Mantle (MNT) — an exchange token  ByBit. However, representatives of the exchange prefer to say that these are separate projects. This is related to regulation and attempts to reduce risks for the exchange itself and its leadership, as was the case with Binance and CZ.

ByBit. However, representatives of the exchange prefer to say that these are separate projects. This is related to regulation and attempts to reduce risks for the exchange itself and its leadership, as was the case with Binance and CZ.

Mantle is an L2 network that scales Ethereum using a modular approach. For this, a separate decentralized level of data availability is used, working in tandem with Ethereum rollups.

The project was created by the BitDAO community - a decentralized organization (DAO) with the largest treasury in the crypto-sphere. The community was launched through the Singapore exchange Bybit and began work in June 2021, after raising funds, and then, in August, during an auction, they issued the BIT governance token. In July 2023, the BIT token was replaced by the MNT token at a 1:1 rate.

Bybit was founded in March 2018. It was registered in the British Virgin Islands with headquarters in Singapore, one of the co-founders is Ben Zhou. Initially, the exchange specialized in derivatives, but from July 15, 2021, it opened crypto spot trading to everyone. In April 2023, it moved its headquarters to the Dubai World Trade Center, UAE.

Funding

BitDAO raised $623 million, including $230 million in a private funding round in June 2021 with the participation of Pantera Capital, DragonFly Capital, Founders Fund, business angel Peter Thiel (former founder and director of PayPal) and other investors. While ~$380 million was raised at IDO/IEO.

Bybit makes contributions to the project treasury from its futures trading volume and has contributed more than $400 million to the BitDAO treasury since July 2021.

While all crypto projects (and not only crypto) are faced with the need to reduce staff, Mantle is hiring people. There are currently 17 vacancies posted on the company's website.

Ecosystem, grants and partnerships

Mantle consists of:

- Mantle Network - L2 itself

- Mantle Governance - DAO

- Mantle Treasury - treasury, which is also inherited from BitDAO

Fund movements can be tracked through Treasury Monitor . For example:

Monthly: 1 - project costs; 2 - employee salaries

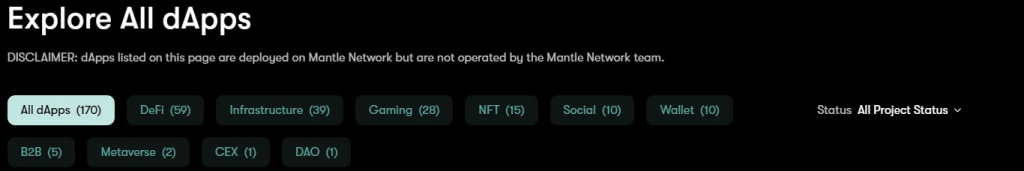

Currently in ecosystem ;170 dApps of the following categories:

Of these, more than 80 projects have already been launched on the mainnet. Among the main ones are:

- Omnichain protocol LayerZero

- Ankr provider

- BitKeep wallet

- DeFi protocol Symbiosis

In April 2023 we launched grants up to $100k.

Also in July they opened Mantle EcoFund together with Strategic Venture Partners for $200 million.

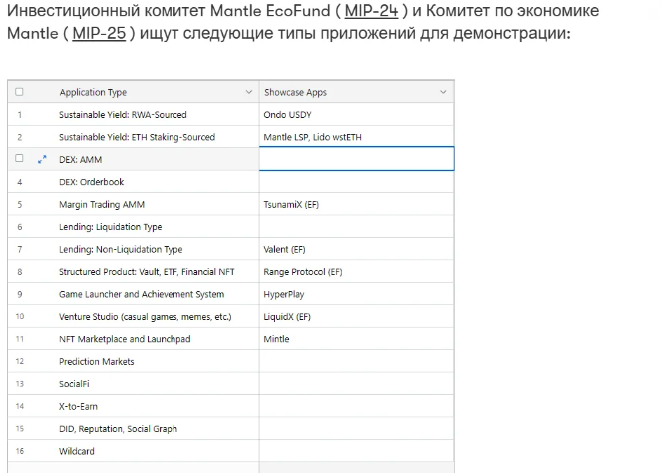

Types of projects that Mantle needs to develop the network.

Among the partnerships we can highlight LayerZero, EigenLayer, Pyth Network, Biconomy, Ankr, etc.

Which is confirmed by the AMA with EigenLayer founder Sreeram Kannan, special projects lead for LayerZero Max Power, Marc from Pyth and Biconomy co-founder Aniket.

