Recently, it became known about Binance's investments in the restaking protocol on Solana. Let's figure out how you can take part in this project.

Quick overview of Solayer

- Restaking on Solana

- Binance as an investor

- Register via the link: https://app.solayer.org/invite/8UIRZU

- Connect Discord and X

- Enter the Solayer invite code: 8UIRZU ( https://app.solayer.org/invite/8UIRZU)

- Restake SOL via LST.

Solayer – restake protocol on Solana, designed to improve dApps by increasing network throughput and providing security for the main layer (L1) of Solana.

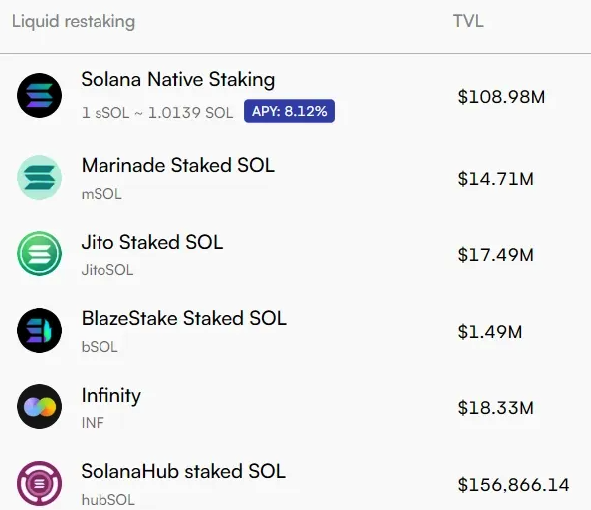

Current TVL ~$159 million or ~1 million SOL: https://defillama.com/protocol/solayer?denomination=SOL

The project has completed two rounds of funding with the participation of Binance Labs, angels Sandeep Nailwal, Anatoly Yakovenko and others. The investment amount is not disclosed.

The project has an excellent Twitter. It is signed by representatives of Coinbase, Binance, Animoca Brands, IOSG VC, Multicoin Capital, Sequoia, eGirl Capital and others.

Tokenomics have not yet been announced.

Team

The company is young, judging by LinkedIn the team consists of less than 10 people.

The project has two co-founders.

Rachel Chu is a co-founder of Solayer. She is also the founder and CEO of the NFT platform Vibe. She previously worked as a core developer at Sushiswap. Although we consider female founders to be red flag, this seems to be a different case. Representatives of Coinbase, Paradigm, eGirl Capital, Electric Capital, Multicoin Capital, Polychain, a16z, etc. are subscribed to her Twitter. That is, she is not a random and far from the last person in the cryptosphere.

The girl is not public, a photo could not be found. Twitter is also not very active.

Rachel's Twitter: https://x.com/0xchu

Jason Li is the second co-founder of Solayer. He is the co-founder of MPCVault, which is developing a non-custodial multisig wallet. He previously founded two more companies - a digital platform for students LoopChat and InkyLabs, a company developing solutions for traders, which was sold for more than $1 million. He has never worked as an ordinary or hired employee anywhere.

He is also not a public figure.

LinkedIn page: https://www.linkedin.com/in/lxjhk/

Competitors and evaluation

The project has few competitors - Jito, Marinade.Finance and Sanctum.

Jito is a leading provider of liquid staking on Solana.

Among investors are Multicoin Capital, Framework Ventures, Solana Ventures, etc. The amount raised is $10 million.

FDV $2.8 billion with a small circulation (12%) is a common occurrence. The project is holding up very well. At its peak it was worth almost twice as much. TVL $1.8 billion

Marinade.Finance – staking protocol on Solana. There is no information on the funds, but Twitter subscribers are top-notch, including representatives of Coinbase, Jump Capital, Multicoin Capital, a16z.

FDV $94 million. The project is trading at the level of local highs of June 2023. At the peak in early December 2023, it was worth almost $700 million. TVL $1.2 billion. The project looks undervalued.

Sanctum – liquid staking provider on Solana. In total, the project raised $13.6 million with the participation of DragonFly Capital, Sequoia Capital, Solana Ventures and others and at the IDO via Jupiter.

FDV $163 million with a circulation of 18%. On July 19, it cost twice as much. TVL $845 million. Also looks undervalued.

