Over the past 10 years, blockchain has become more popular among people interested in new technologies and wanting to keep up with the times. Recently, it has begun to displace existing markets around the world. Blockchain and cryptocurrency have attracted the attention of many investors due to the opportunities it provides them. This is the main reason why this area is being explored, studied and invested in.

We have already told you about cryptocurrencies in different countries, including Nigeria, Mexico, India, Russia and the USA. Today we are going to discuss the status and relevance of cryptocurrency in Australia.

The popularity of cryptocurrency in Australia

Have you ever heard about the creation of the Research and Development Center Metaverse, a $100 million project designed to deliver an entirely new user experience? Or is the mayor proposing to use cryptocurrency as a means of paying taxes? Well, this is real news in the Australian crypto and blockchain sector, and it's happening right now.

Of course, Australia is actively adopting cryptocurrencies, serving as a role model for other countries that are not yet involved. To see if Australians are true crypto enthusiasts, we need to look at the relevant statistics.

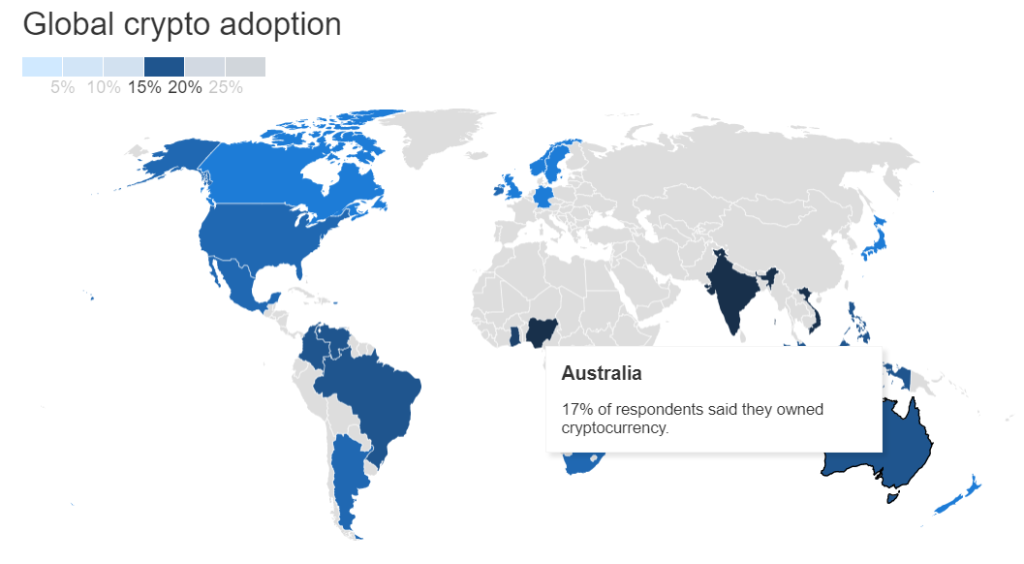

Analytics website Finder reports that Australia is ranked 3rd in the world for cryptocurrency adoption. According to recent surveys, almost 18% of Australians own cryptocurrencies. This seems to be one of the hottest topics on the continent right now. The reason for this acceptance is likely that the government is clearly open to cryptocurrencies and blockchain development.

According to the survey Finder (almost 42,000 people from 22 countries joined the study) 1,003 of them are Australian, and 17.8% of them own cryptocurrency. This survey presents the country's cryptocurrency ownership statistics, and it is much higher than the global average of 11%.

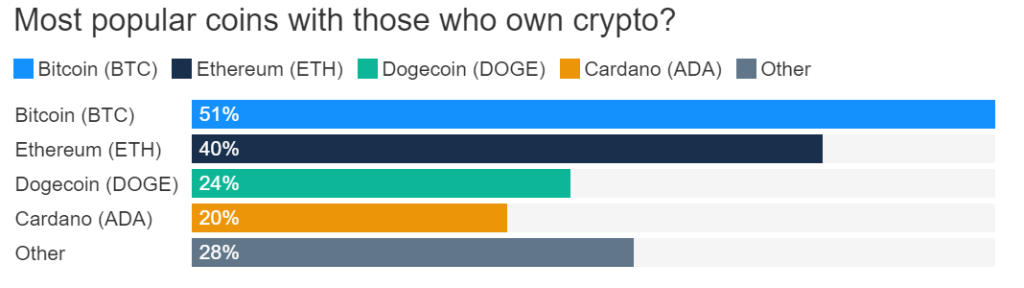

The most popular cryptocurrency was Bitcoin (51%). Less popular currencies are Ethereum (40%), Dogecoin (24%), Cardano (20%) and other assets (28%):

As we could learn from statistics, among Australians who own cryptocurrency , 64% are men, the rest are women.

The survey clearly shows the upward trend of cryptocurrencies and blockchain, which are gaining popularity at a rapid rate. Now the main question concerns the regulation of cryptocurrency in Australia. Let's find out how this whole mechanism works and whether citizens have difficulties using cryptocurrency.

Rules and taxes on cryptocurrency in Australia

Currently, cryptocurrency has official legal status in Australia and is considered ordinary property. The laws surrounding cryptocurrencies also seem to be very advanced - their legitimacy makes them the subject of the Anti-Money Laundering and Anti-Terrorism Financing Act of 2006.

These rules require cryptocurrency exchanges to register with the Australian Transaction Reporting and Analysis Center and verify their customers, maintain records and comply with government reporting requirements.

We're talking about taxes. BTC and crypto assets that have its properties are considered to be subject to capital gains tax (CGT).

In 2021, the Australian Taxation Office (ATO) has stepped up its crackdown on CGT breaches. Given the rules, when the ATO finds a reporting breach in relation to cryptocurrency income, it has the power to impose a penalty of 75% of the unpaid tax liability, in addition to normal taxes.

In 2022, the ATO shared a message with crypto investors. In accordance with it, capital gains and losses are required to be declared each time a digital asset is sold (including NFT).

What else is interesting about the Australian tax system:

- Australian citizens are not taxed when purchasing cryptocurrency if the purchase is made using fiat.

- Investors have the opportunity to receive half of the capital gains tax in a situation where they own the asset for 1 year or more.

Future plans for cryptocurrency regulation

At the end of 2021, Australian Federal Treasurer Josh Frydenberg unveiled a program to radically update the payments system. It includes a special licensing structure for local crypto exchanges to improve regulatory protection when buying and selling cryptocurrency. The reform will also cover businesses that hold cryptocurrency on behalf of clients.

The Treasury also published a proposal for opportunities for an Australian CBDC and proposed a list of benchmarks to be achieved by the end of 2022. This, they say, will protect users, reduce pressure on small businesses and make the rules clearer.

Therefore, we see that regulations regarding cryptocurrency in Australia generally demonstrate a fast and modern approach.

Conclusion

As can be seen from the article, cryptocurrencies are becoming increasingly popular all over the world, and in countries such as Australia they are already gradually occupying positions on a par with fiat.

Australians decided to become one of the first to introduce cryptocurrencies into their lives and created special laws, equating cryptocurrency to ordinary property. It seems like this has always been the case, but we are confident that this is just the beginning of the mass adoption of cryptography and blockchain technologies.