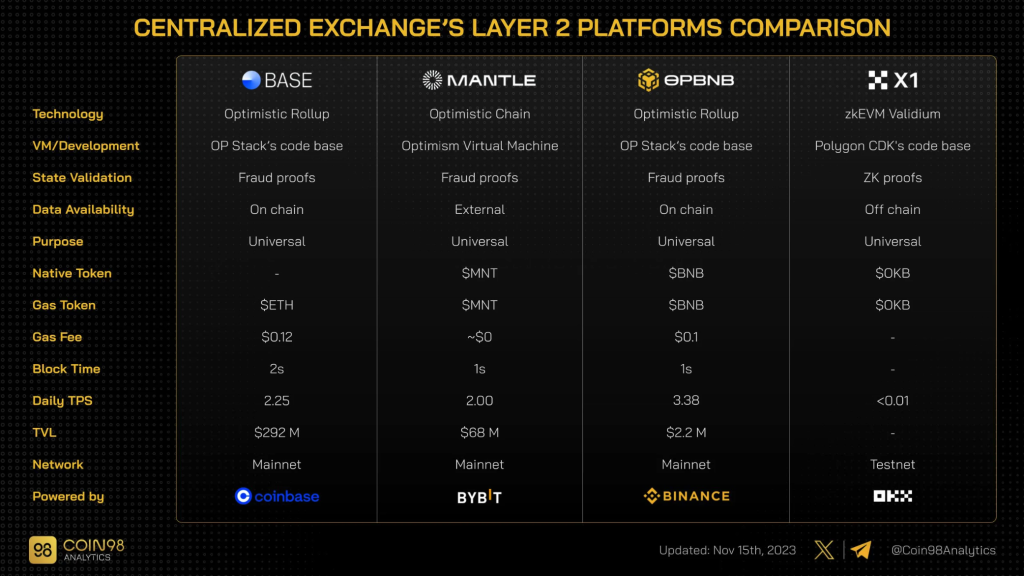

Coin98 published a comparison table with tokens from the exchanges Coinbase, Binance and OKX.

The comparison with OKX is incorrect, since the X1 token network is still on the testnet.

Interestingly, TVL in Mantle is higher than that of opBNB - $76.01 million versus $2.13 million, according to current data from DefiLlama.

Apparently, Coin98 considers Mantle a serious competitor to Base and opBNB.

Having looked at projects from the Mantle category Ecosystem on CoinGecko, we can conclude that the projects are not alive - the daily trading volume rarely exceeds $30 thousand.

Of the projects found on Twitter, four stand out:

- AGNI Finance – DEX on Mantle with live Twitter and TVL $36 million. Launchpad is promised to launch soon. It works quite quickly.

- FusionX Finance – DeFi on Mantle. It works well and takes a long time to load.

- KTX.Finance is a decentralized platform for derivatives and social trading. Maximum leverage is 100x. AUM currently stands at $5.6 million. Operating approx.

- Lendle is a lending and borrowing protocol. Works tolerably.

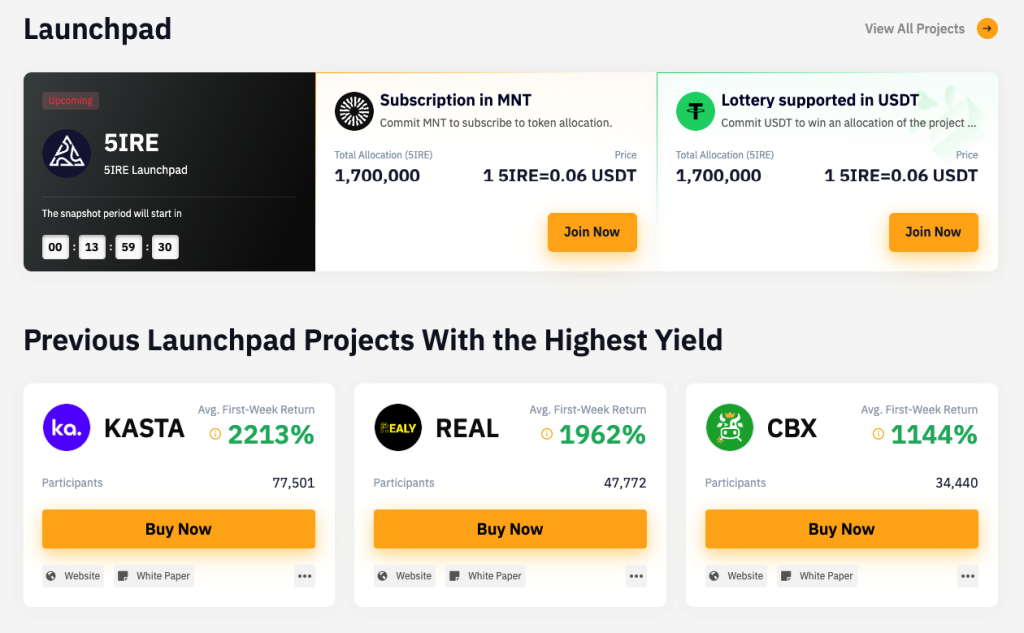

MNT token can be used on launchpad Bybit exchanges.

Current products

Mantle LSD is currently being developed, but without specific details yet.

Mantle LSD is a liquid staking protocol deployed on the Ethereum mainnet, entirely managed by Mantle. Users, including the Mantle treasury, will be able to deposit ETH and receive wrapped mntETH yield-generating tokens. Validation services will be entrusted to external node operators.

