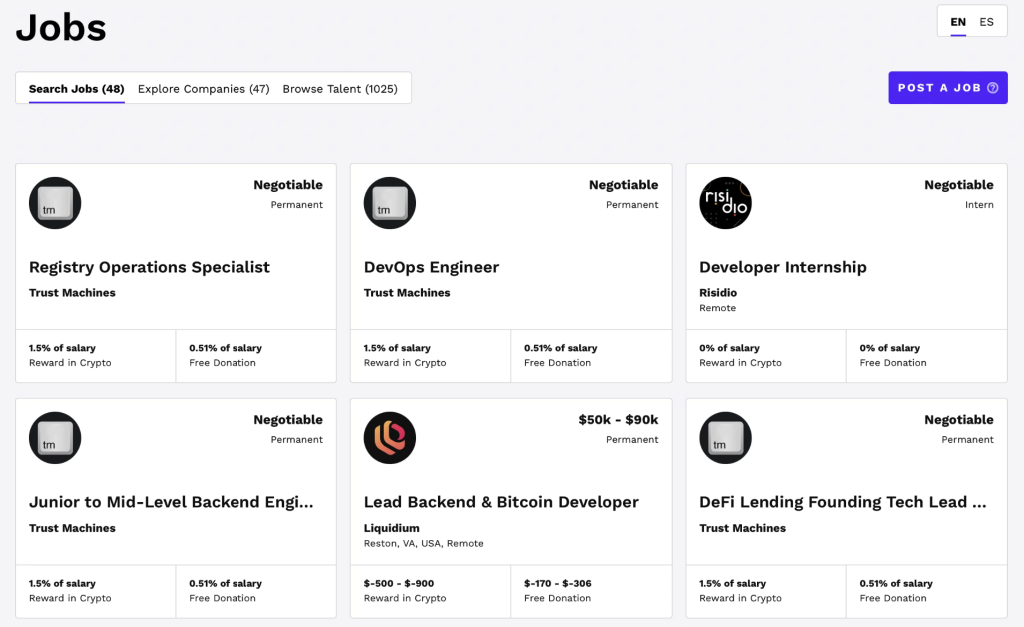

Another indicator that the team has money is number of open vacancies While many other crypto projects are cutting staff to optimize costs, Stacks continues to hire people.

There are currently 48 vacancies available

< h2>Conclusion, risks and growth drivers

Positive points:

- Stacks is a solid project from 2017 that is still afloat and does something. And this is already worth a lot.

- As mentioned above, Stacks was the first to conduct an ICO approved by the SEC in accordance with Reg A+, which gives us confidence in the stability and legality of the company. You shouldn't expect problems with regulation.

- Given the growth of BTC, a new round of hype around Ordinals, NFTs and smart contracts on Bitcoin will probably soon begin. And therefore, attention will be paid to the STX token, as the link between all these components.

- The launch of the flagship sBTC from Stacks is planned for the BTC halving, which is expected in the second quarter of 2024. Apparently the team is actively preparing to catch the trend of next year.

- Good funds and angel investors.

Negative points: < /p>

- The team does not provide treasury data.

- The team does not disclose vesting data (just over 20% of tokens are not in circulation), which is why it is not known when the tokens of early investors will be unlocked (or maybe already).

The viability of the project depends on Bitcoin. This statement can be attributed to both pros and cons. If the next year is favorable for BTC and the growth narratives come true, this will bring success to the Stacks team with its plans.

If for some reason everything does not go as the majority thinks, and BTC goes into a deep drawdown and a black swan arrives, then all this will have a doubly impact on the situation around Stacks:

- Many third-party ecosystem developers will probably leave.

- Activity on the Bitcoin network will decrease, which will greatly affect activity on Stacks.