Looking at the listed projects, it is difficult to say anything about the valuation of Solayer. None of them have Binance as an investor, but investments from Binance do not always justify themselves, however, as well as from other tier1 funds. If suddenly Solayer enters Binance Launchpool, then the valuation at the moment will be more than $1 billion. Otherwise, $400-600 million can be expected at the moment, and given the size of TVL relative to competitors, the valuation may be even less.

Activities

- Points (credits) are currently being farmed via staking.

- To qualify for a reward for retroactivity, you must participate in at least one of the episodes with tasks.

- The first episode has already ended, so we are waiting for the second one to start.

To farm points, follow these steps:

- Register via the link: https://app.solayer.org/invite/8UIRZU

- Connect Discord and X

- Enter the invite code: 8UIRZU ( https://app.solayer.org/invite/8UIRZU)

- Re-stake SOL via LST.

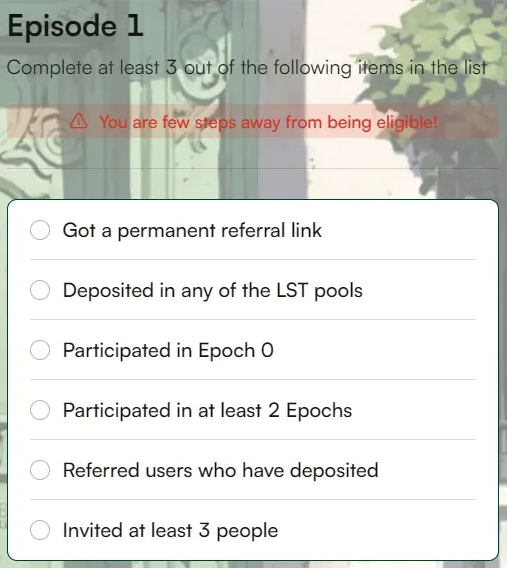

The first episode with tasks (already ended)

In order for the first episode to be counted, it was necessary to fulfill at least 3 of the conditions proposed in Valley.

- To get a permanent referral link, stake 10 SOL in the Solana Native Staking pool

- Restake in any of the LST pools: Marinade, Jito, BlazeStake, Infinity, SolanaHub

- We invite at least 3 people, at least one of whom must make a deposit

- We participate in era 0

- We participate in at least 2 eras

At the moment, ~29 thousand wallets have met the conditions

New requirements will be announced for episode 2.

Farming points in era 4 will be counted in episode 2.

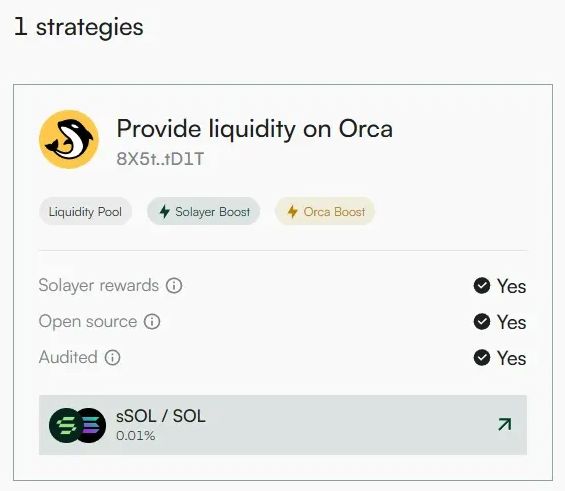

In addition to SOL staking, it is now possible to send sSOL to the sSOL-SOL Liquidity Vault to earn sSOL staking yield and Orca trading fees.

sSOL is a liquid token on Solana that opens up a number of use cases in DeFi, such as liquidity provision, collateral, and spot trading.

This can be done on the Orca DEX or through the Kamino Finance vault.

There is only one strategy on the official website so far – Orca. The strategy through Kamino Finance is not yet displayed.

Let's sum it up

An interesting project with a good TVL, which was collected even before the announcement of investments from Binance. But it is worth keeping in mind that competitors have a TVL several times higher.

There is a girl among the co-founders - this is a minus. But representatives of top funds follow her on Twitter - this is a plus. There is a possibility that the gender component will fade into the background this time.

We all see how Solana rebounded well after the recent collapse, which demonstrates its strength and the great work of MM. Therefore, ecosystem projects have a chance to fly with it.