What is a Spot BTC-ETF and why is it so popular among investors?

To understand a Spot BTC-ETF, you first need to understand the concept of an ETF and a Futures BTC-ETF.

An ETF (Exchange Traded Fund) is an investment vehicle designed to track the price and performance of a specific asset. It can be traded on stock exchanges, and investors can buy and sell the ETF like shares.

A BTC Futures ETF is a fund that is backed by futures contracts linked to the price of BTC. In fact, when you buy a BTC futures ETF, you are not buying BTC.

A spot BTC ETF is a fund that allows investors to buy and sell real BTC at the current market price. Essentially, the fund buys, sells and stores real BTC. This allows investors to own BTC without managing their own BTC wallet.

Advantages of Spot BTC-ETF

Spot BTC-ETF allows you to invest directly in Bitcoin without the need to use an exchange, reduces transaction costs commissions and simplify the investment process. It is less risky than a futures ETF because investors own actual BTC for the entire duration of the contract.

Spot BTC-ETF can be traded on stock exchanges, like stocks. Investors can buy or sell the spot BTC ETF at any time according to market changes.

The launch of a spot BTC-ETF provides traditional financial services companies with a regulatory compliant tool that allows them to participate in the Bitcoin market within established rules.

Capital will prefer spot BTC-ETF

For the following reasons:

- Extension market. ETFs are a large segment of exchange-traded products, with a total value of $7 trillion. The launch of a spot BTC-ETF will attract investors to the cryptocurrency market and increase its size.

- The opportunity to participate directly in the Bitcoin market. This opportunity will allow capital to more flexibly manage its investments, increasing their efficiency.

- Meeting demand and expanding investment opportunities. With the growing popularity of cryptocurrencies, more and more traditional financial institutions want to enter this market.

- Greater transparency and compliance with regulatory standards. This approach creates a safe environment for capital.

The Curse of the Spot BTC-ETF

The idea of creating a spot BTC -ETF has been maturing for several years. Despite many proposals submitted to regulators, at the moment not a single such fund has been approved on major US exchanges, which has become something of a curse for the American crypto market. However, outside the US, spot BTC ETFs have been successfully approved. For example, in February 2021, the Canadian company Purpose Investment successfully launched the world's first spot BTC-ETF, and its trading volume on the first day reached almost $400 million.

The United States, being an important center of the global crypto market, is not going to retreat. Since the beginning of 2013, when the Winklevoss brothers were the first to apply for a stop BTC-ETF, American institutions have submitted similar applications every year, but they have all been rejected. However, in June of this year, the world's largest investment company BlackRock filed its application, which again drew attention to the issue.

BlackRock manages more than $9 trillion in assets and has introduced Coinbase as a cryptocurrency storage and market data provider and Bank of New York Mellon as a cash storage facility. Obviously, BlackRock took this application seriously.

Due to market optimism regarding BlackRock's bid for a spot BTC-ETF, some institutions have decided to submit their bids again. This activity suggests that the decade-long curse of spot BTC-ETF disapproval in the US may be broken with this wave of applications.

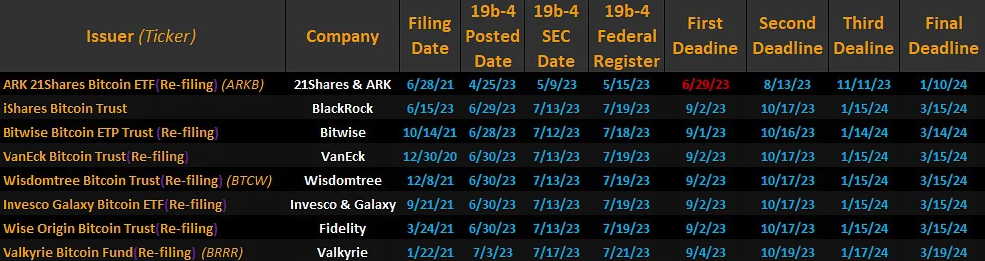

Companies and their applications for the spot BTC-ETF

What impact will the spot BTC-ETF have on the crypto industry?

According to analysts from Bloomberg, if the spot BTC-ETF is approved, the US could account for 99.5% of global cryptocurrency ETF trading volume. Therefore, the importance of the American market is obvious. So what impact will this have on the global cryptocurrency market?

Coinbase could be the biggest winner in the competition for spot BTC-ETF

If the ETF application is approved, the biggest beneficiary in the market will not be the applicant ETF. While they too will benefit, in comparison, Coinbase will be the biggest winner.

Previously, the SEC rejected applications for the Bitcoin Spot ETF due to a lack of regulatory transparency. Therefore, this wave of institutions applying for ETFs entered into co-regulatory agreements to satisfy the authorities' demands. In such co-regulatory agreements, the management company must select a partner to serve as the Bitcoin fund's custodian, responsible for providing regulatory services and allowing both parties to share information about trades, clients and other activities to reduce risk in the market. In this regard, Coinbase is the best choice.

In the current competition for the approval of Bitcoin Spot ETF, in addition to BlackRock and Coinbase, which have confirmed their partnership, Fidelity, VanEck, 21Shares (ArkInvest), Valkyrie and Invesco also submitted updated applications and selected Coinbase as their partner. If the SEC approves these applications, a significant portion of the assets managed by these companies will be stored on Coinbase. According to Nasdaq, 56% of the $129 billion in Bitcoin trades in the United States took place on Coinbase. With the development of the spot BTC-ETF, this share will increase.

The spot BTC-ETF could become a catalyst for the bull market

Once the spot BTC-ETF is approved ETF, this will mean that a safe and efficient “channel” has been created for moving large sums of money from the traditional financial sphere into the world of cryptocurrencies. As the number of such companies grows, the amount of funds pouring into the crypto market will become huge. The SEC's approval of the spot BTC-ETF can be compared to the signal of the beginning of a bull market in the crypto market, especially in the context of a long period of turbulence and regulatory restrictions.

Accelerating the integration of cryptocurrencies into the mainstream

The launch of the spot BTC-ETF provides institutional investors with a convenient way to enter the crypto market. Since an ETF is a more traditional investment vehicle, its launch will make cryptocurrencies more accessible to more investors, which will increase interest in them. This also helps increase the size and liquidity of the cryptocurrency market.

The joint supervision agreement being implemented within the framework of the spot BTC-ETF will increase investor confidence.

To sum it up

Despite many arguments in favor of the approval of a spot BTC-ETF, the outcome is still difficult to predict until final SEC decisions. However, logically, since the SEC allowed the listing of a high-risk futures BTC-ETD, there is no reason to reject a spot BTC-ETF. Previous denials due to lack of regulatory transparency have been rendered irrelevant by shared supervision agreements. Perhaps the SEC is waiting for the development of proper infrastructure to be completed. Therefore, the emergence of a spot BTC-ETF in the US is most likely a matter of time.