On an interesting note, mntETH can be staked on EigenLayer using EigenDA as a partner for Mantle network data availability. It is likely that mntETH will be used as a payment option for second level (L2) fees on Mantle Network.

There is no exact launch date for Mantle LSD.

Before that they developed Mantle multisigwhich was launched in June. In fact, Multisig Mantle is just a fork of the Safe wallet.

Funds were also allocated from the treasury for the development of the game Game7 in collaboration with Forte and educational platform EduDAO in collaboration with student groups.

Regulations and Risks

Mirana (the investment arm of Bybit) lent $150 million to crypto lander Genesis. According to Ben Zhou , $120 million of which were returned. He also assured that customer funds and Bybit's income product are separated from Mirana.

On May 30, 2023, Bybit left the Canadian market, citing changes in legislation. Previously, in June 2021, Bybit was charged by the Ontario Securities Commission.

In the summer of 2023, Bybit filed a lawsuit against an employee of WeChain, a contractor involved in calculating salaries for Bybit employees. During the legal battle, the Supreme Court of Singapore recognized USDT as a type of personal property (with the possibility of transferring it into trust), and ordered the return of the funds to Bybit.

In June, Bybit received an MVP license in Dubai, allowing it to serve a limited number of accredited investors. Bybit is seeking full licensing.

At the beginning of October 2023, Bybit suspended its activities in the UK due to new regulatory standards coming into force and registration with the UK FCA register.

On November 13, 2023, the new management of FTX sued Bybit to recover $953 million in “misappropriated funds.” The lawsuit was filed against Bybit Fintech Ltd, its investment division Mirana and several individuals.

Token behavior and current indicators

Since the launch of the project and the transformation of the BitDao token into MNT, the project has shown a drop of 50% from $0 .6 to ATL $0.3, which is not bad, considering how other projects are behaving:

- Polygon fell three times this year - from $1.5 to $0.49

- Avalanche more than doubled - from $22 to $8.8

- Optmism tripled - from $3 to $1

- Arbitrum more than doubled - from $1.7 to $0.7

After ATL, volumes appeared in the 20th of October and, apparently, MM joined the work on Bybit, thanks to which the token has grown over the past month by 43%.

If you look at the old token BitDao, then we won’t see anything interesting. It performed normally in the bull market, demonstrating an increase from $1.5 to $2.9. But the token had a separate trend. Even with the surge in market activity in the spring of 2022, it did not show much growth. Not alpha.

Conclusions and growth drivers

- Launching LSD. The main growth narrative is the launch of LSD from Mantle. Mantle enters the battle against Rocket Pool with a FDV of $591.66 million and TVL of 2.399 billion. But Mantle is primarily an L2, so it is better compared to the performance of other L2s. If you consider the FDV to TVL ratio (data from DefiLlama) as Optimism ($8.05 billion / $738.2 million = 10.8) and Arbitrum ($11.28 billion / $2 billion = 5.6), with the launch of LSD at the current FDV you can expect TVL in Mantle to increase from the current $76.01 million to $265 million - $510 million.

- Launchpad on Bybit. With MNT tokens you can participate in the launchpad on the Bybit exchange. Everything is similar to BNB and the launchpad on Binance.

- It's own ecosystem. Mantle is not just an L2 network. Behind it is the ByBit exchange, Mantle Governance and Mantle Treasury. You can say Binance at minimum wages. In any case, Coin98 compares it with Binance and Coinbase.

- Activity. Judging by the activity of Mantle, the expanding network of projects, there are all the prerequisites for the further growth of the ecosystem and the joining of new developers.

- Large treasury. Given the impressive size of the treasury, it is safe to say that the project is unlikely to drain its tokens to pay for food, housing and development. This means they don’t put money first. The team most likely needs status, respect, and market capture.

- Growth to competitors. Comparing with competitors, for example, with Optimism and Arbitrum with their FDV of $8.05 billion and $11.28 billion, respectively, on the one hand, and Mantle with FDV with $2.86 billion, we can see a modest 2-3x from the current level. And this does not even take into account the overall market growth.

- Probable listing on top exchanges. The MNT token is traded on only five exchanges, one of which is Uniswap with a volume of almost $250 thousand, and on others (BitMart, Gate, HTX) even less - from $20 thousand to up to 172 thousand. On the bybit exchange, summing up all pairs, an impressive $80 million in volume. From this we can conclude that with such volumes, listing on top exchanges is possible.

There are also risks:

- Risk borrowing client funds for investments in Mirana (the investment division of Bybit).

- The role of BitDAO in the Mantle ecosystem is unclear. Everything looks very confusing. There is no specific CEO in charge of a project with such a large treasury. In fact, the founder of Mantle is Ben Zhou, CEO of Bybit Ben Zhou, but little is said about this. Even on his Twitter, Ben Zhou does not mention Mantle once again.