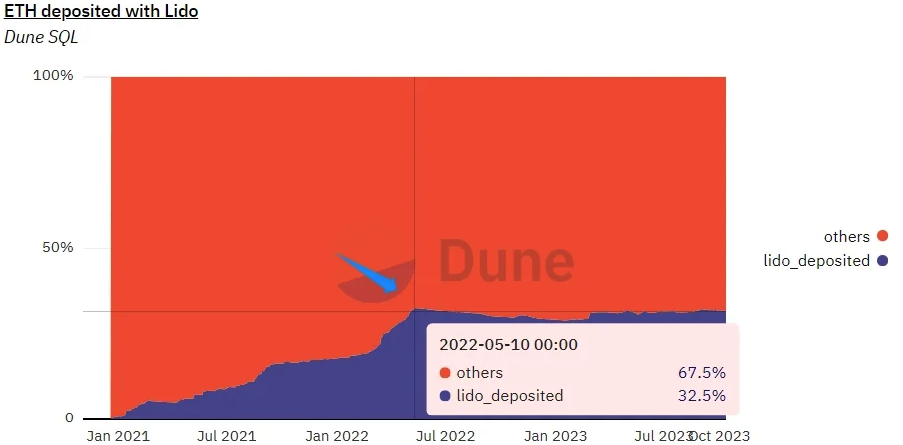

In Ethereum's PoS consensus system, if 1/3 of the validators abuse their rights, it may lead to a breakdown of the consensus. And Lido's market share is now 31.7%.

Recently, there have been rumors that the Ethereum Foundation and Vitalik are selling ETH due to the fact that they know that the PoS mechanism has already failed.

Firstly, Lido is not a single structure. When users delegate their ETH to Lido, Lido delegates it to 20 staking pool validators. A conspiracy between Lido and staking pool validators to attack Ethereum consensus is highly unlikely.

For the year, Lido received income of $55.57 million from staking fees. There is no reason to attack the Ethereum consensus and put your profits at risk. Even if we assume that the Lido team wants to ragpool, they could easily escape with the ETH that is staked through Lido, which is worth ~$14 billion, instead of attacking the consensus.

So while Lido may theoretically have the ability to break Ethereum consensus, that doesn't mean they will actually do so.

Secondly, Lido's market share may never reach 1/3.

As the graph shows, since Lido reached its peak market share of 32.5% in May 2022, it has remained steady 31% over 17 months, and given the current trend, this may continue.

Third, the Ethereum and Lido communities have already recognized the risks associated with Lido's monopoly on Ethereum consensus security and are discussing possible solutions.

The Ethereum community (especially RocketPool) is demanding that Lido give up some of its market share to other small and medium staking pools. Vitalik's latest article discusses ways to mitigate this risk through the use of delegated agency and the participation of delegated agents.

The Lido community proposes a dual voting solution for LDO and stETH, fully equivalent to the governance of Ethereum and the future decentralized middleware system without human intervention.

Conclusion

Lido's market share has been close to 1/3 for 17 months, and during this time there has been no loud discussion about this. This is due to the fact that the market was unstable at that time, and the Rocket Pool team promised to surpass Lido. However, Rocket Pool's market share today is less than 3%.

Therefore, these discussions may have arisen because small staking pools like Rocket Pool want to compete on a level playing field, and are therefore trying to use decentralization as pressure on the community to take Lido's market share.